India’s food service industry experiences transformative changes through rapid growth of cloud kitchen franchises. Modern digital-first food venture businesses employ both proven franchise concepts with delivery-only operation systems to transform entrepreneurial restaurant methods. At present, the cloud-based kitchen franchise sector in India demonstrates extraordinary growth as an essential food industry segment. The appeal of kitchen franchises stems from their lack of infrastructure needs, modest capital needs, and ability to run multiple brands utilizing single-production facilities, so they have become the preferred business solution for food startup owners throughout metropolitan areas as well as smaller cities.

The COVID-19 pandemic created the perfect conditions to drive up the adoption of kitchen franchises at an accelerated rate of 80% during the 2020 to 2022 timeframe. Indian cloud kitchen market statistics indicate that the revenue reached ₹42,860 crores in 2024 and will grow to ₹112,000 crores by 2030 with a yearly growth rate of 17.3%. A detailed report investigates the Indian ghost kitchen franchise sector as it examines major players alongside investment needs, operational structures, and success elements in this growing industry.

What is a Cloud Kitchen Franchise?

Cloud kitchen franchises function as commercial food production sites dedicated to online deliveries because they lack a space to serve customers inside their facilities. Digital restaurants run their business through partnerships with Swiggy and Zomato alongside other food aggregator platforms to provide exclusive online delivery service.

The cloud kitchen franchise business model provides multiple decisive benefits to operators.

- Reduced Overhead: Kitchen franchises function in reduced facilities since they remove traditional restaurant dining areas requiring space which amounts to 60-70% less than standard establishments.

- Multi-Brand Operations: Cloud kitchens can operate between three to six unique food brands at their single franchise location which boosts revenue efficiency through increased kitchen efficiency.

- Data-Driven Strategy: Kitchen franchises use customer data analytics to run optimal menus and marketing strategies and pricing structures through proprietary business intelligence tools that their top franchisors provide their franchisees.

- Scalability: Kitchen franchises achieve rapid market expansion through their lack of customer contact requirements and consequently require less upfront costs than typical restaurant models.

The essential foundation of this model positions large-scale preparation centers in areas that serve delivery zones with limited distances of 3 to 5 kilometers from urban centers. The delivery-oriented business model enables kitchen franchises to optimize their operations and pass these performance advantages directly to their franchisees through increased profitability.

The Indian Food Delivery Market

The Indian food delivery ecosystem has grown extraordinarily, creating the perfect environment for cloud kitchen franchises to flourish. Consider these market statistics:

- India’s online food delivery market reached USD 13.45 billion in 2024

- Projected to grow at 25.4% CAGR through 2028

- Daily food delivery orders surpassed 6 million in major cities by end of 2024

- Digital penetration in tier-2 and tier-3 cities increased by 152% since 2021

- 87% of urban Indian consumers ordered food online at least once month in 2024

A strong digital food system operates through several driving elements.

- Digital Payment Adoption: UPI digital transactions used for food delivery grew 212% from 2022 through 2024 to reach 79% of the total food delivery orders.

- Smartphone Penetration: Smartphone users in India now exceed 750 million and a majority of these people (68%) use food delivery applications at least once per month.

- Aggregator Expansion: The food delivery platforms Zomato and Swiggy operate in more than 1000 cities throughout India to meet the demands of 85% of this country’s urban residents.

- Changing Consumer Habits: Working professionals in urban areas spent 34 percent higher on online food delivery services in 2020 compared to 2019 and the yearly order values showed an 18 percent rise.

The various industry trends have established new possibilities for kitchen franchises due to their growing market share from 15% in 2019 to 39% in 2024.

Why Choose a Cloud Kitchen Franchise Over Starting Your Own?

A cloud kitchen franchise investment proves more favorable than independent operations because it provides substantial enterprise advantages to drive profitability and sustainability.

