The Indian e-commerce scene is among the most lively and fast-growing markets worldwide, and at its core is the Flipkart Business Model. After only a few years of its establishment, Flipkart has evolved to be the top digital marketplace in the country. The company is a leader with a rough market share of around 38%, and it competes with the best of global giants and local challengers alike. The historic acquisition made by Walmart for an eye-popping $16 billion in 2018 not only proved the company’s dominance in the market but also brought in vital financial power and global retail know-how.

Besides, the company persevered with its technological focus, well-performing logistics through Ekart, and innovative programs like Flipkart Plus that ensured it was the leader in the digital revolution in India. In this article, we will decode the detailed Flipkart Business Model, examining its key components, revenue streams, competitive strategy, and path to profitability. Continue reading!

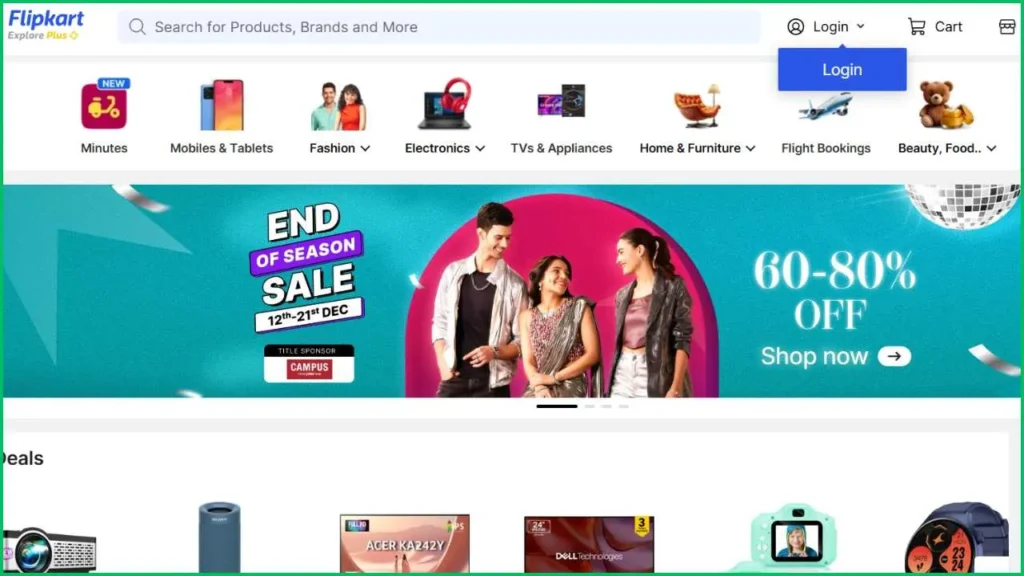

Brief Overview of Flipkart as India’s Leading E-commerce Company

Flipkart’s narrative is a real landmark in the influence of the entrepreneurial digital age vision. The company was set up in 2007 by Sachin and Binny Bansal, two ex-Amazon employees who, even though they were not related, had a joint objective: to provide the Indian masses with the convenience of online shopping. The duo invested merely $5,600 to start an online bookstore, seeing a vast, unexploited market. Within a short span, the company diversified its product portfolio and garnered its very first round of funding of $1 million from Accel India in the 2nd year of operation.

Their early triumph was primarily driven by the establishment of a customer-centric model, which also implemented the COD method (Cash-on-Delivery), thus overcoming the then-low credit/debit card usage and lack of trust in online transactions. Flipkart gradually penetrated the markets of electronics, fashion, and groceries, turning into a full-fledged online retail destination.

The acquisition of fashion portals like Myntra and the coming up with its logistics arm, Ekart, thus has been a double whammy for Flipkart in terms of market leadership in India. Besides, synchronization with the worldwide retail giant Walmart has been instrumental in providing the necessary resources to scale fast and take on the competitors.

Flipkart Company Overview – Quick Table

| Feature | Details |

| Founded | 2007 |

| Founders | Sachin Bansal, Binny Bansal |

| Headquarters | Bengaluru, Karnataka, India |

| Industry | E-commerce, Retail |

| Parent Company | Walmart (since 2018) |

| Key Subsidiaries | Myntra, PhonePe, Ekart, Flipkart Wholesale |

| Core Model | B2C E-commerce Marketplace |

| Estimated Market Share | ~38% (India E-commerce) |

| Focus | Affordability, Accessibility, and Convenience |

The Idea Behind Flipkart

The main problem that Flipkart solved in the Indian retail market was to make the market accessible and convenient. When the Bansals launched their project, the physical stores were severely fragmented, and online shopping was almost non-existent. They aimed at being the “Amazon of India” but with an Indian flavor. They understood that trust had to be established if they were to succeed. COD or Cash-on-Delivery was the revolutionary idea that allowed customers to pay for goods only when they received them.

