India has become a global leader in fintech companies in India in an age of people who interface with financial services differently. India has been at the forefront when it comes to adopting a digital first approach to financial inclusion, and as a result, India has seen innovative startups emerge that are transforming everything, including payments and lending, wealth management, and insurance.

More than 450 million smartphone users and the proliferation of the internet have facilitated unprecedented expansion of India’s fintech ecosystem with billions of dollars in investments and several unicorns. This in-depth insight dives into key market players, current trends, and opportunities that mark India in 2025 as one of the most active financial technology markets worldwide.

India’s Fintech Revolution

The fintech development in India is estimated to reach the value of $461 million by 2025 and further progress to $50 billion by 2030, which indicates a revolutionary change in the financial landscape of the country. The revolution was started with the launch of the Unified Payments Interface (UPI) that democratized digital payments across economic spectrums.

The establishment of government schemes such as Digital India, Jan Dhan Yojana and Aadhaar has given fintech companies in India a strong start that they can build on. Regulatory facilitation has helped the country adopt an innovative strategy of financial inclusion that is equal parts technology and regulatory support and India is now the second-largest fintech hub in the world after the United States.

List of Fintech Companies in India by Category

|

Category |

Top Companies |

|

Payments & UPI |

PhonePe, Paytm, Google Pay, Razorpay |

|

Lending & Credit |

KreditBee, Capital Float, MoneyTap, Lendingkart |

|

Wealthtech & Investments |

Zerodha, Groww, Upstox, Paytm Money |

|

Insurtech |

PolicyBazaar, Acko, Digit Insurance, Turtlemint |

|

Neobanking |

Jupiter, Fi Money, Niyo, Open |

|

Cryptocurrency |

CoinDCX, WazirX, ZebPay, CoinSwitch |

|

Business Banking |

RazorpayX, Open, EnKash, Cashfree |

|

BNPL & Consumer Finance |

Simpl, LazyPay, ZestMoney, Slice |

Top Fintech Companies in India (2025 Edition)

Payments & UPI

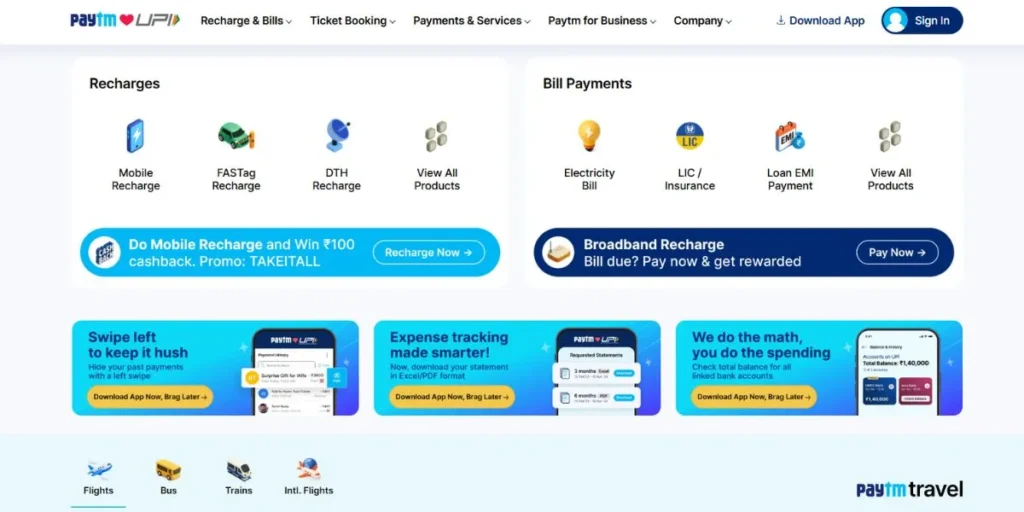

1. Paytm

Among the fintech companies in India, Paytm is one of the innovators of digital payments in India transforming the way Indians make digital transactions. The company is headquartered in Bangalore and started by Vijay Shekhar Sharma as a basic company, but has developed into a wide-ranging financial services nexus.