Economic Advantages

A cloud kitchen franchise demands investment amounts that fall between 50–70% lower than conventional restaurants because owners need ₹5–30 lakhs to start up their kitchens but must spend ₹50 lakhs–1.5 crores on traditional food service location setup. The National Restaurant Association of India (NRAI) reports cloud eateries reach financial break-even much sooner at 8–12 months which is half the time compared to 18–24 months of traditional dining restaurants.

EBITDA margins reach 20–25% because rental expenses make up only 8–10% of revenue while normal dine-in operations maintain 15–20% rental costs. The food delivery sector has demonstrated rising importance to the economy as it adds 0.4% to India’s service sector GDP in 2024 and analysts predict this figure will reach 0.7% by 2027 due to escalating expansion.

Operational Benefits

Cloud kitchen franchises that lead the industry deliver tested operational frameworks and universal standard procedures across multiple locations that provide increased operational security by 63% over single-sited independent operations. A franchisee operating multiple cuisine brands through the multi-brand model can generate increased revenue potential of 120-150% from running 3-5 concepts out of one kitchen.

These franchises dedicate an average of 12–15% of their revenue to implement advanced systems they typically surpass in compared to independent operators. Their supply chain management enables franchisees to secure bulk buying discounts which decrease their food costs by 8–12% and ensure maximum inventory fulfillment rates up to 93%.

Market Access

Top kitchen franchises achieve widespread market awareness that reaches up to 75% in their target areas which leads to diminished expenses for customer acquisition through marketing programs. Food delivery aggregators provide top kitchen franchises with favorable terms that deliver commission rate reductions down to 18–22 percent while improving their search algorithm ranking. The existing customer loyalty system operated by these cloud kitchen brands increases customer retention by 28–35 percent more than independent cloud kitchens achieve. This leads to enhanced profitability as well as sustained customer engagement.

Comparison: Cloud Kitchen Franchise vs. Independent Operation

| Factor | Cloud Kitchen Franchise | Independent Cloud Kitchen |

| Initial Investment | ₹5-30 lakhs | ₹12-40 lakhs |

| Time to Market | 45-60 days | 90-120 days |

| Break-Even Period | 8-12 months | 12-18 months |

| Food Cost | 28-32% of revenue | 32-38% of revenue |

| Brand Recognition | Immediate | 6-12 months to establish |

| Technology Systems | Provided | Self-development required |

| Aggregator Commissions | 18-22% | 25-30% |

| Marketing Support | Comprehensive | Self-managed |

| Success Rate (2-year) | 78% | 42% |

The data convincingly demonstrates that kitchen franchises offer substantially reduced risk profiles while accelerating profitability timelines, making them increasingly attractive to investors seeking food industry opportunities with manageable risk parameters.

Top 10 Cloud Kitchen Franchise Opportunities in India (2025)

1. Rebel Foods

The cloud kitchen franchise leader Rebel Foods operates 4,000 internet restaurants which serve customers across various countries throughout India. Their innovative “Thrasio of food” model encompasses recognizable brands like Faasos, Behrouz Biryani, Ovenstory Pizza, and Mandarin Oak. Rebel Foods earned unicorn status during 2021 after securing $175 million funding which elevated its business value to $1.4 billion. The proprietary kitchen operating systems developed by the company produce 35% more operational efficiency than conventional restaurant systems.

- Franchise Models: Master franchise and operational franchise options

- Investment Range: ₹30-50 lakhs

- Franchise Fee: ₹5-10 lakhs (non-refundable)

- Space Requirements: 500-1,200 sq. ft.

- Support Offered: Training, marketing, supply chain integration, technology platform

- Revenue Sharing: 3-5% of gross revenue

- Profit Margin: 22-28% after all expenses

2. Biryani By Kilo

Biryani By Kilo stands apart due to its authentic culinary methods which involve cooking biryani in single clay containers using the “dum” cooking method. Since 2018 the cloud kitchen franchise has achieved year-over-year growth of 60% as it has added over 120 locations throughout 25+ cities. The traditional cooking methods along with premium ingredients allow them to retain 42% of their customers better than the industry standard of keeping 29%. To reach 200 locations the company plans for expansion through 2026.