By doing this alone, many Indian consumers who were skeptical about using their credit cards online had the entry barrier leveled. The decision to start with books was a very smart one – books have fixed prices and are simple to ship. This way, they could work out their logistics and delivery process, which would help them later when they ventured into more complicated categories such as electronics and fashion.

Flipkart’s Success Story: Journey from Startup to Market Leader

The story of Flipkart’s rise can be illustrated through the four primary stages, each representing its strategic development and adjustments.

Phase 1: Startup Phase (2007–2010)

- Focus: Building the base of an online bookstore.

- Key Milestone: Launch of the website; Introduction of the Cash-on-Delivery (COD) payment option; Securing the first round of institutional funding from Accel India in 2009.

- Strategy: Winning customer loyalty and starting to build up a small but solid delivery network.

Phase 2: Expansion Phase (2011–2014)

- Focus: Aggressively expanding category and location.

- Key Milestones: Expanding product range to include electronics, fashion, and home goods; Buying the fashion portal Myntra; Starting the local delivery service, Ekart, which was very important to the Flipkart Business Model.

- Strategy: Taking complete control of the logistics chain to offer faster, more reliable deliveries, which dramatically improved the customer experience.

Phase 3: Scale & Competition Phase (2015–2018)

- Focus: Competing aggressively against the most challenging rivals, mainly Amazon India.

- Key Milestones: Initiating the “Big Billion Day” yearly sale, which turned into a national shopping craze; entirely moving to a pure-play marketplace model; Obtaining huge funding rounds to be able to match on pricing and marketing.

- Strategy: Growing in size, applying technology for personalization, and being the leader at key sales events to strengthen the market share.

Phase 4: Walmart Acquisition & Stabilization (2018)

- Focus: Financial stabilization, increase in operations, and growth of varied nature.

- Key Milestones: Walmart’s acquisition of Flipkart for $16 billion; The advent of financial services through PhonePe and its lending services, such as super.money; Emphasis on quick-commerce (Flipkart Minutes) and B2B wholesale.

- Strategy: With the help of Walmart’s vast retail experience and financial support, the company is able to cut down on losses, has more automated fulfillment centers, and is entering the previously underserved markets with the help of subsidiaries like Shopsy.

Flipkart – 2025 Insights

- Flipkart’s consolidated revenue from operations in FY25 rose by about 17.3% to ₹82,787 crore (≈ $10 billion) from ~₹70,541 crore in FY24

- The marketplace arm (Flipkart Internet) reported operating revenue of ~₹20,493 crore in FY25, up ~14% year-on-year.

- On a consolidated basis, Flipkart India reported a net loss of ₹5,189 crore in FY25, wider than the ₹4,248 crore loss in FY24.

Flipkart Business Model in India

The Flipkart Business Model is a typical B2C (Business-to-Consumer) marketplace model. Flipkart is a facilitator that connects millions of third-party sellers with customers. The company charges a commission for each sale made.

Key Partners

- Third-Party Sellers & Brands: The marketplace ecosystem’s primary energy source, the providers of product inventory.

- Ekart (Logistics Arm): Delivering the most essential services of delivery and fulfillment.

- Fintech & Banks: Collaborations for payment gateways, consumer credit, and seller financing through super.money.

- Walmart: A strategic partner who can bring in global scale, resources, and retail expertise.

Key Activities

- Platform Management: The process of maintaining the website and mobile app and increasing the user base.

- Logistics & Fulfillment: The entire supply chain, warehouses, and delivery (Ekart) management.

- Marketing & Customer Acquisition: Implementing huge seasonal sales and digital marketing campaigns.

- Technology Development: Employing AI for user-specific customization and supply chain automation.

Key Resources

- Technology Platform: The main e-commerce business website, mobile app, and backend systems.

- Ekart Logistics Network: A comprehensive network of fulfillment and delivery centers all over the country.

- Customer Data: A large quantity of purchase history and behavior data that can be used for targeted recommendations and advertising.

- Brand Value: Great customer trust and recognition in the Indian market.

Value Proposition

- For Customers: Cheap (competitive) prices, very fast delivery (Flipkart Minutes), large product selection, easy returns, and convenient payment methods (COD, EMI).

- For Sellers: The chance to access a large, pan-India customer base, the offer of logistics services (Ekart), and the financial help as well.

Customer Segments

- Primary Target: Middle-income, urban, and semi-urban consumers aged 18-45.

- Secondary Target: Tech-savvy millennials and Gen-Z who are looking for quick delivery and the latest deals.

- Expansion Target: Tier-2 and Tier-3 cities using affordable platforms such as Shopsy.

