Do you use your phone daily? Most of us do. We phone friends, play video games, etc. We should have a mobile recharge in order to do all this. Millions of people refill their phones every month. You know you can make money out of it? You can earn some money by recharging phones. It only requires a smartphone and what is known as Mobile Recharge Commission Apps.

This paper presents the top apps for making money. We will use simple words and make sure everyone understands. We will discuss the 10 most popular apps, how much money you can earn from them, and how to stay safe when using them.

Are you ready to begin earning more money now?

What is a Mobile Recharge Commission App?

A mobile recharge commission app is an online platform that allows its users to undertake different financial operations and make commissions on every successful operation. These platforms are also commonly seen as earning apps because they enable users to generate regular income through everyday services. Such applications act as a mediator between the service providers and the final consumers and provide a win-win situation to all the stakeholders of the ecosystem.

The commission is differentiated in terms of the type of service, the number of transactions and the policy framework of a particular app.The beauty of these platforms is its simplicity and accessibility. There is no knowledge of advanced technicality, and users do not have to invest a lot of capital to begin earning.

The majority of apps offer their users comprehensive training tools, customer service, and marketing support, so they could develop their businesses successfully. They are based on a franchise-like basis where separate agents are allowed to set up micro-businesses but use the infrastructure and brand recognition of the app.

How Does the Commission System Work?

Understanding the commission structure goes a long way in helping maximize earnings from Mobile recharge commission apps. Here’s how these typically operate:

- Percentage-Based Commissions: However, most platforms work on a commission structure that pays a certain percentage of the transaction value. This is usually between 0.25% and 5%, depending upon the nature of service and its volume brackets.

- Flat-Rate Commissions: A few services pay out a fixed commission amount for every transaction independent of the price of the transaction, granting a stable flow of income for agents having high transactions.

- Tiered Commission Structure: At a threshold level, better commission rates are unlocked with transaction volume. That motivates the agents to develop their business and remain at consistent performance levels.

- Instant Credit System: Commissions are instantly credited to the agents’ wallets after successful transactions, thus allowing for reinvestment and growth opportunities for the business.

- Volume-Based Bonuses: Various Mobile recharge commission apps feature bonuses and rewards based on monthly or quarterly target fulfillment, giving agents an ectopic reward to make the latter revenues look much greater.

- Referral Commissions: Multi-level commission structures allow agents to earn from transactions performed by their referred sub-agents, creating passive income opportunities through network building.

Why Use These Apps?

You may ask, why then should I use these apps? There are many good reasons. These apps do not only serve as a recharge tool but rather business tools. Here’s why they’re useful:

1. Earn Extra Income

The biggest benefit. Every time you recharge a number, a small profit is earned known as a commission. It’s a reward for using the app. The more times you are recharged the higher the money you receive.

2. Start a Small Business

You do not have to visit a shop or spend a lot of money. You can work at home, charge phones to neighbors and support family members. It is a zero-investment business concept.

3. Save Money on Your Own Bills

You can save money even when you are not a business person. You can get cashback when recharging your personal phone. Recharge that cashback in the future. Over a year, you can save a lot.

4. Convenience

No need to go to a store. You can refresh yourself in your bed, at night, or in the morning. The apps are 24/7easy to save time and effort.

Key Features to Look for in a Recharge Commission App

Establishing the recharge commission business demands that you pick appropriately, as it will affect your success in the long run. Pay attention to these important aspects:

- Commission Structure Comparison: Look for platforms offering attractive and transparent commission structures across all services, with clear information about rates and payment schedules.

- Comprehensive Offer: Consider apps for recharge commissions that have an extensive portfolio of services so you can satisfy customer demands and increase your earnings through a single platform.

- System Downtime Guarantees: Make sure the platform has reliable servers with low downtimes, since they need fast transaction processing to improve customer satisfaction and ensure uninterrupted business operations.

- Helpdesk Availability: A constantly available technical support service is vital during peak hours to quickly resolve problems that would hinder smooth operations.

- Promotional Materials Provided: Aiding agents in acquiring new clients by providing promotional materials, campaigns, or support boosts helps automated much more efficiently than manually.

- Client Information Security Center: Strict standards of protection through fraud prevention systems, advanced encryption protocols, and strict regulatory compliance protect agents and customers from possible data breaches.

Mobile Recharge Commission Apps 2026: Quick Comparison Table

| Platform | Commission Rate | Service Portfolio | User Base | Support Quality | Technology | Best For |

| MobiKwik | 2-4% | Comprehensive | High | Excellent | Advanced | All Markets |

| Paytm | 1.5-3.5% | Extensive | Very High | Good | Cutting-edge | Urban Markets |