- Franchise Models: FOFO (Franchise-Owned Franchise-Operated)

- Investment Range: ₹20-30 lakhs

- Franchise Fee: ₹7.5 lakhs

- Space Requirements: 700-1,000 sq. ft.

- Support Offered: Chef training, marketing, centralized ingredient sourcing

- Revenue Sharing: 4% of gross revenue

- Profit Margin: 20-25% after all expenses

3. Gobbler’s

Gobbler’s launched in 2019 then accelerated its growth to establish 53 outlets catering premium rolls and wraps while spotlighting fusion cuisine until today. Through their efficient kitchen layout Gobbler’s uses 40% less building space than conventional cloud kitchen franchises yet produces the same quantity of food. The combination of AI forecasting technology allows the company to minimize ingredient waste by 27%. The Gobbler’s network handles about 1,500 daily orders through its entire operational setup.

- Franchise Models: Standard franchise and mini-franchise options

- Investment Range: ₹7-15 lakhs

- Franchise Fee: ₹3 lakhs

- Space Requirements: 250-500 sq. ft.

- Support Offered: Comprehensive training, proprietary recipe access, marketing support

- Revenue Sharing: 1-10% sliding scale based on monthly revenue

- Profit Margin: 18-24% after all expenses

4. WarmOven

WarmOven manages a dessert and bakery segment through their operation of more than 70 kitchen franchises based in India. The company launched in 2019 and developed its competitive position through specialized business in cakes and cookies and dessert items that lead to higher average order value than multi-item providers. The proprietary packaging methods of WarmOven enable a 30% product freshness duration which allows expanded delivery zones. Monthly order processing at the brand reaches 35,000 orders and delivers products on time to customers 88% of the time.

- Franchise Models: Standard franchise with centralized production options

- Investment Range: ₹2-5 lakhs

- Franchise Fee: ₹1 lakh

- Space Requirements: 200-400 sq. ft.

- Support Offered: Recipe training, technology platform, marketing materials

- Revenue Sharing: Performance-based model (5-8%)

- Profit Margin: 25-30% after all expenses

5. Fresh Menu

The leader in the Indian food delivery ecosystem having begun its operations in 2014. As a culinary service provider, Fresh Menu produces chef-made signature dishes which feature daily selection changes and offer international food witha specific local touch. Fresh Menu has achieved widespread expansion across four major cities of India while reaching over 50 cloud kitchens in the national territory. The company implements a business approach that delivers high-quality ingredients, inventive recipes, and quick distribution logistics.

The Indian cloud kitchen market will grow to $2.5 billion by 202,6 and Fresh Menu will use its franchise program to exploit this opportunity during 2025. The company serves young working individuals as well as families in cities who desire restaurant-quality meals delivered conveniently. Through their advanced technology syste,m Fresh Menu facilitates franchisees to improve operational efficiency while adapting their menus to satisfy each location’s preferred customer preferences better.

- Franchise Models Offered: Hub-and-spoke model with central commissary and multiple delivery-only outlets.

- Investment Range: ₹30 lakhs to ₹75 lakhs depending on location and kitchen size.

- Franchise Fee: ₹10 lakhs one-time fee with a 5-year renewable agreement.

- Space Requirements: 500-1,200 sq. ft. for standard cloud kitchen units.

- Support Offered: Comprehensive training, centralized marketing, proprietary technology platform, and operational guidance.

- Revenue Sharing: 8-12% of monthly gross sales.

- Profit Margin: Average 18-22% net profit after all expenses and fees.