Revenue Streams

The main streams are commissions, advertising, and logistics fees.)

Cost Structure

- Logistics & Fulfillment Costs: The highest cost, which includes expenses for transportation, warehousing, and the handling of the inventory.

- Technology & Infrastructure: The expenses related to the platform, cloud services, and the IT personnel.

- Marketing & Promotions: Advertising expenses, discounts, and customer acquisition campaigns.

- Employee Compensation: Salaries of the staff.

How Flipkart Makes Money (Revenue Model)

| Revenue Stream | Contribution Estimate |

| Seller Commission Fees | Largest Share (40-50%) |

| Sponsored Product Listings | High Growth Area (10-15%) |

| Ekart Logistics Services | Significant Share (10-15%) |

| Flipkart Plus Subscriptions | Growing Area (~5-10%) |

| Private Label Brands | Strategic Share (10-15%) |

| Fintech Services | Emerging Area (~10%) |

The Flipkart Business Model features several revenue streams that significantly contribute to its income, thus ensuring a diversified and stable revenue structure. The significant revenues are made up of:

- Commission Fees from Sellers: This is the primary income source. Flipkart takes a cut ranging from 5% to 25%, depending on the product category, for each sale made by a third-party seller on its platform.

- Advertising & Promotion Revenue: Sellers can pay to promote their products, making them appear in premium spots (like the top of search results or banner ads) to drive more sales. This high-margin stream is a fast-growing part of the revenue pie.

- Logistics & Fulfillment Fees (Ekart): Sellers using Flipkart’s in-house logistics service, Ekart, for storage, packing, shipping, and returns pay a fee. This turns a significant cost center into a revenue stream and ensures delivery quality.

- Flipkart Plus Subscription: It is a paid loyalty program that annually charges members and in return offers them benefits such as free and faster delivery, early access to sales, and exclusive deals, thus generating recurring revenue.

- Fintech & Financial Services (PhonePe / super.money): Money is made by charging a fee to the payment gateway, taking a cut from services like insurance and mutual funds, and collecting interest on loans given to both customers and sellers.

- Private Label Sales: Flipkart sells its own branded products (e.g., in fashion, electronics, and accessories), which typically offer higher profit margins than reselling third-party goods.

- Data & Analytics Services: Flipkart leverages the vast customer and seller data it collects to provide valuable market insights and analytics services to brands for a fee.

Is Flipkart a B2C or a B2B Company?

Flipkart is mainly a B2C (Business-to-Consumer) company as it operates a core marketplace where millions of sellers are directly linked with individual buyers. But it also has some significant B2B components in its operation:

- Flipkart Wholesale: This is a completely B2B unit of the company, which is aimed at small retailers (kiranas) and businesses by supplying them with products in bulk.

- Ekart Logistics: Ekart, which is primarily the logistics arm of Flipkart, also provides logistics and fulfillment services to other businesses (third parties), thereby making it a B2B service provider.

- Seller Financing: The provision of working capital loans to sellers is a B2B financial service.

Hence, Flipkart would largely be considered as a B2C company that offers a few strategic B2B services, which is another dimension of the Flipkart Business Model.

How Does Flipkart Earn Profit?

Due to intense competition and high costs for logistics and acquiring customers, Flipkart is struggling to become profitable. It makes a gross profit from commissions and fee revenue, but needs to manage its costs strategically to make a net profit.

- Scale and Volume: Flipkart is able to take advantage of economies of scale by massively driving sales volume, which means the per-unit cost of logistics and technology gets lower.

- High-Margin Revenue: By increasing the proportion of high-margin revenues, such as advertising and private label sales, the overall profitability improves. Besides this, advertising revenue has improved tremendously.

- Logistics Efficiency: To cut down the high logistics costs, which are the most significant expenses, Flipkart is heavily investing in the use of automation in its fulfillment centers (some are up to 85% automated) and also in delivery route optimization.

- Financial Services: The move into fintech lending and insurance, which has higher profit margins than the core retail business, is a vital part of Flipkart’s long-term plan.

Is Flipkart in Loss or Profit?

At the moment, Flipkart is operating at a loss, but it is gradually making strides towards reducing that loss.

| Flipkart Financials (FY) | 2023 | 2024 |

| Operating Revenue | INR 55,824 crore | INR 70,542 crore |

| Total Expenses | INR 60,859 crore | INR 75,038 crore |

| Profit/Loss | INR -4,897 crore (Loss) | INR -4,248 crore (Loss) |

The figures indicate that Flipkart’s operating revenue has gone up substantially, whereas its expenses remain at a higher level, resulting in a net loss. On the other hand, the loss has narrowed from FY23 to FY24, which is a good sign of operational efficiency improvement and overall better health of the Flipkart Business Model.