| Google Pay | 1-2.5% | Limited | High | Good | Advanced | Tech Users |

| PhonePe | 2-3.5% | Growing | High | Excellent | Modern | Growth Markets |

| Freecharge | 1.5-3% | Moderate | Medium | Good | Standard | Customer Focus |

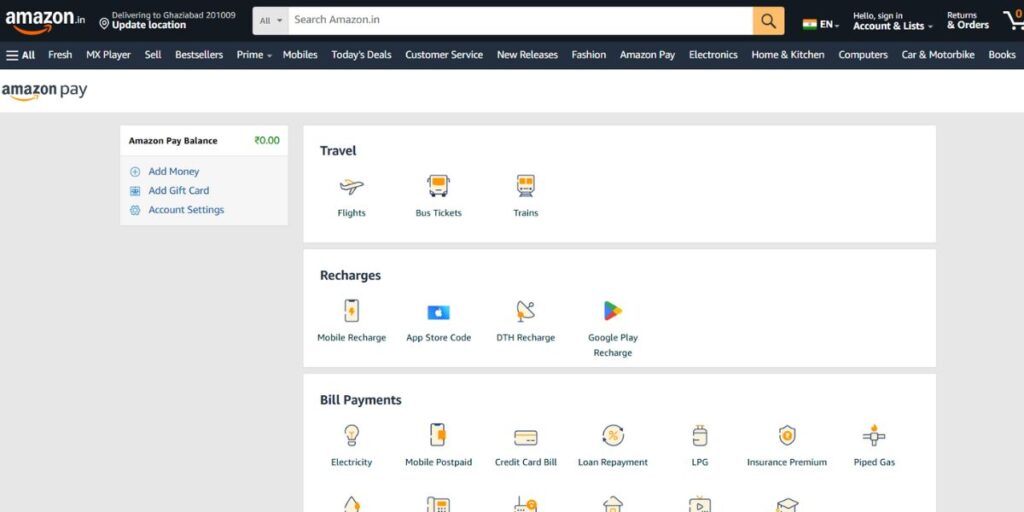

| Amazon Pay | 1-3% | E-commerce Focused | High | Excellent | Advanced | Online Integration |

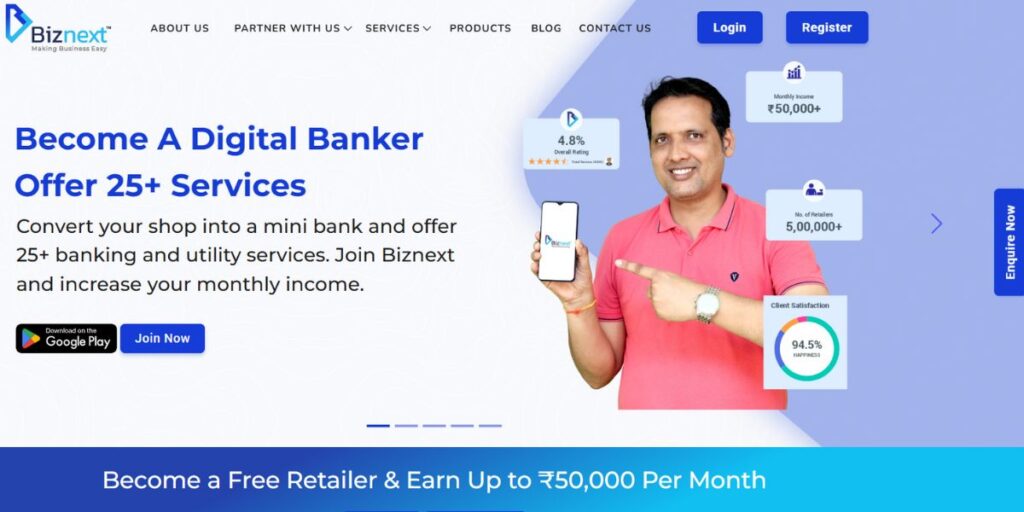

| Biznext | 3-5% | B2B Specialized | Medium | Professional | Enterprise | Business Focus |

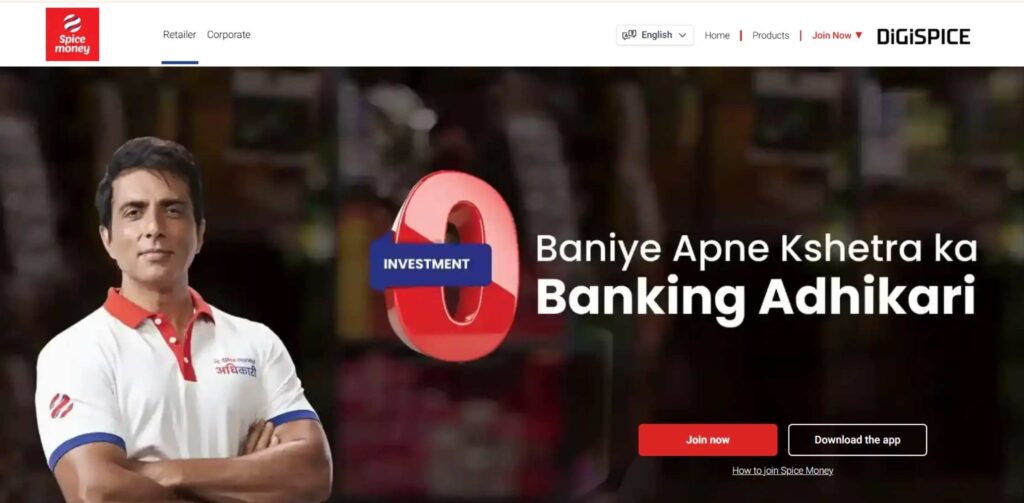

| Spice Money | 2-4% | Small Business | Medium | Excellent | Simple | Beginners |