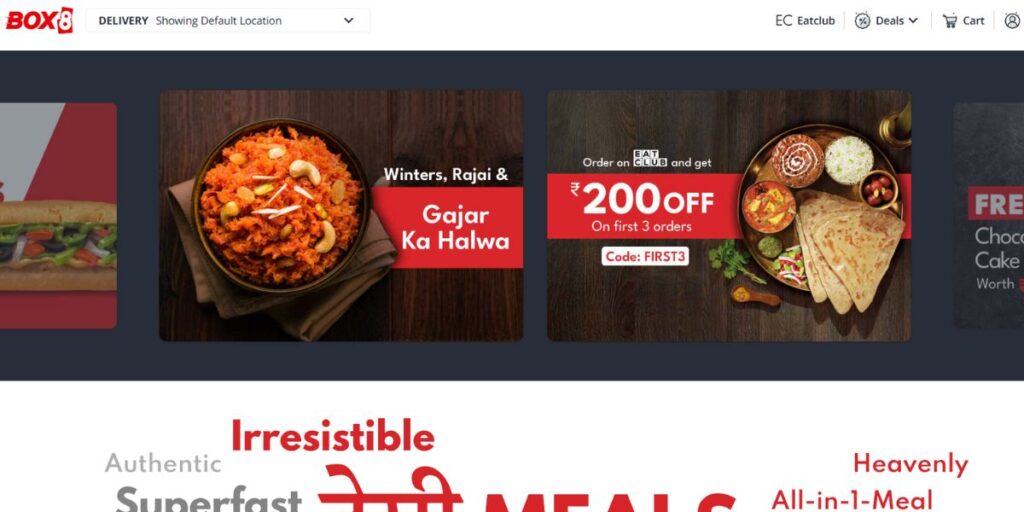

6. Box8

Box8 introduced the Indian QSR cloud kitchen franchise model through their Mumbai startup which has expanded to more than 150 locations across the entire nation of India. The company implements a combination of Indian culinary tastes and practical packaging solutions that shortens delivery durations by 13% compared to normal industry standards. Through their self-developed kitchen management system the company achieved a 42% decrease in order processing durations starting from the day they launched it. Validation of their customer satisfaction shows a score of 4.3/5 while the company reaches 60,000 customers every week.

- Franchise Models: Standard franchise and micro-cloud kitchen options

- Investment Range: Under ₹5 lakhs

- Franchise Fee: ₹1.5 lakhs

- Space Requirements: 250-500 sq. ft.

- Support Offered: Comprehensive training, technology platform, marketing

- Revenue Sharing: 5-10% of gross revenue

- Profit Margin: 20-25% after all expenses

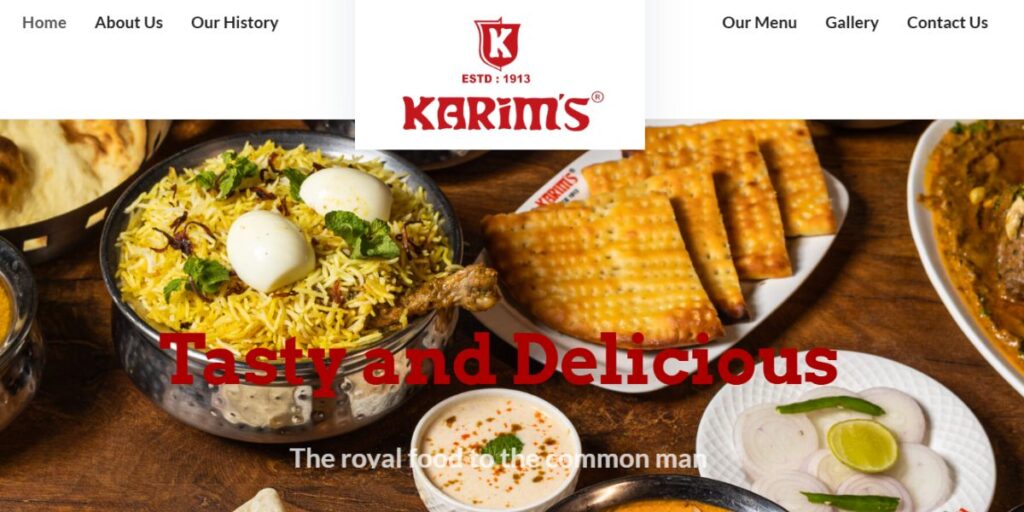

7. Karim’s

Karim’s maintains a successful fusion of its historic heritage dating back to 1913 together with contemporary cloud kitchen operations. By implementing their franchise model they maintain real Mughlai cuisine and exploit digital delivery solutions. The business started operating cloud kitchen franchises in 2018 and achieved fifty locations while aiming to reach 150 locations by 2027. The brand value improves price offerings by 15% despite competition yet consumers show devotion by acquiring products more than two times per month.