Flipkart vs Amazon – Business Model Comparison

Both companies are leading e-commerce players; however, their fundamental strategies reveal significant differences in the Indian market.

| Parameter | Flipkart | Amazon India |

| Parent Company | Walmart (Retail Focus) | Amazon (Tech/Cloud Focus) |

| Primary Model | Digital-First Marketplace (B2C) | Hybrid (Offline/Online/AWS) |

| Value Proposition | Affordability, Accessibility, Faster Delivery | Premium Experience (Prime), Wider Global Selection |

| Channel Strategy | Using Shopsy for smaller cities; Quick-commerce (Flipkart Minutes) | Strong integration with global Prime benefits and digital services. |

| Core Innovation | Fintech (super.money), Quick-commerce, Social-commerce | Cloud Services (AWS), Voice-controlled shopping (Alexa) |

| Market Focus | Mass Market, Tier 2/3 cities | Premium, Metro cities |

About CEO of Flipkart

Who is the CEO?

Kalyan Krishnamurthy is the CEO of the Flipkart Group. After the Walmart acquisition, he has been a major leader in taking the company through its most competitive phase, with a focus on profitability and operational efficiency.

Salary

Though the exact 2026 pay is not disclosed, the reports of previous years suggest that the total annual pay of top leadership at Flipkart Group, including Krishnamurthy, could be anywhere between INR 30 – 40 crores (or roughly $3.6 – $4.8 million). This pay package is usually composed of a combination of salary, bonuses, and stock options.

Leadership Vision

Krishnamurthy has a comprehensive three-point plan for the company’s future: Customer-First, Operational Excellence, and Diversification. Aiming to make the supply chain more efficient through the use of AI and automation, Krishnamurthy is also intent on driving the high-margin business areas (advertising and fintech) and by extending the brand rapidly into the unserved markets to consolidate Flipkart’s leadership position. Besides that, he assures that the core Flipkart Business Model stays attractive to the next generation of Indian digital shoppers.

Strengths & Weaknesses of Flipkart Business Model

Strengths

- Strong Brand Recognition: An authentic, homegrown Indian brand that is very memorable.

- Robust Logistics Network (Ekart): Being in control of logistics ensures that deliveries are reliable and fast, which is a significant competitive advantage.

- Fintech Integration (PhonePe/super.money): Initiating revenue streams from financial services with good margins.

- Walmart Backing: The company has access to a large amount of money and the know-how of the global retail market.

- Customer-Centric Innovation: Introduction of COD, buyback guarantees, along with simple returns specifically designed for Indian shoppers.

Weaknesses

- High Cash Burn: Even though the losses have been reduced, the necessity for deep discounts and high marketing expenditures is still keeping the costs at a high level.

- Regulatory Risks: The Indian e-commerce sector is facing a range of government policies regarding FDI and seller operations that are changing frequently and dynamically.

- Inventory Management: Ensuring quality while managing stock in such a large marketplace can be very challenging.

- Dependence on Discounts: Customers are very price-sensitive and used to buying only during significant sale events, thus margins get squeezed.

Conclusion

The Flipkart Business Model 2026 is a profoundly complicated and varied company that, at its base, is a B2C marketplace model. In essence, the model’s triumph is not merely to be found in the sales of products; rather, it is to be found in the way of dealing with the Indian market complexities in the optimal way. Even though the firm is still on the tough path to achieve a stable net profit, the clear increase in its operating revenue together with the shift to fintech and quick-commerce is, indeed, a great strength to its position as a market leader.

The backing from Walmart gives the company the required ammunition to keep growing and innovating, thus making the Flipkart Business Model an interesting case of digital dominance in one of the most formidable economies in the world.

FAQs

1. What is Flipkart?

Flipkart is India’s largest homegrown e-commerce company, founded in 2007, that operates a marketplace offering a wide range of products from electronics and fashion to groceries.

2. How does Flipkart earn money?

Flipkart earns money through a combination of seller commissions on sales, fees for logistics/fulfillment (Ekart), sponsored product advertising, and revenue from its financial and subscription services (Flipkart Plus).

3. What is Flipkart Plus?

Flipkart Plus is a loyalty program that offers members premium benefits like free and faster delivery, priority customer support, and early access to major sale events, helping increase customer retention.

4. Who owns Flipkart now?

Walmart, the American multinational retail giant, is the majority owner of Flipkart. The company was bought by Walmart in 2018 for $16 billion.

5. What is the core strategy of Flipkart?

The core strategy of the Flipkart Business Model is to dominate the mass Indian market by offering the widest product range at competitive prices, backed by a fast, reliable, and automated logistics network.