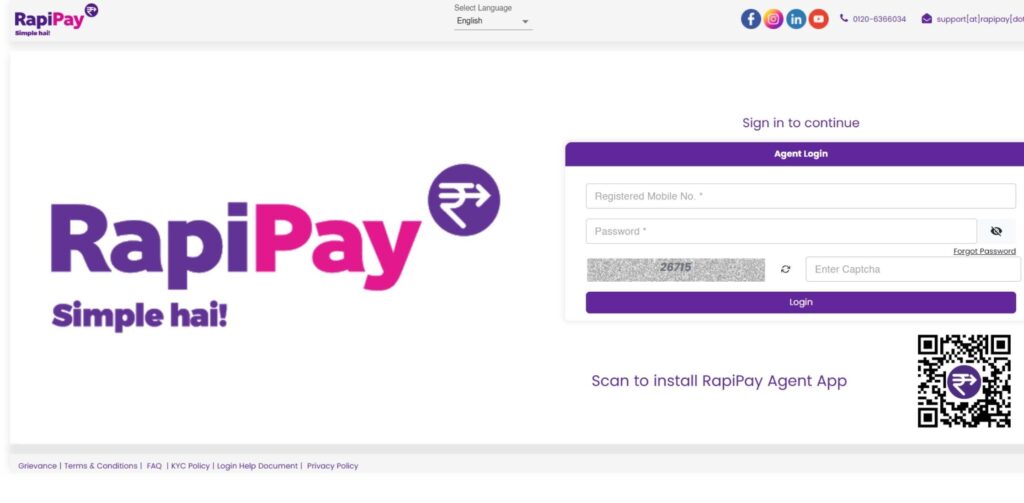

| RapiPay | 2.5-4.5% | Innovative | Growing | Good | Cutting-edge | Tech Focus |

| Recharge1 | 3-5% | Recharge Only | Medium | Specialized | Optimized | Recharge Focus |

Top 10 Best Mobile Recharge Commission Apps in 2026

1. MobiKwik – Your Digital Wallet Partner

MobiKwik is one of the most popular digital wallet and one of the best Mobile Recharge Commission Apps, with competitive commission-based models of mobile recharge services. The platform offers provision of smooth integration to retailers and agents where recharges are immediate in all major telecom operators. MobiKwik promises fast processing of transactions and a high level of success because of its user-friendly interface and a strong technology support base.

The commission rates provided by the app are also highly appealing as they vary between 0.5-2% according to the operator and operating plan, which makes it an object of interest among business owners who want to earn regular revenues by selling mobile recharge services.

Key Features:

- Multi-service platform covering recharges, bill payments, and financial services

- Instant transaction processing with real-time commission credits

- Comprehensive dashboard for transaction tracking and business analytics

- 24/7 customer support with multilingual assistance

- Advanced security protocols and fraud prevention systems

- Regular promotional campaigns and marketing support for agents

Pros:

- High commission rates across all services

- Extensive service portfolio for diverse revenue streams

- Strong brand recognition and customer trust

- Reliable technology infrastructure with minimal downtime

Cons:

- Higher competition due to popularity

- Strict compliance requirements for new agents

- Limited customization options for agent interfaces

- Occasional delays in commission payouts during peak periods

Step-by-step Guide to Join:

- Download the MobiKwik partner app from official app stores

- Complete registration with valid documents and business details

- Submit KYC verification and wait for approval process

- Attend online training sessions and certification programs

- Start offering services after receiving login credentials and initial wallet balance

Who It’s For:

- Good with students, individuals and small shopkeepers.

Rewards / Commission Structure:

- No direct cash commission.

- Earn SuperCash on the addition of money and bills.

- Use 5 to 10 per cent on your next installment of SuperCash.

- Sometimes level-rate cashback offers such as 50% off.

Average Earnings / Payout Options:

- Earnings: Save ₹100 to ₹500 per month.

- Payout: Money remains in your MobiKwik wallet, it can be used in other bills or even when buying products. SuperCash is not able to be sent to a bank.

Download Link: https://play.google.com/store/apps/details?id=com.mobikwik_new&hl=en_IN&gl=IN&pli=1

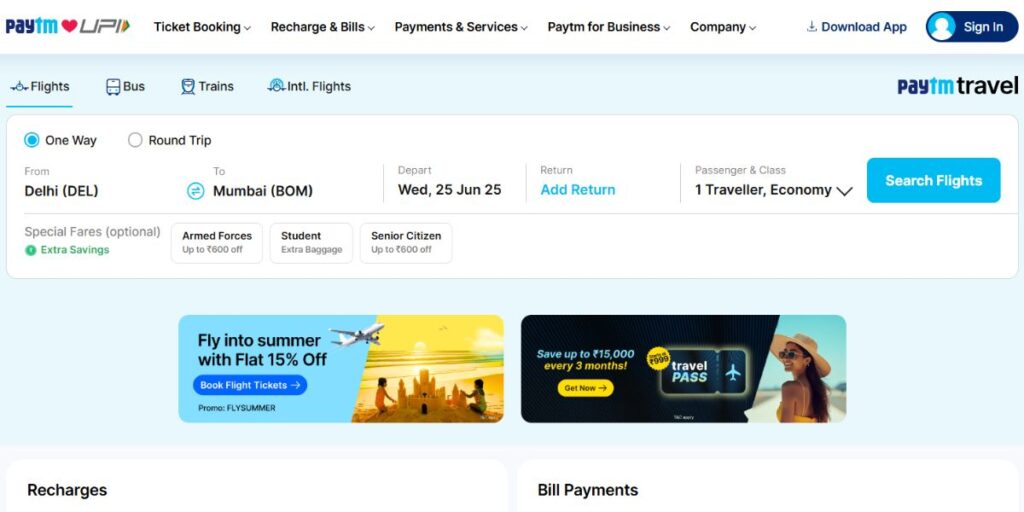

2. Paytm – India’s Leading Payment Platform

Paytm is still the biggest digital payment platform in India and provides a full range of mobile charging services with attractive commission rates. Among mobile Recharge Commission Apps, it stands out for agents, companies that want to expand in the year 2025. Paytm is one of the major options that can earn the highest profits in the mobile recharge business. The platform has a wide network of all telecom operators, DTH services, and payment of utility bills.