- Franchise Models: Premium franchise and heritage kitchen concepts

- Investment Range: ₹50 lakhs-1 crore

- Franchise Fee: ₹15 lakhs

- Space Requirements: 800-1,500 sq. ft.

- Support Offered: Chef training, authentic recipe development, marketing, technology

- Revenue Sharing: 7% of gross revenue

- Profit Margin: 22-27% after all expenses

8. Zomato Hyperpure Kitchens

Zomato Hyperpure Kitchens is a modern infrastructure-driven platform that supports cloud kitchen entrepreneurs with ready-to-use, fully equipped kitchen spaces. Backed by Zomato’s extensive logistics, supply chain, and tech ecosystem, Hyperpure Kitchens caters to food brands seeking a fast and reliable way to launch or expand delivery operations.

With access to Zomato’s Hyperpure ingredient sourcing platform, partners benefit from clean-label, high-quality supplies at competitive prices. The model minimizes setup time, reduces overhead, and enables operators to focus on food quality and brand growth, making it ideal for new ventures and established F&B chains.

- Franchise Models: Infrastructure and kitchen leasing model (not traditional franchise)

- Investment Range: ₹8–12 lakhs (setup & operational costs)

- Franchise Fee: None (leasing/licensing model)

- Space Requirements: 300–1000 sq. ft. per kitchen unit

- Support Offered: Fully equipped kitchen units, ingredient sourcing via Hyperpure, tech integration, access to Zomato’s delivery ecosystem

- Revenue Sharing: Typically, none; rent/lease structure instead

- Profit Margin: 20–25%, depending on scale and cuisine

- Website: hyperpure.com

9. The Rolling Plate

The Rolling Plate started in 2019 before its expansion to over twenty storefronts that serve innovative street-food rolls and bowls presented in modern formats. Their midway position between Quick Service Restaurants and premium dining prepared them to succeed in upper-middle-class communities through orders with values surpassing category norms by 27 percent. The process-based workflow optimization cuts their staff needs down by 30% but keeps their kitchen productive capacity intact.

- Franchise Models: Standard and express formats

- Investment Range: Under ₹10 lakhs

- Franchise Fee: ₹2 lakhs

- Space Requirements: 350-600 sq. ft.

- Support Offered: Operations training, marketing support, technology platform

- Revenue Sharing: Up to 10% based on performance tiers

- Profit Margin: 20-25% after all expenses

10. Mr. Shawarma

The company called Mr. Shawarma launched in 2017 and now operates more than 50 franchised cloud kitchens that serve Middle Eastern food with Indian influence. The investments they made into specialized equipment enable them to produce authentic shawarma food products at 40% faster speed compared to basic general-purpose kitchens. The focused menu strategy of their cloud kitchen operations produces food expenses 33% below multi-cuisine facilities without negative impact on customer ratings which stay above 4.2/5. The brand operates a daily transaction volume of 2,500 orders throughout their various kitchen franchises.

- Franchise Models: Standard and mini-franchise options

- Investment Range: ₹5-10 lakhs

- Franchise Fee: ₹2 lakhs

- Space Requirements: 300-600 sq. ft.