According to the most recent regulatory and competition, Paytm is still providing more than 300 million customers with the merchant payment option, getting computerized wallets and partnering with banks. The popularity of the platform has been enhanced by integration with QR-codes and UPI, making it omnipresent in Indian retail.

The paytm broad strategy involves payment services, banking services, lending and insurance products. A strong market presence in the Indian digital payments segment was ensured due to the early mover advantage of the company. The platform is available with complete digital financial solutions to consumers and merchants countrywide with Paytm Payments Bank and numerous financial products.

Why They’re Big: the first-mover advantage in the Indian space of digital payments, with a full-blown merchant ecosystem.

Best For: Business and small merchants that require integrated payment and business solutions.

Core Services:

UPI, digital wallet payments services

Merchant payment via QR codes

Paytm Payments bank services and savings accounts

Billing and recharging mobiles, and integrating the market place

2. PhonePe

PhonePe, is currently the most valuable privately held fintech firm in India as it has a valuation of 12 billion, ahead of fintech companies in India. The platform owned by Flipkart accounts for the greatest portion of the overall volume of UPI transactions monthly in India, billions in transactions are processed.

PhonePe has been very successful owing to its user friendly interface, our strong security measures and the capacity to build partnerships with merchants all over the country. It extended to cover insurance, sovereign gold reserves, and mutual funds and grew into a full service financial services hybrid.

This shows that PhonePe has a dominant market share as it carries out at least 45 among every single UPI transaction in India. The stress on the user-experience and integration has seen the company garner more than 400 million users. As financial technologies evolve and ever more services emerge, PhonePe is an example of how digital payments are transforming in India, a market with many exciting new developments happening in fintech.

Why They’re Big: UPI Market Share – it leads the market with more than 45 percent of all digital payments in India.

Best For: Personal customers who want a smooth UPI payment-based experience with simple investing choices.

Core Services:

Merchant and peer-to-peer payments UPI

Insurance and mutual funds investments

The mobile recharges and bill payment services

Gold interest and wealth management

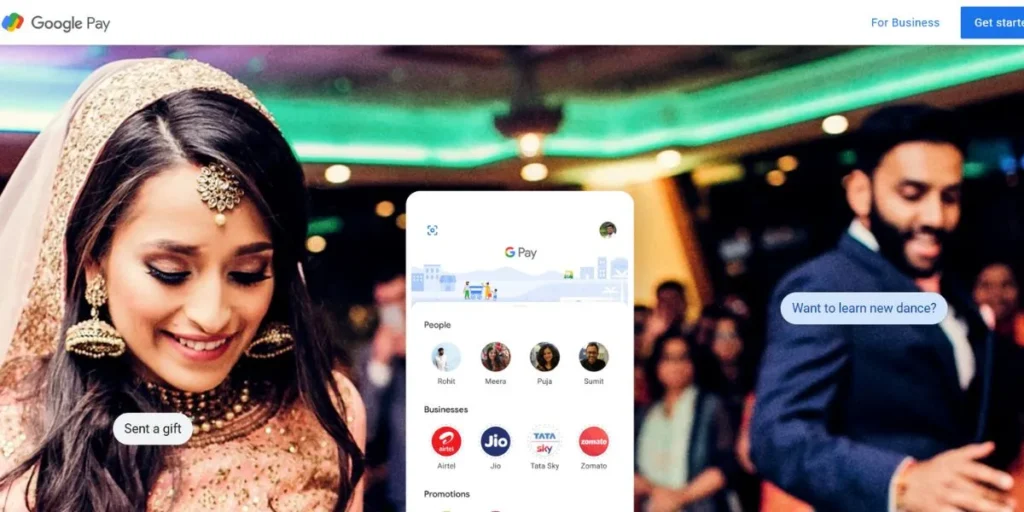

3. Google Pay

Google Pay harnesses the worldwide technology base of Google to offer secure and seamless payment experiences to be a leading payments app and fintech firm in India. It has been integrated with the Google ecosystem to give it access to Gmail, YouTube, and Google Assistant; this makes payment flows seamless to millions of users.

