8 Best AI Tools For Accounting

Does accounting sound difficult to you? Well, it might not be accessible in the 90’s or 80’s!

Why? Cause in the 20’s, you can go beyond your imagination and create suitable things you want to create!

So, You guys might be thinking, what are we talking about? You guys heard about “ modern problems require modern solutions,” so here it is! The complete solution for your accounting!

What are the difficulties you are facing right now? Let us guess: You need the appropriate solutions for your monthly or daily budget reports, financial reports, and many more! So these are some of the best AI tools for accounting, which will help you with real-time financial analysis to boost your business to a daily tally! So, in this blog, we will talk about such AI tools!

Let’s dive into it!

What do AI tools Do For Your Accounting?

The acceptance of AI in the accounting industry has been on the rise in recent years. Accounting firms of all dimensions, from global giants to local boutiques, are gradually turning to AI solutions to enhance their services. This shift is single-minded by the realization that AI can power mundane tasks, reduce errors, and free up accountants to focus on higher-value suggested roles.

AI tools act like a supercharged assistant for your accounting tasks, tackling the mundane and giving you superpowers in three main areas:

- Streamlining Workflows: Imagine AI handling the repetitive stuff. AI automates tasks like data entry from receipts, categorizing transactions, and bank reconciliation. This frees you up for more strategic thinking and analysis.

- Boosting Accuracy and Efficiency: Say goodbye to typos and missed entries. AI reduces errors in data entry and speeds up processes significantly. This means less time spent chasing mistakes and more time spent on what matters.

- Uncovering Hidden Insights: AI can analyze mountains of data you never had time for before. It can spot trends, predict future financial health, and even identify potential fraud. With this newfound knowledge, you can provide proactive financial advice and make data-driven decisions.

How to Use Tools For Accounting?

AI can be used both for automating high-volume repetitive tasks and making offers based on invaluable gains. Here’s how you can leverage AI accounting tools-

Identify Repetitive Tasks:

Initiate by recognizing your workflow. List and digest all the actions of computations that are required to be performed from data entry to report generation.

Point out those processes which can be based on repetition and manual actions. These represent ideal targets for AI automation.

Essay: Artificial Intelligence (AI) has brought revolution to the way several sectors like healthcare companies, the automobile industry, and finance operate, as these AI technologies help in repeated tasks, improve productivity, decrease mistakes, and hence increase efficiency.

AI enables systematically and rapidly analysis of large volumes of data with greater precision compared to their lesser human counterparts and shifts parts of the burden from healthcare professionals as well as the whole healthcare system.

Similar to other AI applications An illustration of the task could be keying in from the receipts, classification of transactions and the creation of bank reconciliation among others.

Choose the Right AI Tool

Highlight the tasks that you tend to repeat and consider to apply for AI -powered accounting software or platforms. There are a number of platforms which merge AI to their accounting means and others are considered as standalone systems.

Take into account the volumes and complexity of your data while also think about the functionalities needed to achieve the desired goals.Look for features like:

- Machine learning: A machine learning AI that continually works to learn the patterns of your data to get more and perform repetitive tasks without intervention soon.

- Optical Character Recognition (OCR): AI that draws out data from laser printed cash registers and copies of invoices.

- Automated categorization: AI that automatically categorizes transactions considering the trend in the past such context.

- Anomaly detection: AI that finds out unusually large transactions through the monitoring process and if so, it can block such transactions to reduce the chances of fraud and errors.

Implementation and Training:

For the best results, ensure you integrate the platform into your usual workflow. Most of the AI models are made use of some training data to fulfil their purposes. This can be achieved by giving historical data into the system to enable it to draw inferences in your accounting methods.

Remember AI is a tool, not a replacement:Remember AI is a tool, not a replacement:

In contrast, AI automates tasks and makes the process more efficient. However, human and AI together shouldn’t outsmart the other, but work together. A good accountant will still check AI outputs and add subjectivity in cases that are not straightforward.

Importance of AI Tools For Accounting

It comes as no surprise that AI technology has become a game-changer in the accounting world with significant benefits ranging from fast processing, to growing accuracy in financial reporting and an autonomous review of the situation.

Here’s why AI is becoming increasingly important for accountants:The next is the key role that AI play, and the reason why it is rapidly becoming more important, is boxed below.

Enhanced Productivity and Accuracy:

Automation: AI is applied for the repetitive tasks which are particularly the data entry, invoice processing and the bank reconciliation. Thereby, the level of expertise among accountants is raised, which again is developed through progressive thinking and planning.