The Paytm merchant and agent program provides competitive commission rates, live tracking of the transactions, and 24/7 customer care. Brand awareness and the number of users that the platform has ensures that it would be a good platform to use when a retailer wants to have a steady growth in business by offering mobile recharging services.

Key Features

- Comprehensive payment ecosystem with maximum service coverage

- Advanced analytics and reporting tools for business optimization

- Multiple payment acceptance methods including QR codes and POS systems

- Extensive marketing support and promotional material access

- Integration with offline retail operations and inventory management

- Regular training programs and business development support

Pros:

- Largest user base ensuring high transaction volumes

- Excellent brand recognition and market penetration

- Comprehensive service portfolio with regular additions

- Strong technology infrastructure and innovation focus

Cons:

- Intense competition among agents in saturated markets

- Complex onboarding process with strict verification requirements

- Variable commission rates based on performance metrics

- High customer acquisition costs in competitive areas

Step-by-step Guide to Join:

- Visit Paytm’s official partner registration portal online

- Fill detailed application form with business and personal information

- Upload required documents for KYC and business verification

- Attend mandatory training sessions and pass certification tests

- Receive partner credentials and start conducting transactions

Who It’s For:

Personal use and large-scale companies. Paytm for Business can be used in case you have a shop.

Rewards / Commission Structure:

- Revised policies: Cashback Points are provided to ordinary users.

- Award points each time you recharge.

- 1000 points usually equal ₹10.

- Redeem points into wallet balance.

- Remark: Paytm can now charge a minor platform fee (recharge ₹1 or 2).

Average Earnings / Payout Options:

- Earnings: Differing depending on fortune on scratch cards.

- Payout: Money back to Paytm Wallet. Use at any place or deposit in the bank.

Download Link: https://play.google.com/store/apps/details?id=net.one97.paytm&hl=en_IN

3. Google Pay – Trusted by Millions

Google Pay has become a powerhouse in the UPI ecosystem of India, with a 36.7 percent share of UPI transactions. Although Google Pay is mostly recognized by peer-to-peer payments, it also provides the service of mobile recharges, which has commission opportunities to business partners. The adoption of Google ecosystem in the platform gives a great user experience and high transaction success rates.

Google Pay has started charging a convenience fee of 0.5-1 percent of the value of the transactions done in addition to GST but offers and maintains competitive commission structures with authorized retailers and agents that offer recharge services to customers.

Key Features:

- UPI-based instant payment processing with high success rates

- Integration with Google’s ecosystem for enhanced user experience

- Advanced fraud detection and security measures

- Simple interface design for easy adoption by diverse user demographics

- Comprehensive transaction history and reporting features

- Regular feature updates and technological improvements

Pros:

- Strong brand trust and security reputation

- High transaction success rates and minimal technical issues

- Growing user base with increasing adoption rates

- Simple and intuitive user interface

Cons:

- Limited service portfolio compared to comprehensive platforms

- Lower commission rates on certain transaction types

- Dependency on UPI infrastructure availability

- Limited customization options for agent branding

Step-by-step Guide to Join:

- Access Google Pay for Business registration through official website

- Provide business registration details and owner information

- Complete verification process with required documentation

- Set up business profile and payment acceptance methods

- Begin accepting payments and earning commissions on transactions

Who It’s For:

For people who want speed. It is quick but not business commission based, it is personal reward.

Commission Structure / Rewards:

- Works on luck.

- A scratch card is awarded with every recharge.

- You could be a winner of 10, 50 or Better Luck Next Time.

- More can be provided by special festival offers.

Average Earnings / Payout Options:

- Earnings: Does not have a fixed value in any case; it may be 0 or 100.

- Payout: One trip to the bank account, no wallet required.

Download Link: https://play.google.com/store/apps/details?id=com.google.android.apps.nbu.paisa.user&hl=en_IN

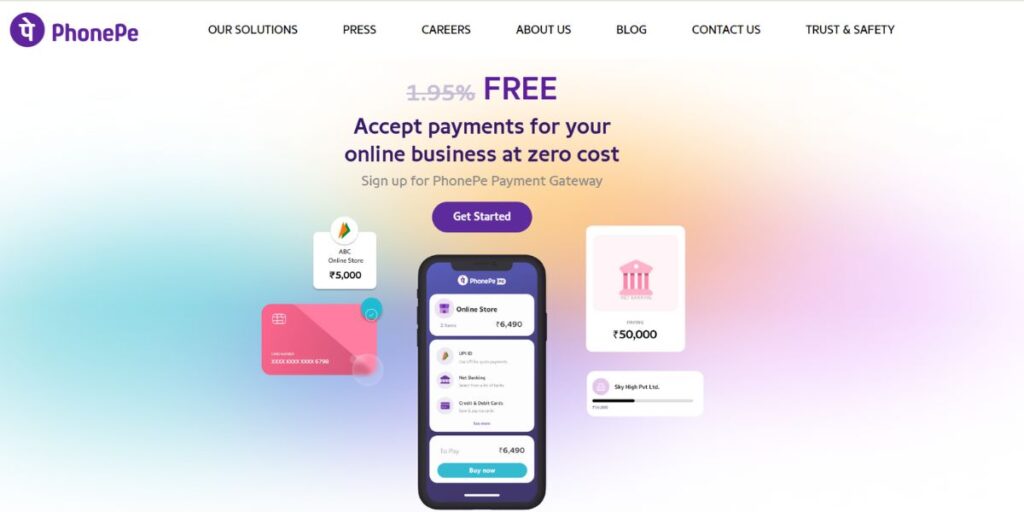

4. PhonePe – Growing Fast, Earning More

PhonePe has the largest market share in the UPI market in India (48.3 percent) and can provide full mobile recharging services with competitive commission rates. As one of the leading mobile Recharge Commission Apps, the platform enables one to have smooth recharging experiences with all the significant telecom providers and DTH service providers.