The emphasis on the security of the Google Pay system, based on tokenization and a comprehensive fraud-detection mechanism, has attracted much trust among users in Indian highly competitive digital payment realms.

Its cashback programs and reward schemes have resulted in a lot of adoption and transaction volumes among users of the platform. Google Pay is made up of international technology standards and local market understanding, and it is accessible to different users in India.

The wide acceptance countrywide is also promoted by the partnership of the company with banks and merchants. Google Pay with its constant improvement of features and security brings it to the leading system of payments in the dynamic fintech world of India.

Why They’re Big: They are supported by the technology and massive numbers of Google and they have tight security systems.

Best For: Users whose actions are a part of and related to Google business and who need secure and rewarded transactions.

Core Services:

The advanced security feature payments of UPI

Connection with Google services and contacts

Rewards programs and other cashback offers

Bills splitting and paying as a group features

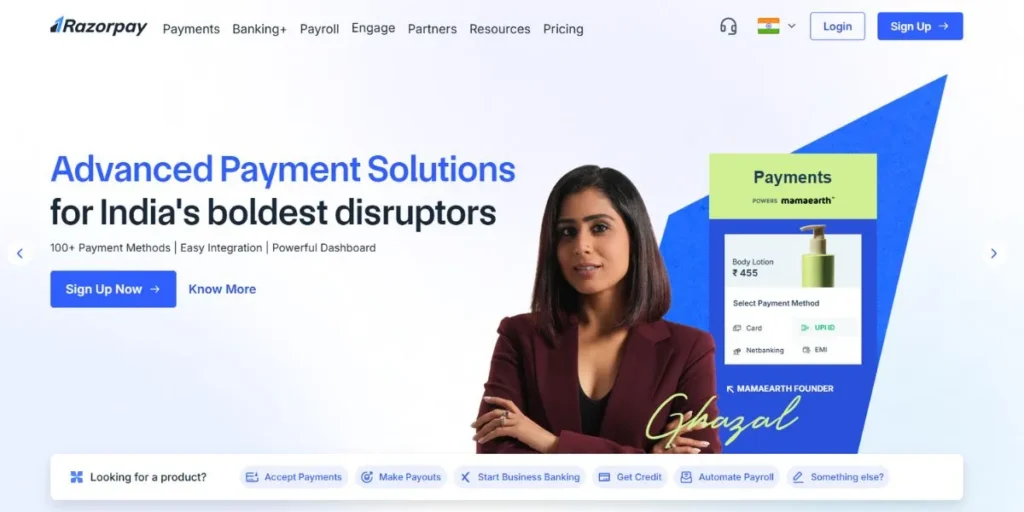

4. Razorpay

Razorpay is considered the leader of payment gateway in India and has been able to emerge as one of the most successful fintech companies in India with a valuation of 7.5 billion. It offers business, extending payment infrastructure and developer-friendly APIs to over 8 million businesses, which it is providing with seamless integration.

The integration options are vast and vary greatly which has seen Razorpay utilized by most start-ups and enterprises as a secure payment option. Given the entry of the platform into banking, lending, and payroll services, it becomes indicative that it is mutating into a full-stack financial technology enterprise.

Razorpay is handling billions in transaction volume per month, having contributed to the growth of India on the market of digital economy. Responding to innovation and customer service, this company has won the respect of different companies in other sectors of operation. Having strong security, compliance with regulations, Razorpay continues to grow its services to cover new emerging needs of businesses in the dynamic market of India.

Why They’re Big: The leader in the market of services to payment gateway and a strong API infrastructure of companies.

Best For: Companies and developers who need extensive payment integration services.

