Imagine a world where preparing finance doesn’t send shivers down your spine. A world where assessing calculations ends up a breeze and opportune, precise installments reach your workers with minimal effort. Choosing the Best payroll software for small business is vital for little businesses to ensure accuracy, compliance, and efficiency in managing employee payments.

According to a 2023 survey by the National Small Business Association, 52% of little businesses utilized finance computer programs, highlighting its significance in modern trade operations. This perfect world for little businesses can be achieved with the magic touch of finance computer programs. Studies reveal the harsh reality that a whopping 73% of small trade owners report investing at least five hours per month on finance assignments.

Payroll software for small business swoops in as your hero, automating tedious calculations, ensuring compliance with tax regulations, and freeing up those valuable hours for strategic endeavors. Let’s set out on a journey to find the ideal payroll software for your little commerce, transforming finance from a beast into a faithful companion.

How to Ensure Standard Payroll Processing?

- Business Size and Complexity: Assess the number of employees and payroll complexity, including various employment types, to determine suitable software capabilities.

- Budget Constraints: Set up your finance program budget, adjusting cost-effectiveness with vital highlights and adaptability for future development.

- Ease of Use: Select program with a user-friendly interface that requires negligible preparing for productive usage and operation.

- Integration Capabilities: Guarantee the program coordinating consistently with existing bookkeeping, HR, and time-tracking frameworks for streamlined operations.

- Compliance and Tax Management: Select computer program that naturally upgrades with assessed law changes, guaranteeing precise charge filings and findings.

- Scalability: Take software that can scale together with your trade, permitting simple expansion of highlights as your needs develop.

- Support and Customer Service: Assess the quality and accessibility of client back, counting instructional exercises, FAQs, and live chat for investigating.

- Automation and Features: Look for computerization in finance calculations, coordinate stores, and benefits organization to improve effectiveness and exactness.

What Features are Included in a Payroll Service Provider?

Once you have a clearer picture of your needs, explore the features that are essential for most small businesses:

- Automated Payroll Processing: Streamlines finance calculations and forms, sparing time and lessening manual mistakes.

- Tax Filing and Compliance: Consequently calculates and records government, state, and nearby charges, guaranteeing compliance with the most recent directions.

- Direct Deposit and Payment Options: Gives coordinate store capabilities and different installment alternatives to suit worker inclinations.

- Employee Self-Service Portal: Permits workers to get to pay stubs, charge shapes, and overhaul individual data online.

- Time and Attendance Tracking: Coordinating with time-tracking frameworks to precisely calculate hours worked and extra minutes.

- Benefits Management: Oversees worker benefits such as wellbeing protections, retirement plans, and other advantages.

- Customizable Reporting: Creates point by point and customizable finance reports for bits of knowledge and investigation.

- Scalability: Adjusts to trade development, obliging more workers and extra finance needs.

- Integration with Accounting Software: Consistently coordinating with accounting software for synchronized money related administration.

- Customer Support: Gives solid client support through different channels, guaranteeing help when required.

15 Best Payroll software for small business

1. OnPay

OnPay simplifies payroll for small businesses, offering a user-friendly platform and a focus on affordability.

Why should you use onpay?

- Simple Payroll Processing: OnPay mechanizes finance calculations, assess withholding, and filings, guaranteeing precision and sparing you time.

- Employee Self-Service: Workers can get to paystubs, W-2s, and update individual data through a secure online entry.

- Direct Deposit: Workers get their paychecks electronically, killing the bother of paper checks.

- Competitive Pricing: OnPay offers a level month to month charge additionally a per-employee expense, making it a budget-friendly alternative for small businesses.

- Seamless Integrations: Coordinating with prevalent accounting program like QuickBooks for easy information exchange.

Best For

- OnPay shines brightest for small businesses seeking a user-friendly and affordable payroll solution.

- Entrepreneurs who are on a low budget, value simplicity, and businesses with straightforward payroll structures will find all the essential features at a competitive price.

Pricing

| Plans | Price |

|---|---|

| Base Fee | $40 per month |

| Per Employee | $6 per employee per month |

2. Gusto

Gusto offers a powerful suite of features designed to streamline HR and payroll processes for small and medium-sized businesses.

Why should you use gusto?

- Automated Payroll Processing: Easily run finance with programmed calculations, charge recording, and coordinate store.