The merchant program of PhonePe provides a good commission ratio, immediate settlement facility, and business tracking through advanced analytics. The platform supports both small and large-scale recharge business with the daily limit of transaction up to 1 lakh. Due to its huge merchant network and an easy-to-use interface, PhonePe is a great solution to every entrepreneur who wants to get involved in the mobile recharge business.

Key Features:

- Multi-language support catering to diverse Indian markets

- Comprehensive merchant solutions including POS and QR code systems

- Real-time transaction notifications and status updates

- Extensive API integration capabilities for advanced users

- Regular cashback and promotional campaigns for customer retention

- Detailed analytics dashboard for business performance tracking

Pros:

- Rapidly growing user base with increasing market share

- Competitive commission rates with transparent pricing

- Strong financial backing ensuring platform stability

- Excellent customer acquisition and retention programs

Cons:

- Relatively newer compared to established competitors

- Limited offline presence in rural markets

- Service portfolio still expanding compared to mature platforms

- Higher dependency on smartphone penetration

Step-by-step Guide to Join:

- Download PhonePe Business app from official app stores

- Register using mobile number and basic business information

- Complete detailed KYC process with document verification

- Attend product training and certification programs

- Activate merchant account and start earning commissions

Who It’s For:

- PhonePe works best with those citizens who pay numerous bills such as electricity, water, and mobile.

Rewards/ Commission Structure:

- Discounts on popular applications (food).

- Instant cashback on your PhonePe Gift Cards.

- Important to note: A “Platform Fee” of ₹1-3 is imposed on every recharge, thus you do not get commission directly.

Average Earnings / Payout Options:

- Majority of earnings are in the form of coupons; direct earnings are low among normal users.

- Cashback remains in your PhonePe wallet or in your Gift Cards and can be utilized later to make recharges.

Download Link: https://play.google.com/store/apps/details?id=com.google.android.apps.nbu.paisa.user&hl=en_IN

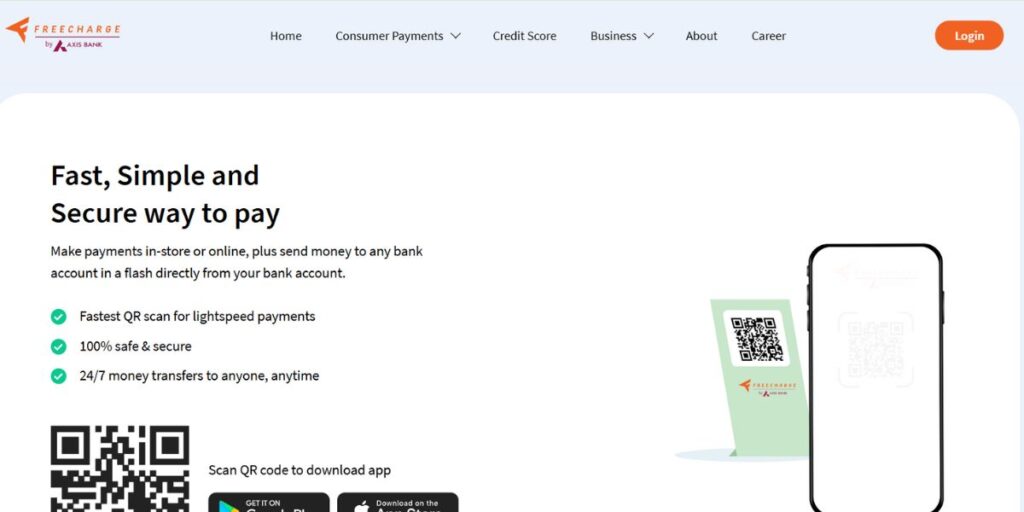

5. Freecharge – Rewarding Every Transaction

Freecharge is a mobile recharge company that has one of the best commissioning structures in the market. The site is specialized towards prepaid recharges, DTH services, and utility bill payments and offers dedicated tools to the recharge retailers. Freecharge also provides good cashback rates and commission rates which mostly varies between 1% to 3 percent according to the category of services offered.

The mobile recharge emphasis on the platform enables an optimum user experience and success rates. Freecharge offers such features as immediate refund in the case of failed transactions and round the clock customer service, which makes it a popular solution among recharge business operators who focus on this field.