Core Services:

Business payment gateway and APIs

Banking and current account banking

Payroll and employee benefit services

Working capital and lending finance facilities

Lending & Credit

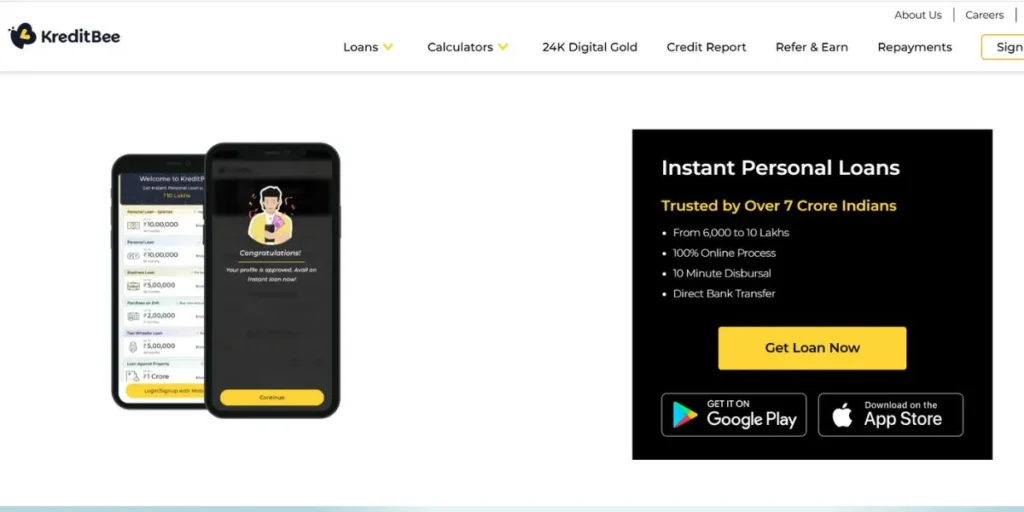

5. KreditBee

KreditBee has transformed personal lending and claims to be the first-ever India-based fintech company that embraces technology and offers immediate loans to underserved groups. The platform leverages alternative data sources and machine learning to ensure credit decisions are made in real-time to provide its users with fast loan approvals who would otherwise be excluded in the traditional banking ecosystem.

The credit available through KreditBee has reached millions of users in India because it is based on a mobile-first approach and minimal documentation requirements.

Its efforts towards having a responsible lending practice and transparent pricing has created a high level of customer loyalty and customer trust. Every day, KreditBee has thousands of loan requirements reflecting the scale of demand of readily available credit products.

The new credit scoring techniques of the platform aid financial service usage by the users who have little to no history in the sphere of credit. KreditBee is reaching further in the Indian personal lending market with competitive interest rates, available repayment terms and conditions.

Why They’re Big: First mover in instant personal loans based on alternate credit scoring.

Best For: personal lending and machine learning

Core Services:

Small documentation instant personal loans

Line of credit accounts to regular clients

Purchase financing with EMI Oh

Guidance and tools to boost credit scores

6. MoneyTap

Personal credit lines were a world-first concept to the market in India when MoneyTap started operations, thus being among the pioneering fintech firms in India. Its unusual system of payment by use enables the customers to withdraw the amount required and be charged interest on what he or she uses.

The alliances formed with banking giants will guarantee the competitive interest costs and fund security to the users at different income levels. The financial prudence and transparent approach in terms of fees have made consumers aware of the importance of responsible usage of the credit that the company has to offer.

MoneyTap targets thousands of customers that demand flexibility in their borrowing behavior instead of conventional loans. The digital-first platform has made access to credit to be associated automatically with young professionals and salaried personnel.

On the one hand, the features such as no-cost EMIs and instant credit approval allow MoneyTap to continue gaining more users in the Indian market of personal finances, both promoting financial literacy rates and providing convenient options of taking a credit.

Why They’re Big: The first bank to offer a personal credit line concept, which is flexible when it comes to borrowing.

Best For: Someone who wants flexible credit access where he only pays as he goes as well as a person who wants a pay-as-you-go convenience.

Core Services:

Personal line of credit with easy withdrawal plans

Free EMI on shopping

Emergency fund and advance of salary facilities

Credit usage monitoring and tools

Wealthtech & Investments

7. Groww

Groww is one of the top fintech companies in India and it has democratized investments through the availability of mutual funds, stocks, investment, and products to first-time investors. Its unique education approach and commission-free investments in mutual funds have gained the platform millions of young investors who are interested in financial growth.