- Benefits Administration: Rearrange benefits administration with highlights for wellbeing protections, retirement plans, and more.

- Time Tracking: Integrate time following instruments for precise finance preparing for hourly workers.

- Employee Self-Service: Engage representatives to get to paystubs, W-2s, and overhaul individual data through a secure online entrance.

- Reporting Tools: Create comprehensive reports for charge purposes, workforce investigation, and budgeting.

- Seamless Integrations: Integrates with popular accounting software for effortless data flow.

Best For

Gusto shines for growing small and mid-sized businesses seeking a comprehensive HR and payroll solution.

Pricing

| Plans | Price |

|---|---|

| Simple Plan | $40 per month |

| Plus Plan | $80 per month |

| Premium Plan | Custom pricing |

3. ADP RUN

ADP RUN Powered by ADP caters to businesses with complex payroll needs, offering a robust and customizable solution.

Is ADP run good payroll software?

- Comprehensive Payroll Processing: Handles various pay types (hourly, salary, commission), multiple locations, and even union complexities.

- Advanced Tax Compliance: Guarantees exact charge calculations, filings, and multi-state finance prerequisites.

- Benefits Administration: Oversee wellbeing protections, retirement plans, and other benefits for your representatives.

- Time Tracking Integration: Interfaces with time clocks or worker planning programs for consistent finance preparation.

- Customizable Reporting: Produce in-depth reports custom-made to your particular needs for charge purposes, workforce examination, and budgeting.

- Security and Scalability: Sponsored by ADP’s industry mastery, ADP RUN offers rigorous security highlights and the capacity to scale to suit trade development.

Best For

Businesses seeking industry expertise and a reliable platform to manage their unique payroll landscape will find a strong ally in ADP RUN.

Pricing

| Plans | Price |

|---|---|

| Essential Plan | $59/month |

| Enhanced Plan | $99/month |

| Complete Plan | Custom pricing |

Suggested Read – Best AI Sales Assistant Software

4. Paychex Flex

Paychex Flex offers a comprehensive solution for payroll, HR, and benefits administration, all rolled into a single platform

Why should you use Paychex Flex?

- Simplified Payroll Processing: Robotize finance calculations, assess filings, and coordinate store for productive pay cycles.

- HR Management Tools: Manage representative onboarding, track time and participation, and get to representative information inside the stage.

- Benefits Administration: Simplify enrollment and administration of wellbeing protections, retirement plans, and other benefits.

- Reporting and Analytics: Create comprehensive reports for assess purposes, workforce examination, and educated decision-making.

- Mobile App: Engage representatives with a versatile app to get to paystubs, W-2s, and ask time off.

- Seamless Integrations: Coordinating with well known accounting program for easy information stream.

Best For

- Paychex Flex shines for businesses seeking a one-stop shop for HR, payroll, and benefits administration.

- Whether you’re a growing startup or an established company, Paychex Flex offers scalability to match your needs.

Pricing

| Plans | Price |

|---|---|

| Essentials | $39/month |

| Select | Custom pricing |

| Pro | Custom pricing |

5. Justworks

Justworks aims to be the all-in-one solution for small businesses, streamlining payroll, HR, and compliance tasks.

Why should you choose Justworks?

- Automated Payroll Processing: Justworks mechanizes finance calculations, charge filings, and coordinate store, guaranteeing exactness and sparing you time.

- Benefits Administration: Offer wellbeing protections, retirement plans, and other benefits to your workers with disentangled organization through Justworks.

- HR Management Tools: Manage representative onboarding, PTO following, and get to fundamental HR functionalities inside the stage.

- Compliance Support: Justworks remains on best of ever-changing controls, guaranteeing your commerce is compliant with government, state, and neighborhood business laws.

- Dedicated Customer Support: Get 24/7 help from Justworks group of specialists by means of phone, e-mail, chat, or Slack.

- Vendor and Contractor Payments: Simplify installments to sellers and temporary workers nearby your customary finance preparing.

Best For

Justworks is a perfect fit for small businesses seeking an all-in-one solution for payroll, HR, and compliance, all wrapped up in an affordable and user-friendly package.

Pricing

| Plans | Price |

|---|---|

| Basic Plan | $59/month |

| Plus Plan | $99/month |

6. TriNet

TriNet caters to the needs of growing and established businesses, offering a suite of payroll, HR, and benefits administration features.

What features does TriNet support?