Key Features:

- Attractive cashback and reward programs for customer retention

- Simple and intuitive interface suitable for all user types

- Quick transaction processing with instant confirmation messages

- Comprehensive customer support through multiple channels

- Regular promotional campaigns and festival offers

- Integration with popular e-commerce and lifestyle services

Pros:

- Excellent customer retention through reward programs

- User-friendly interface requiring minimal training

- Strong focus on customer satisfaction and experience

- Regular promotional activities boosting transaction volumes

Cons:

- Limited service portfolio compared to comprehensive platforms

- Lower commission rates on basic recharge services

- Smaller market share compared to leading competitors

- Limited business development support for agents

Step-by-step Guide to Join:

- Visit Freecharge partner registration portal online

- Submit application with business and personal details

- Upload necessary documents for verification process

- Complete basic training modules and platform orientation

- Receive partner credentials and begin offering services

Who It’s For:

- Freecharge should be chosen in case you like to find promo codes.

Rewards/ Commission Structure:

- Freecharge publishes particular codes on a monthly basis.

- e.g. 10 cashback = use code FC10.

- The codes are delivered by email or SMS.

- To obtain the money, you have to apply the code manually.

Average Earnings / Payout Options:

- Income: 30 to 50rs monthly with the help of the codes.

- Payout: Added money to the Freecharge Wallet and may be used to pay bills.

Download Link: https://play.google.com/store/apps/details?id=com.freecharge.android&hl=en_IN

6. Amazon Pay – E-commerce Giant’s Payment Solution

Amazon Pay uses the huge Amazon ecosystem to offer end-to-end mobile recharge service with compelling commission potential. The platform is highly compatible with merchant services of Amazon, which gives an opportunity to get more business than recharges. Amazon Pay is a competitive payment system with competitive commission rates and stable transaction processing, which is available on all major telecom operators.

The fact that the platform is integrated with the customer base of Amazon places a lot of business opportunities on retailers. Amazon Pay has such features as instant settlements, detailed reporting, and comprehensive customer support, which makes it a great solution to businesses that want to diversify its income by offering mobile recharge services.

Key Features:

- Integration with Amazon’s vast e-commerce ecosystem

- Advanced security measures and fraud protection

- Seamless customer experience across multiple touchpoints

- Comprehensive transaction tracking and reporting systems

- Regular promotional tie-ups with Amazon services

- 24/7 customer support with multi-channel assistance

Pros:

- Strong brand trust and customer confidence

- Integration benefits with Amazon shopping platform

- Excellent security and fraud protection measures

- Growing customer base through the Amazon ecosystem

Cons:

- Limited standalone presence outside Amazon ecosystem

- Complex commission structure with varying rates

- Higher focus on e-commerce integration than pure recharge services

- Limited customization options for independent agents

Step-by-step Guide to Join:

- Access the Amazon Pay partner program through Amazon Seller Central

- Complete a detailed business registration and verification process

- Submit required documentation for KYC compliance

- Undergo platform training and certification requirements

- Activate services and begin earning commissions on transactions

Who It’s For:

Ideal for individuals who make purchases on Amazon for clothes, gadgets, and more.

Rewards/ Commission Structure:

- Cashbacks on Flash Sales are larger.

- You will get a 25-50 refund on your initial recharge of the month.

- 100% cashback is usually offered to new users.

Average Earnings / Payout Options:

- Earnings: Have the potential to save 100, and it will include 100 or more monthly.

- Payout: You receive the money on your Amazon Pay balance and use it to purchase any item on Amazon.

Download Link: https://play.google.com/store/apps/details?id=in.amazon.mShop.android.shopping&hl=en_IN

7. Biznext – B2B Portal for Professionals

Biznext is considered as one of the best platforms to gain maximum incomes in mobile recharge business by the year 2025. As one of the emerging mobile Recharge Commission Apps, this platform exclusively focuses on B2B solutions in mobile recharge services with a well-structured and alluring commission mix to the retailers and distributors. Biznext gives users a chance to make money via direct sales and referral networks, and covers several levels of commission.

The platform also provides competitive commission rates, instant processing of transactions and full business tools such as inventory management and sales analytics. Biznext, with its main target audience of small businesses and entrepreneurs has become one of the most revered players in the Indian mobile recharge commission industry.

Key Features:

- Professional B2B portal with advanced business management tools

- Comprehensive API integration for custom business solutions

- Multi-level commission structures for network building

- Advanced reporting and analytics for business optimization

- Dedicated relationship managers for partner support

- White-label solutions for brand customization

Pros:

- Higher commission rates compared to consumer-focused platforms

- Professional business development support and guidance

- Advanced technology infrastructure for scalable operations

- Flexible solutions for different business models

Cons:

- Higher entry requirements and verification standards

- Complex platform requiring technical expertise

- Limited brand recognition among general consumers

- Focus on B2B may limit direct consumer engagement

Step-by-step Guide to Join:

- Apply through Biznext’s official partner registration portal

- Provide detailed business plan and financial projections

- Complete comprehensive verification including business licenses

- Attend intensive training programs and certification processes

- Receive advanced credentials and access to professional tools

Who It’s For:

- It is perfect for shopkeepers, agents, and grocery store owners who wish to establish a Recharge Center.

Commission Structure:

- Fixed commission rates:

- Airtel/Jio/Vi: 2 %–4 %

- DTH (TV): 4 %–5 %

- Model: Charging 200 INR will result in a 4 -8 profit immediately.

Average Earnings / Payout Options:

- Hard-working agents can earn 5000 to 15000 per month.

- Commission is easily deposited in your trade wallet and can be rolled into the bank.

Download Link: https://play.google.com/store/apps/details?id=com.biznext.spiral&hl=en

8. Spice Money

Spice Money is one of India’s leading rural fintech platforms and a strong player in the mobile recharge and AEPS commission business. Known for empowering small retailers and village-level entrepreneurs, Spice Money offers multiple earning opportunities, including mobile recharge, DTH recharge, bill payments, Aadhaar-enabled payment services (AEPS), money transfer, insurance, and more.