The user-friendly layout of the Groww platform and extended portfolio tracking features have made the process of making investments easier in India, by retail investors. Acquisition of stocks and offering initial public offerings has seen the firm focus on a universal investment environment to fulfill different requirements of its users.

Groww carries out thousands of investment orders every day, which is an indication of increasingly active investor involvement in the Indian capital markets. The publisher has also established high user engagement by dedicating the platform to investor education in the form of content as well as webinars. Groww keeps enabling Indian citizens to accumulate wealth through systematic investment and financial planning through the features such as automated SIP and goal-based investing.

Why They’re Big: Company is the primary interface of first-time investors in zero-commission mutual fund investments.

Best For: Novel investors who need education, who want mutual funds and stocks simple to deal with.

Core Services:

Investment in zero-commission mutual funds

Demat account and stock trading

IPO investment and application service

Portfolio and investment tracking tools

8. Zerodha

Zerodha is one of the most successful fintech companies in India that has over 12 million active participants as it transformed stock trading by introducing discount brokerage. The company disengaged the traditional per-trade commission structures, and this has made investing affordable to retail investors in the country.

Zerodha has been building products with the technology-first approach – this has brought on board serious traders and investors who prefer to use professional grade tools. The loyalty of the company is exemplary because of its bootstrapped growth model and emphasis on customer education that engages actions such as Varsity.

Zerodha has millions of trades every day, making a substantial contribution to the volumes in India, capital markets. The members of the platform have credible pricing structure and a strong technology infrastructure that are embraced by investors across the US. As a profitable, customer-centric organisation with a history of continuous innovation in trading technology and educational content, Zerodha has continued to push India towards retail investing.

Why They’re Big: Dismantled all that traditional brokerage was by offering discount pricing and using advanced trading technology.

Best For: Those who take trading seriously and want to invest and want to trade Active, as well.

Core Services:

Discounting, trading in stocks and commodities services

Mutual fund online investment platform (Coin)

High power trading instruments and technical analysis

Teaching content and market intelligence

9. Upstox

Upstox is one of the strongest Indian fintech companies that transform stock trading with competitive prices and convenient user-interface. Upstox has comprehensive trading features targeting both the beginner traders and professional traders to have the best trading experience with ready advanced charting functionalities, real-time market information, and technical trading analysis tools.

The mobile-first strategy of the platform is appealing to the younger population because they are looking to find convenient trading strategies. Important functions are the trading of stocks and derivatives at low prices, investment in mutual funds, ETF selections and investment consultation.

The investment-related educational contents and customer support offered by Upstox equip users with knowledge that makes them able to make sound investment-related decisions. The platform also offers advanced technology at a reasonable price; hence, it is a good option to choose if you want trading tools of professional quality without the expensive pricing. Upstox, with its seamless cross-device transition and end to end research services, continues to democratise the Indian investor universe.

Why They’re Big: Strike the middle ground between low rates and easy trading to all classes of investors.

Best For: Both inexperienced and accomplished traders who want trading features of all kinds.

Core Services:

Cheap derivative and stock trading

Investments options include mutual fund and ETFs

High-level charting and the technical analysis tools

Investment advisory services and research services

10. Paytm Money

Paytm Money is a strategic business entity that uses the huge Paytm ecosystem to provide the multi-faceted integrated investment services to millions of consumers in India. The platform integrates the investment opportunities with payment infrastructure, seamlessly intersecting the two worlds and easing up the transaction.

Paytm money categorizes itself as a goal based investing and systematic investment plan (SIPs) platform which helps a user gain disciplined investing behaviour through automated savings and portfolio management. The major services of the company are mutual fund investments, trading in stocks, provision of demat accounts and goal-based investment planning tools.

This feature will allow instant fund transfer via the platform since the Paytm payment system is integrated with the platform to allow seamless transactions. Investment advisory services provide education content that help users make decisions with investment concepts broken down into easy-to-understand information.