- Comprehensive Payroll Processing: Handles assorted pay structures (hourly, salary, commission) and mechanizes calculations, charge filings, and coordinate store.

- Benefits Administration: Simplify enrollment and administration of wellbeing protections, retirement plans, and other benefits for your workers.

- HR Management Tools: Manage representative onboarding, track time and participation, and get to worker information inside the stage.

- Risk Management and Compliance: TriNet makes a difference to minimize dangers related with workers’ remuneration and representative benefits. They too remain overhauled on changing controls to guarantee compliance.

- Dedicated HR Support: Pick up get to to a group of HR experts for direction and back on representative relations, benefits, and compliance.

- Customizable Reporting and Analytics: Produce in-depth reports custom fitted to your particular needs for charge purposes, workforce investigation, and educated decision-making.

Best For

TriNet is a perfect fit for businesses on the rise, particularly those that have outgrown basic payroll solutions.

Pricing

TriNet uses a custom pricing model.

7. Wave Payroll

Wave Payroll positions itself as a user-friendly and budget-conscious payroll solution designed specifically for small businesses.

Should I use Wave Payroll?

- Effortless Payroll Processing: Mechanize finance calculations, assess withholding and filings, and coordinate store for productive pay cycles.

- Employee Self-Service Portal: Enable representatives to get to paystubs, W-2s, and upgrade individual data through a secure online entry.

- Seamless Integration: Coordinating with Wave Accounting program for easy information stream between finance and accounting capacities.

- Tax Filing and Compliance: Wave Payroll handles federal and state tax calculations and filings for businesses in a limited number of US states (check their website for details). For other states, you might need to handle some tax paperwork yourself.

- Flat-Rate Pricing: Wave Finance offers a straightforward estimating structure with a level charge per representative, making it a budget-friendly choice for little businesses.

Best For

- Wave Payroll shines brightest for small businesses seeking a user-friendly and budget-friendly payroll solution.

- It’s ideal for entrepreneurs on a tight budget who value simplicity.

Pricing

| Plans | Price |

|---|---|

| Starter Plan | Free |

| Pro Plan | $16/month |

8. Paycor

Paycor caters to small and medium-sized businesses (SMBs) seeking a comprehensive solution for HR and payroll needs.

Should I use Wave Paycor?

- Automated Payroll Processing: Paycor robotizes finance calculations, assess withholding and filings, and coordinate store, guaranteeing exactness and sparing you time.

- Benefits Administration: Streamline enrollment and administration of health protections, retirement plans, and other benefits for your workers.

- Applicant Tracking System (ATS): Streamline the enlisting handle with highlights like work posting, continue administration, and candidate screening tools.

- Performance Management: Set objectives, track representative execution, and give criticism inside the stage.

- Reporting and Analytics: Create comprehensive reports for assess purposes, workforce investigation, and educated decision-making.

Best For

Paycor is a perfect fit for growing small and mid-sized businesses (SMBs) looking to streamline their HR and payroll operations.

Pricing

There they provide custom based pricing based on demands of the business or organisations.

9. Patriot Payroll

Patriot Payroll offers a user-friendly and scalable solution for businesses of all sizes, from startups to established enterprises.

Is Patriot payroll a good payroll software?

- Automated Payroll Processing: Mechanize finance calculations, assess withholding and filings, and coordinate store for productive pay cycles.

- Flexible Pay Options: Handle different pay structures, counting hourly, compensation, commission, and rewards.

- Time and Attendance Management: Integrate time clocks or employee scheduling software for seamless payroll processing.

- Tax Filing and Compliance: Patriot Payroll ensures accurate tax calculations, filings, and multi-state payroll requirements.

- Employee Self-Service Portal: Enable representatives to get to paystubs, W-2s, and ask time off.

- Seamless Integrations: Coordinating with a well known bookkeeping computer program for easy information stream.

- Security and Reliability: Backed by robust security features and industry expertise, Patriot Payroll prioritizes data security and reliable service.

Best for

Patriot Payroll shines for businesses of all sizes, from startups to established enterprises, seeking a user-friendly and adaptable solution for their payroll needs.

Pricing

| Plan | Price |

|---|---|

| Basic Payroll | $17/month |

| Full Service Payroll | $37/month |

10. Wagepoint

Wagepoint is a user-friendly payroll software outlined for little businesses, streamlining finance preparation and compliance with ease.