- Support Offered: Specialized equipment training, recipe standardization, marketing

- Revenue Sharing: Up to 10% based on revenue tiers

- Profit Margin: 22-28% after all expenses

Factors to Consider When Choosing a Cloud Kitchen Franchise

The process of choosing a cloud kitchen franchise demands thorough investigation within various essential factors:

Brand Strength and Recognition

Prospective franchisees need to check brand search volumes using Google Trends because successful kitchen franchises demonstrate annual demand growth between 25–40% annually. The evaluation of delivery platform ratings reveals that successful franchises achieve a 4.2 rating scale at ResponseType: 78% of their locations. Leading brands normally obtain above 65% positive consumer brand recall results from surveys targeted at their specific markets.

Technology Infrastructure

Cloud kitchen franchises that lead the market spend 12–15% of their earnings on proprietary operational software which boosts kitchen performance. A quality indicator for franchises involves their ability to connect flawlessly with various delivery systems while leading franchises maintain a 99.7% order precision rate. Money from leading franchises enables franchisees to access detailed performance data that drives data-based choices which lead to higher profit margins of 15–20% over the industry average.

Territory Exclusivity

The planning process for franchise territories uses a protection radius which normally measures between 1.5 to 3 kilometers in urban areas to prevent intra-franchise market competition. About three-quarters (75%) of franchises contain essential development schedules within their agreements which specify expansion deadlines. Exclusive top-tier franchisors analyze territory locations by combining more than fifteen demographic variables which helps them make strategic franchise placement decisions.

Support Structure

Franchisors provide minimum 14-day but maximally 30-day training to new franchisees which they back up with regular restorative courses for persistent quality maintenance. System-wide sales generate corporate marketing funds totaling between 1% and 3% to increase brand visibility. Franchise locations receive operational leadership through periodic field support assessments that happen weekly to monthly based on their stage of development.

Financial Performance

Unit Economics evaluation requires reviewing Item 22 from disclosure documents because it shows the real performance metrics of a franchise. The complete cost structure needs analysis against industry benchmarks for the purpose of maintaining sustainability. A franchise’s outlook for expansion should be evaluated via system-wide sales figures because established franchises show predictable annual growth rates spanning from 25% to 35%.

Adaptability to Market Changes

Successful kitchen franchises maintain their market position by updating 15–20% of their menu items each quarter when following new food market trends. Price flexibility among leading franchises enables local adjustments from franchisees to cater to their market conditions while present in 65% of major franchises. Successful cloud kitchen franchises should offer format flexibility which allows them to serve both different kitchen sizes and different investment levels for franchisees.

Low-Investment Cloud Kitchen Franchise Options in India Under 5 Lakh

Multiple kitchen franchises accept new operators with capital limits starting at less than ₹5 lakh.

1. Box8 Express Model

The Box8 Express model operates using a constrained menu of high-margin products to decrease equipment requirements while meeting brand requirements. The particular tier-2 city expansion of this format attained financial recovery across 28 locations within nine months during 2023-2024.

- Investment Range: ₹3.5-4.8 lakhs

- Space Requirement: 200-300 sq. ft.

- Expected ROI Timeline: 10-12 months

- Key Advantage: Simplified menu focusing on top-performing items requires 40% less equipment

2. WarmOven Micro-Kitchen

The production process of WarmOven micro-kitchens functions through a central facility system which manufactures some ingredients before they are completed at franchise locations. By implementing this approach business operators achieve decreased equipment expenses that amount to 42% without compromising product dependability. This food operation handles between 30 and 50 daily orders which produce revenue of ₹450 to ₹600 on average for each transaction.

- Investment Range: ₹2-3.5 lakhs

- Space Requirement: 150-250 sq. ft.

- Expected ROI Timeline: 8-10 months

- Key Advantage: Centralized production support reduces onsite preparation requirements

3. Cloud Tiffins Regional Cuisine

Cloud Tiffins delivers regional Indian cuisines through rotating menu concepts which enables franchisees to take advantage of local food preferences. The company protects food quality through their exclusive packaging solutions which enable deliveries up to 45+ minutes and expands the service range. The operating margins of their franchise network reach average levels exceeding 24%.

- Investment Range: ₹4-4.9 lakhs

- Space Requirement: 250-350 sq. ft.