As far as the audience of the existing Paytm users is concerned, the version of the platform has a familiar interface design and a trustful brand reliability which can be used as a reason to choose convenient investment solutions within an already existing digital ecosystem.

Why They’re Big: Integrates payment and investment functions in Paytm so that it can leverage on its huge user base.

Best For: Existing Paytm users who want convenient investing in areas that they already use.

Core Services:

An investment in mutual funds with the SIP option

dummy stock and demat account services

Goal-based investment planning oriented tools

Paytm payment infrastructure integration

Insurtech

11. PolicyBazaar

PolicyBazaar is a 3 billion dollar company that rules the domain of online insurance in India changing the way people buy insurance. The platform functions as a complete insurance market, and includes transparent comparison of many insurance providers and advisory services. The smart comparison engine of PolicyBazaar searches hundreds of insurance plans and customers get the right place of the insurance cover at appropriate prices.

Its specialty is in a full-fledged insurance comparison, expert-consultation assistance, claim support, and individual insurance suggestions using the rich profile of the user. Good relationships will be applied with the top insurers to ensure a wide range of product offerings and competitive premiums.

The concentration on claim support and customer service has instilled confidence in the online acquisition of insurance in the company. The subject matter experts at PolicyBazaar offer personal advice based on the needs of the customer, consulting on the complicated insurance choices. Open processes and wide coverage choice on the platform means that more consumers can turn to the platform to get their desired insurance products and professional advice at competitive rates.

Why They’re Big: It is a market leader in online insurance that provides comprehensive insurance comparison and advisory services.

Best For: Insurance shoppers looking to be able to easily compare insurance and receive professional advice.

Core Services:

In depth insurance comparison between the several providers

Advisor and consultancy services of experts

Helping and support claims services

User-based insurance recommendations and reverse searching

12. Acko

Acko is challenging the traditional insurance business, creating an end-to-end online digital insurer business model, entirely technology-based in its operation. The company focuses on instant policy issuance and claims process automation, removing the need for old-fashioned sets of papers and a time-consuming process of approval.

Specialization Acko insures in select areas, and specialises on motor and travel insurance especially, so it can charge very competitive prices. Its key products are tokenized insurance policies and instant motor insurance policies, travel insurance, electronic claims management, tailored insurance avenues, and an end-to-end mobile first insurance command measurement platform.

The paperless process and user-friendly mobile interface of the platform entices tech-savvy customers who need a convenient way to undertake insurance processes. The technology also allows Acko to customize policy in real time and settle claims instantly using a unique way of technology.

The direct-to-consumer strategy of the company has neutralized the use of the middleman hence, the premiums are reduced and the speed of delivering the services is improved. With its high-tech insurance services that are easy and convenient, Acko is the future of insurance in an age of efficiency and on-digital convenience of modern consumer values.

Why They’re Big: Instant policy processing and claims processing via full-stack digital insurer.

Best For: Customers who are tech-savvy and look at fast and paperless insurance.

Core Services:

Immediate motor and travel policy

Digital settlement and insuring

Personalized insurance products to suit need

Insurance management platform mobile-first

13. Digit Insurance

Digit Insurance is a digitally focused-company that integrates unique product design with top customer service to deliver differentiated insurance experiences to the contemporary consumer. The ability to cover the contemporary risks and lifestyle-oriented insurance products that appeal to the youthful sectors of the population is relevant in terms of how the company focuses.

Digit is known to offer transparent pricing structures, as well as favorable claim resolution frameworks, which have won it much industry accreditation, and customer confidence. Its core services involve extensive motor and health insurance with new unique features, travel and gadget insurance that is customized to fit modern lifestyles, risk assessment incorporation that is based on the IoT which accurately calculates premiums and transparent settlement of claims within a customer friendly process.

The combined use of the platform with the IoT devices allows executing advanced risk analysis and individual calculations of the premium. Digit also provides transparency to quit the dark costs and confusing conditions, which make insurance accessible and simpler to understand. Young professionals that want modern insurance with a transparent process and great customer service will find Digit Insurance with innovative plans to suit modern lifestyle requirements.