What benefits does wagepoint offer?

- Automated Payroll Processing: Simplifies finance calculations and preparing, lessening manual workload and errors.

- Tax Filing and Compliance: Consequently handles government, state, and neighborhood assess filings, guaranteeing administrative compliance.

- Direct Deposit: Provides coordinate store choices, permitting representatives to get payments directly to their bank accounts.

- Employee Self-Service: Offers a web entry for representatives to get to pay stubs and assess shapes, and update data.

- Time and Attendance Integration: Coordinating with time-tracking frameworks to precisely calculate hours worked and manage extra minutes.

- Customer Support: Provides reliable client back through different channels, guaranteeing help is accessible when required.

Best For

Wagepoint is best for small businesses seeking straightforward, efficient payroll management with essential features and strong customer support.

Pricing

| Plans | Price |

|---|---|

| Solo | $20/month |

| Unlimited | $40/month |

Also Read – Top GST Billing Software

11. Xero Payroll

Xero Payroll offers comprehensive finance arrangements coordinated with Xero accounting, outlined for little businesses to streamline financial administration.

Why should you use Xero for payroll & expenses?

- Automated Payroll Processing: Simplifies finance calculations and preparing, guaranteeing precision and productivity for little trade payrolls.

- Tax Filing and Compliance: Handles government, state, and neighborhood charge filings consequently, keeping businesses compliant with the most recent controls.

- Direct Deposit: Gives coordinate store capabilities, permitting workers to get installments expeditiously and safely.

- Employee Self-Service: Highlights an internet entry where representatives can get to payslips, charge records, and upgrade individual data.

- Integration with Accounting Software: Consistently coordinating with Xero bookkeeping, giving a bound together arrangement for money related administration and finance.

- Customizable Reporting: Produces detailed, customizable finance reports for experiences, supporting in money related examination and decision-making.

Best For

Xero Payroll is best for small businesses as of now utilizing Xero accounting, looking for coordinates and proficient finance and accounting arrangement.

Pricing

| Plans | Price |

|---|---|

| Starter | $14.50/month |

| Standard | $23/month |

| Premium | $31/month |

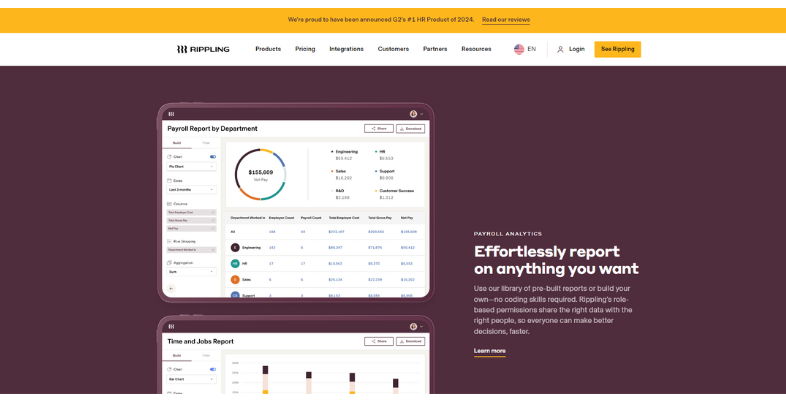

12. Rippling

Rippling is an all-in-one HR and finance computer program, outlined to streamline finance, benefits, and worker administration for small businesses.

What HR features does ripple offer?

- Automated Payroll Processing: Forms finance with automated calculations, guaranteeing precision and effectiveness, and reducing manual mistakes.

- Tax Filing and Compliance: Manages and records government, state, and neighborhood charges consequently, guaranteeing compliance with changing controls.

- Benefits Administration: Simplifies benefits administration, counting wellbeing protections, 401(k) plans, and other worker advantages.

- Employee Onboarding: Streamlines the onboarding handle with automated workflows, making it simple to set up modern contracts rapidly.

- Time and Attendance Tracking: Coordinating with time-tracking frameworks to precisely calculate hours worked and manage representative participation.

- Integration Capabilities: Coordinating with different third-party applications, giving a comprehensive arrangement for HR, IT, and finance needs.

Best For

Rippling is best for little to medium-sized businesses looking for a bound together stage for HR, finance, and IT administration.

Pricing

- Starts from- $8/month

- Custom based pricing

13. QuickBooks Payroll

QuickBooks Payroll integrates consistently with QuickBooks bookkeeping, giving effective finance administration and compliance arrangements for little businesses.