As a trusted Recharge Commission App, Spice Money provides competitive commission rates, instant settlements, and a secure transaction system.

Key Features:

- Multi-service fintech platform (Recharge, AEPS, Money Transfer, Insurance, Bill Payments)

- Strong rural and semi-urban network presence

- Instant commission settlement system

- Easy-to-use mobile app and web portal

- Dedicated distributor and field support

- Secure and RBI-compliant transaction framework

Pros:

- Wide range of services beyond recharge

- Trusted brand with strong rural penetration

- Regular incentives and bonus programs

- Low investment to start

- Strong support network for merchants

Cons:

- Commission margins may vary by service

- Earnings depend heavily on transaction volume

- Requires proper KYC and documentation

- Competitive market in urban areas

Step-by-Step Guide to Join:

- Download the Spice Money app or register via the official website

- Complete KYC with Aadhaar and PAN details

- Submit business verification documents

- Activate services after approval

- Start offering recharge and financial services

Who It’s For:

Ideal for small shop owners, rural entrepreneurs, CSC operators, and individuals looking to start a recharge and mini-banking business.

Commission Structure:

Mobile Recharge:

Airtel / Jio / Vi: 2% – 3%

DTH Recharge:

4% – 5%

AEPS & Money Transfer:

Commission varies based on the transaction slab

Example: On a ₹200 recharge, you may earn ₹4 – ₹6 depending on the operator and slab.

Average Earnings / Payout Options:

Active agents can earn between ₹8,000 and ₹20,000 per month, depending on transaction volume and the services they offer.

Download Link:

https://play.google.com/store/apps/details?id=com.spicemoney.merchant

9. RapiPay

RapiPay is one of India’s fastest-growing fintech platforms offering mobile recharge, AEPS, domestic money transfer, bill payments, and micro-ATM services. Designed mainly for retailers and small business owners, RapiPay enables merchants to earn attractive commissions by providing digital financial services to customers in rural and semi-urban areas.

As a trusted Recharge Commission App, RapiPay offers real-time transactions, secure payment processing, and easy onboarding.

Key Features:

- Mobile & DTH recharge services

- AEPS (Aadhaar Enabled Payment System)

- Domestic money transfer (DMT)

- Micro-ATM services

- Instant wallet settlement

- Strong banking partnerships

- User-friendly retailer app

Pros:

- Multiple earning streams in one platform

- Low startup investment

- Quick transaction processing

- Growing brand presence in rural markets

- Regular incentives and performance bonuses

Cons:

- Commission margins vary by service

- Earnings depend on customer footfall

- Requires proper KYC and retailer verification

- Competition in urban areas

Step-by-Step Guide to Join:

- Download the RapiPay Retailer App

- Register with mobile number

- Complete KYC (Aadhaar, PAN, business details)

- Submit required verification documents

- Add wallet balance and activate services

- Start offering recharge and financial services

Who It’s For:

Ideal for kirana shop owners, mobile shop owners, CSC operators, and individuals looking to start a mini-banking and recharge business.

Commission Structure:

Mobile Recharge:

Airtel / Jio / Vi: 2% – 3%

DTH Recharge:

3% – 5%

AEPS Services:

Commission based on transaction amount slab

Example: On a ₹200 recharge, you can earn approximately ₹4 – ₹6 depending on operator and slab.

Average Earnings / Payout Options:

Active retailers can earn ₹7,000 to ₹18,000 per month depending on transaction volume and services used.

Commission is credited to the wallet instantly and can be transferred to a linked bank account.

Download Link:

https://play.google.com/store/apps/details?id=com.rapipay.retailer

10. Recharge1 – Dedicated Recharge Platform

Recharge1 is a company that deals purely in mobile recharge and DTH services with among the highest commission rates in the business. The platform also offers specialized features to recharge retailers such as bulk recharge, customer management software, and profit monitoring. Recharge1 also has commission rates that vary between 1-4 percent based on the category of service and volume.

The targeted nature of the platform regarding recharge services guarantees its maximum performance and increased success rates. Possessing such features as instant credit facilities, 24/7 technical support, and thorough training programs, Recharge1 becomes a perfect solution to entrepreneurs who are interested in developing dedicated mobile recharge businesses.

Key Features:

- Specialized focus on recharge and bill payment services

- Optimized transaction processing for maximum success rates

- Industry-specific features and tools for recharge businesses

- Competitive commission rates with transparent pricing structure

- Dedicated customer support specializing in recharge services

- Regular operator tie-ups and exclusive promotional offers

Pros:

- Specialized expertise in recharge services ensuring optimal performance

- Higher success rates due to focused platform architecture

- Competitive commission rates without cross-subsidy from other services

- Simplified operations focusing on core business requirements

Cons:

- Limited service portfolio restricting revenue diversification

- Smaller brand recognition compared to multi-service platforms

- Dependency on recharge market growth and trends

- Limited scalability options beyond core recharge services

Step-by-step Guide to Join:

- Register on Recharge1 partner portal with basic information

- Provide business details and expected transaction volumes

- Complete KYC verification with standard documentation

- Attend recharge-specific training and platform orientation

- Receive credentials and begin offering specialized recharge services

Who It’s For:

- Individuals who prefer to have the cashback assured either as an individual or as an agent.