Why They’re Big: Insurance products that focus on the newest threats and a high level of customer service.

Best For: Young professionals who want modern solutions to insurance with no hidden procedures.

Core Services:

Car and health insurance that are innovative

Devices and travels insurance in contemporary lives

Risk assessment and calculation of premium with OT integration

Clear processes of settling claims without frustrating customers

Neobanking

14. Jupiter

Jupiter is the new generation of digital-first banks in India, offering end-to-end bank experiences using modern mobile applications. The platform integrates the elements of a traditional banking model with the new financial control tools and functions and makes up an entire financial environment. The emphasis of Jupiter on quality user experience and personalized financial advisor enable customers to act in their best financial interest.

Other services have been core services such as digital savings accounts, high-yield savings accounts, integrated payment and money transfers, personal financial management and budgeting tools, and investment and wealth management integrations.

The data-driven nature of the platform delivers the individualized financial information and suggestions depending on the personal financial goals and patterns of spending. The user-friendly design of the interface used in Jupiter allows every user to manage the complicated financial procedures.

Tech-savvy customers who want all-in-one digital banking services with comprehensive financial insights can utilize Jupiter as a single place that can convert traditional banking into a modern personalized way of managing finances.

Why They’re Big: The End to End digital banking offering that includes personalized financial management tools.

Best For: Power users looking to get full digital banking with financial analysis.

Core Services:

High interest digital savings accounts

Combined payment and money services

Budget and personal finance management tools

Integration of investment and wealth management

15. Fi Money

Fi Money changes personal finance by using a behavioral finance approach to automatically create better financial behaviors in users. The platform is focused on the management of salary accounts, which includes smart automated savings that promote prudent economical practices. The peculiarities of Fi Money draw the attention of young professionals who aim at habit building and are willing to achieve their financial goals easily.

The core services feature cover include full scale salary account management with automated savings, user friendly expense tracking and budget management, goal based savings and investment and built in bill payments and subscription management.

The behavioral finance model of the platform employs psychological knowledge and stimulates good financial decisions made by subtle nudges and automated financial tasks. Fi Money integration with expenses monitoring and invoice management also ensures full financial visibility that is not achieved through manual work.

As perfectionists and young professionals, Fi Money provides forward-thinking solutions which enable the building of automated financial habits and systematic savings increases no longer a burdensome chore but a highly effective tool in the path towards long-term financial wellness and the accomplishment of goals via intelligent automation.

Why They’re Big: Behavioral finance strategy to self teach users to have improved financial practices on auto-pilot.

Best For: Young Professionals who want their finances to grow through automated financial habits and savings.

Core Services:

Automated savings salary accounting

Templates to monitor costs and budgets

Saving and investment functions that are goal-based

Subscriptions and Bill payment management

16. Niyo

Niyo specialises in niche banking services to particular user categories, especially in the area of travel banking, and cross-border transactions. The platform works with regular travellers and overseas workers that have special financial services that cater to global mobility. The strategic partnerships Niyo has with traditional banks have seen it have a full range of banking offerings but still keep digital-first user experiences superior.

The core services entail the international travel and forex banking solutions, zero artifacts international dealings, and international transactions as well as ATM activities across the global platforms, special accounts that serve the overseas workers and the students abroad, and the integrated expense management systems in the international spending.

The niche strategy of the foreign exchange and international banking specialization also positions the platform in a special niche with a need to serve niche markets. It makes Niyo valuable to globally mobile professionals since its priority is on removing camouflaged foreign exchange costs and giving transparency regarding international banking.

Frequent travelers or corporate professionals who have active international banking requirements are offered specialized solutions which traditional banks can not and the Niyo solution combines global connectivity/accessibility with digital convenience and transparent pricing.

Why They’re Big: Specialist banking services in the field of travel and overseas transactions.

Best For: Frequent business travelers and people with need to have international banking facilities.