Should you run payroll services with QuickBooks?

- Automated Payroll Processing: Streamlines finance calculations, preparing paychecks precisely and proficiently with negligible manual input.

- Tax Filing and Compliance: Consequently handles government, state, and nearby charge calculations and filings, guaranteeing businesses remain compliant.

- Direct Deposit: Offers coordinate store choices, empowering workers to get their paychecks safely and on time.

- Employee Self-Service: Provides a web entry for representatives to get to pay stubs, assess shapes, and update individual data.

- Integration with QuickBooks: Consistently coordinating with QuickBooks accounting computer program, advertising a bound together arrangement for monetary administration.

- Mobile App Access: Permits finance administration on-the-go through a user-friendly versatile app, giving adaptability and comfort.

Best For

QuickBooks Payroll is best for little businesses as of now utilizing QuickBooks accounting, looking for coordinates finance and money related administration arrangements.

Pricing

| Plans | Price |

|---|---|

| Starter | $22.50/month |

| Essential | $31.50/month |

| Premium Plus | $51/month |

14. Sage Payroll

Sage Payroll gives vigorous finance arrangements for little businesses, advertising easy-to-use highlights for proficient finance and compliance administration.

Why should you use sage payroll software?

- Automated Payroll Processing: Simplifies finance calculations, guaranteeing precise and opportune paycheck preparing with negligible manual intervention.

- Tax Filing and Compliance: Naturally handles assess calculations and filings, guaranteeing adherence to government, state, and nearby assess controls.

- Direct Deposit: Offers secure coordinate store alternatives, permitting representatives to get their paychecks promptly and helpfully.

- Employee Self-Service: Gives an internet entry where workers can get to payslips, charge archives, and update their individual data.

- Customizable Reporting: Creates detailed, customizable reports for bits of knowledge into finance costs and financial examination.

- Integration with Accounting Software: Coordinating consistently with Sage bookkeeping arrangements, advertising a bound together stage for money related and finance administration.

Best For

Sage Payroll is best for small businesses seeking comprehensive, integrated payroll solutions with robust compliance and reporting features.

Pricing

| Plans | Price |

|---|---|

| Essentials | $11/month |

| Standard | $21/month |

| Premium | $32/month |

15. Zoho Payroll

Zoho Payroll offers a comprehensive finance arrangement tailored for little businesses, guaranteeing exact finance preparing and compliance.

Why should you use Zoho Payroll?

- Tax Filing and Compliance: Manages government, state, and neighborhood charge filings consequently, guaranteeing compliance with administrative necessities.

- Direct Deposit: Empowers coordinate store, permitting workers to get their pay safely and productively.

- Employee Self-Service Portal: This gives an entry for workers to get to pay stubs, assess shapes, and upgrade their individual data.

- Integration with Zoho Ecosystem: Consistently coordinating with other Zoho applications, advertising a bound together stage for commerce administration.

- Customizable Reporting: Creates detailed, customizable finance reports for monetary investigation and vital decision-making.

Best For

Zoho Payroll is best for small businesses using Zoho applications, seeking an integrated, efficient payroll and business management solution.

Pricing

| Plans | Price |

|---|---|

| Free version | Free |

| Standard | ₹40/month |

| Professional | ₹60/month |

Conclusion

Payroll software is an investment that pays off in the long run. By selecting the right solution, you can free up valuable time and resources, ensure compliance, and keep your employees happy with timely and accurate payments. Remember, the “best” payroll software is the one that perfectly complements your unique small business needs. So, take your time, research, and choose your champion wisely!

FAQs

Is payroll software expensive?

Payroll software pricing varies depending on features, number of employees, and payment structures. Some offer flat monthly fees, while others charge per-employee fees. Consider your budget and prioritize the features you truly need.

What about security?

Payroll software handles sensitive employee data. Choose a provider with robust security measures like data encryption and multi-factor authentication.

Do I need HR features in my payroll software?

If your business is small and has basic payroll needs, core payroll processing might suffice. However, as you grow, features like employee onboarding, time tracking, and benefits administration become valuable. Consider your current and future HR needs.

Is user-friendliness important?

Absolutely! Payroll software should be intuitive and easy to navigate, even for those without HR expertise. Look for platforms with clear interfaces, helpful tutorials, and readily available customer support.