Commission Structure:

- R1 Cash offers a maximum percentage cashback on every recharge (limited).

- Future payments can be made with the help of balance.

- “Refer and Earn” will reward you when your friends refill using you.

Average Earnings / Payout Options:

- Loyalty: ₹500 and above per month for referring friends.

- Rewards remain in the Recharge1 wallet, which is best for paying electricity or mobile bills.

Download Link: https://play.google.com/store/search?q=recharge%201&c=apps&hl=en

How to Start Earning with a Recharge App

It is necessary to develop an effective business using Mobile recharge commission apps through a detailed plan and follow-through. This is a step-by-step guide to get started:

- Select the Right Platform: Identify and pick the platforms that resonate with the market you are targeting, technical capacities, and the objectives of the business. Consider factors such as commission rates, service portfolio, and support quality before choosing.

- Total Verification: Make sure all documentation is in place and accurate to avoid delaying approval. Most platforms require verification using a PAN card, an Aadhaar card, bank information, and business registration documents.

- Know Your Market: Reach out to the needs of your local market, competition, and customer preferences. Pay attention to peak transaction times, favorite services and price expectations to customize your offerings adequately.

- Create a Customer Base: Begin with friends, family, and local shops to build early transaction volume. Spread slowly by using word-of-mouth marketing, social media promotion, and through the provision of high-quality customer service.

- Maintain a Good Float Balance: Never be short on cash when serving your customers. Failure to honor a transaction owing to lack of enough money can kill your reputation and customer relations in a short time.

- Track Performance Metrics: Keep track of the number of transactions you make, your earnings in terms of commissions, the rate of customer retention, and performance service-wise. Apply this data to ensure you are using an optimal business strategy and to identify new growth opportunities within it.

Tips to Maximize Commission Earnings

- Focusing on High-Priced Services: If you want to maximize your earnings per transaction, give priority to service avenues that yield higher commissions-that is to say, bill payments and collecting insurance premiums-generally more lucrative when compared to simple mobile recharge.

- Loyalty: Good customer relations-the transaction records, being there for the customer in times of need, result in repeat business and referrals by satisfied customers.

- Take Advantage of Festival Seasons: Special campaigns should be planned around festivals, when recharge and payment activity increases. Promote with all they have got during this time; keep an adequate wallet balance for these trips.

- Diversify Income Streams: Have some scratches on whichever platform you are operating; carefully strategize whether multiple recharge commission apps are available to diversify income sources and services while catering to different segments.

- Marketing: Local advertising, social media marketing, and referral programs will bring customers through the door. Offering a few incentives to first-time users may nudge them to try it.

- Stay Updated with Platform Changes: Check regularly for any new services offered on your chosen platform, changes to the commission structure, special offers on promotional commissions, etc.

Safety and Trust — What You Should Know

There should be care when using money apps. There are numerous counterfeit applications available online; you should be wary. Below are steps to stay safe.

1. Verify the App

Reviews on the Google Play Store should be read before downloading to see what other people say. If the rating is less than 3 stars, do not use the app.

2. Check for HTTPS

The next time you visit a website, check the address bar. It must begin with https://. The “s” means it is a secure connection. If it displays only the site’s address, it is not a safe site.

3. Customer Support

Good apps support teams. Before adding money, reach out to them by email or phone. Timely responses indicate that the app is reliable.

4. Start Small

Don’t deposit ₹5,000 right away. Begin with ₹100 for one recharge. Increase the amount if it is successful. This is the golden rule of safety.

5. Beware of Fake Calls

Authentic companies do not request your PIN or password. When someone receives a call and is asked to use the OTP to turn on a commission, they should hang up because it is a scam.

Conclusion

The Indian market of mobile recharge commissions is an enormous opportunity on the market where an entrepreneur can find a source of sustainable income in the form of digital payment services. Agents can establish profitable enterprises and, at the same time, meet the critical financial service needs of their communities with the right platform and consistent service delivery. The key to success in this business is to select platforms that will help you achieve your objectives, provide the best possible customer service, and remain flexible in the face of market changes and new technologies.

In light of the constant development of the digital payment ecosystem in India, it is only the early adopters of the reliable Mobile recharge commission apps who will have the best chance to profit on increasing transaction numbers and growing lists of services offered. It is all about having good beginnings and growing and expanding operations in a phased approach, while maintaining the quality of service and regulatory compliance throughout the growth process.

FAQs

What will be my monthly income on recharge commission apps?

The income is based on the quantity of transactions, the mix of services, and commission rates. Active agents typically receive 5000-50000 INR per month, with the best earning even more by maintaining high volumes and a variety of services at all times.

What are the documents needed to begin with Mobile recharge commission apps?

The standard requirements are a PAN card, an Aadhaar card, bank account details, passport-size photos, and business registration forms. Certain platforms may require additional documents depending on anticipated transaction volumes.

Do these platforms have any joining fees?

Most recognized recharge commission applications do not have joining fees. They may, however, require security deposits or minimum wallet amounts. Avoid sites that require advance payments, as they may be scams.

What is the rate of my commission payouts?

The commission payment frequencies differ across platforms. Most of them provide fast credit to your wallet, and bank transfers usually occur daily, weekly, or monthly, depending on the platform’s policy and the settlement frequency you request.

Is it possible to use several recharge commission apps at the same time?

Indeed, it is common and advisable to use more than one platform to increase income. Nevertheless, you should be able to manage numerous accounts and maintain sufficient float coverage across all platforms.