Core Services:

International travel and bank foreign exchange (fx) services

Zero-markup international transactions and use of ATMs

Special accounts on foreign workers and students

Embedded cost-tracking of international spend

Biggest Fintech Companies in India (2025)

India Landscape Its landscape is dominated by a few unicorns and fast-growing startups that have attracted exceptional valuation, and user base:

- PhonePe: PhonePe is the forefront leader in terms of valuation of about 12billion and extending to more than 400 million UPI in India, performing the highest count of UPI transactions. The extensive outlook in the financial system and intelligent business associations with merchants have consolidated its authority in the market.

- Razorpay: Next is Razorpay with a value of 7.5 billion dollars providing its payment gateway service to 8 million customers. Its developer-friendly stance and thorough API infrastructure has established the company as a staple of India’s digital economy.

- Paytm: Paytm is achieving its relevance with a valuation of 6B and 300M+ users even though it is not without regulatory problems. Its first mover advantage and its multifaceted environment of merchants has also empowered the platform to remain relevant in the context of digital payments in India.

- Zerodha: Zerodha is the selected bootstrapped success story of India. It has more than 12 million active users, and it is an innovative disrupter of stock trading in India because of discount brokerage and excellent technology services.

- PolicyBazaar: PolicyBazaar is a giant in the industry, it has a valuation of $3 billion, and it is the most renowned insurance comparison and gateway to buying insurance in India.

These firms exemplify the heterogeneous essence of fintech firms in India since they address a wide range of areas including payments, lending, investments, and insurance businesses to millions of customers in the country.

How to Start a Fintech Company in India

The Indian fintech market is one with enormous potential in front of entrepreneurs who will go the extra mile in wading through the regulatory quagmires and market trends. The secret to success lies in customer understanding, creation of a strong technology and adherence to the changing regulations.

Regulatory Compliance: RBI regulations, data protection laws, and laws on the specific sector all have to be understood and followed to insure long term operations and legal issues.

Technology Infrastructure: To come up with scalable, secure and user-friendly platforms capable of supporting a high transaction level whilst ensuring data integrity and system stability during the growth stages.

Customer Acquisition: creatively establishing marketing methods and alliances to use in obtaining customers in a competitive scenario in addition to creating confidence and showing obvious value offering.

Funding Strategy: Preparation of detailed business plans and financial models to make the business interesting to investors and displaying how business can achieve sustainable unit economics and clear routes to profitability.

Market Differentiation: The ability to find the underserved segments or the unique value props in differentiating your solution(s) in the market and sustaining competitive advantages in the market since there is market dominance by major players in the industry.

Conclusion

India is also an example of the digitalization and rising financial inclusion, in such a manner that their fintech businesses have shown impressive growth trends. It is no surprise that India’s fintech market is being eyed by global investors, with the total sum of this market expected to reach $95.30 billion by 2030. This can be proved by the fact that such firms as PhonePe, Razorpay, and Zerodha have managed to become successful.

The conducive environment in the fintech industry is adopted by government initiatives, sound digital infrastructure, and a big underserved population. Fintech companies operating in India will lead the next era of democratization in finance and will bring innovative, affordable and accessible financial solutions to both urban and rural sectors.

Frequently Asked Questions

What are the most valued Fintech Companies in India?

The Indian valuation is led by PhonePe with $12 billion followed by Razorpay with its $7.5 billion and Paytm with $6 billion valuation, among the most valuable fintechs in the country.

What do Fintech Companies in India succeed internationally?

The Indian fintech companies in India thrive on novel technology, intimate knowledge of the market, affordability of their services and emphasis on financial inclusion because they believe in reaching out to the underserved people.

What are the strategies fintech companies in India can use to remain compliant with regulations?

Major fintech organizations in India have a separate compliance team, frequent meetings with the RBI, an excellent data protection system, and adherence to the developing regulations on financial technology.

What are the opportunities in Fintech Companies in India?

The market provides growth in neobanking, rural fintech, business-to-business payments and niche financing, and fintech organizations in India received a large amount of venture capital and personal capital funding.

Where do Fintech Companies in India stand against the rest of the world?

Cost innovation as a competitive advantage is shown by the Indian fintech companies in India in the form of local expertise to the local markets and government support, as well as unique approaches to solve emerging market problems.