- Expected ROI Timeline: 9-12 months

- Key Advantage: Specialized regional cuisine focus creates distinct market positioning

The Cloud Kitchen Franchise Application Process: What to Expect

The procedure to obtain cloud kitchen franchising takes between 45 to 90 days.

Initial Inquiry and Qualification (7-14 days)

The franchisor starts by analyzing candidate financial results to confirm their ability to provide the needed liquid capital which generally needs to reach 50% of their total investment before unleveraging it. About 87 percent of franchisors accomplish extensive background investigation to guarantee applicant trustworthiness. At this preliminary phase candidates must finish the initial application to share their background information together with their financial standing and selected business site.

Discovery and Due Diligence (14-30 days)

The evaluation process requires future franchisees to study their Franchise Disclosure Document (FDD) so they understand all key elements within the franchise relationship because this material is legally enforced. The franchisor usually organizes three to five interviews between franchisees that provide direct access to their experiences. The candidate has two options for observing operational kitchens through virtual viewing or physical visits. A financial projection analysis takes place after which the process evaluates the unit economics and additional performance indicators.

Territory and Location Selection (7-14 days)

The selection of franchise locations begins through brand standard reviews followed by customer demographic research of the service region and competitor mapping within the delivery zone. The complete assessment process leads enterprises to develop forecasts which predict performance at particular locations.

Final Approval and Onboarding (14-30 days)

New franchisees who overcome the approval process must execute a lengthy franchise contract for 5 to 7 years and provide the initial franchise payment before joining their new business. The franchise applicants begin their training in full programs and development schedules define important stages until the restaurant opens. Most successful cloud kitchen franchise owners have food industry experience while meeting minimum financial requirements as well as sharing company principles and process compliance and showing a capability to grow their business through expansion programs.

Conclusion

Franchisees who thrive in the cloud kitchen space are those who combine the strengths of established brands with smart systems, local market insight, and operational agility. By aligning with experienced franchise networks and leveraging their technology-driven frameworks, entrepreneurs can accelerate their path to profitability while minimizing common startup hurdles.

As the delivery-first dining model continues to evolve, we can expect innovations in kitchen layouts, order management systems, and distribution strategies. Those who stay ahead by offering unique culinary experiences, maintaining high standards, and adapting swiftly to changing customer expectations will be well-positioned for long-term success in this dynamic and growing industry.

FAQs

1. What range of time does a cloud kitchen franchise typically need to generate a return on investment in India?

Ghost kitchen franchises generally reach ROI during their 12-18 month operating cycle though specific low-cost models can start making profits between 8-10 months. The achieving of Return on Investment in cloud kitchen operations depends directly on location selection and operational efficiency as well as marketing effectiveness.

2. What strategies do Ghost Kitchen franchise outlets use to manage their food delivery operations?

Cloud kitchen franchise businesses work together with delivery service providers such as Zomato and Swiggy who operate the delivery service network. Cloud kitchens generate 85% of their sales from delivery apps but they receive 15% of their orders through their own direct order channels.

3. What difficulties do Ghost kitchen franchise owners encounter during operation?

The main obstacles faced by Ghost kitchen franchises operators stem from 25-30% platform commission fees and expensive customer acquisition costs together with food quality control during delivery and overcoming competition in digital market environments. Virtual brand management benefits from advanced systems for inventory control and staffing routines when handling concurrent brand operations.

4. What are the special regulations which affect cloud kitchen franchises?

To operate their business cloud kitchen franchises need to fulfill three main regulatory requirements that include FSSAI standards and municipal and GST coding obligations. Residents of different states must follow specific cloud kitchen regulatory requirements which include specifications for infrastructure systems alongside waste control protocols and fire protection standards.

5. What variables determine the territory boundaries for cloud kitchen franchises?

The division of territories depends on delivery distance (between three and five kilometers in cities) alongside population statistics together with neighborhood income data and existing market competition analysis. The majority of franchise agreements indicate protected territory areas where new locations of the same brand cannot be established.