Reduced Errors: People are more prone to making mistakes while they’re working through the manuals. AI tools can be highly advantageous in the accuracy and precision of the data as a human error in the data processing can be minimized with the usage of such tools.

Deeper Financial Insights:

Real-Time Analysis: AI can go over a large quantity of the financial resources in the moment and therefore help the accountants visualize clearly how the company is working financially.

Predictive Analytics: AI can be used for prediction of future patterns and recognizing of anything that can either escalate into major risk or move in the right direction. It also grants them the opportunity of providing more advanced monetary counseling.

Improved Fraud Detection:

Anomaly Detection: AI can observe all transactions passing through the system and identify behaviour that is irnormal for a transaction. Such an activity might be a sign of fraud. It therefore assists them in minimizing sets of losses.

Focus on Strategic Work:

AI aligns with the improved accounting roles by automating various routine jobs and utilising an accountant to do tasks that are mainly important which are like financial modelling, taking risks and assessing the business progress of the clients.

Competitive Advantage:

AI plays as a powerful tool for accounting firms to provide faster services, ensure accuracy, and conduct in – depth financial analysis. Such a state will be beneficial to entrepreneurship activity and an increased chance of business attraction and client retention.

At the end, AI is not going to substitutes the accountants; but, they can be used as the very potent and effective tools for improving the accountants productivity, accuracy & the value they are delivering.

So Here are Some Best AI tools For Accounting

1. BILL

BILL AI automates invoice making by filling in essential details, such as vendor name and email address, due date, amount, payment terms, PO number, IBAN, and SWIFT code (for international payments).

The tool also senses duplicates in multi-page invoices and sends warning messages to avoid levying extra charges on clients or clientele or making double payments.

Features

- Data entry automation: Upload demands in PDF or image format using a computer or mobile device. The feature uses AI to extract information and create digital invoices routinely.

- Invoice processing: Check the mined details for incomplete or duplicate information before converting data into digital invoices.

- Expense categorization: Mechanically categorize and allocate expenses using AI. After you generate an entry, AI recognizes patterns and utilizes what you have learned from past uploads to assign them to appropriate outlay categories.

Importance of BILL

Accounting and finance managers can deliberate BILL AI to reduce manual data entry errors and inflated bill duplication, saving you time and effort. You can apply the tool’s data extraction capabilities to convert paper-based IDs into digital invoices.

The tool only extracts complete and readable data, so you can focus on other value-adding accounting activities, such as budgeting and forecasting, instead of manually entering data into the system besides calculating accounts payables and receivables.

Customer support: BILL offers an erudition center, guides, webinars, blogs, customer stories, FAQs, emails, chats, and phone calls for assistance on tool capabilities besides implementation.

Pricing

| Essential | Team | Corporate | Enterprise |

| $40/month/user | $55/month/user | $79/month/user | Custom pricing |

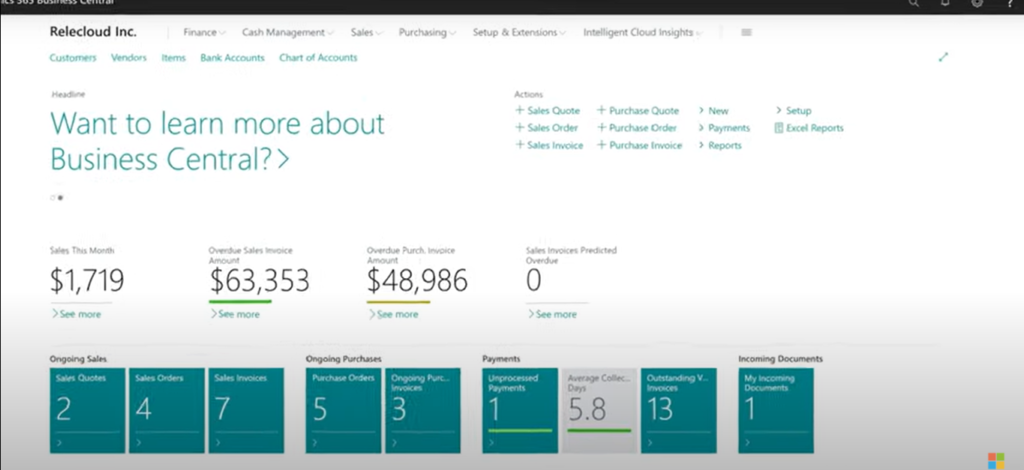

2. Dynamic 365 Business Central

Dynamic 365 Finance module, a part of the business central suite, offers AI-enabled landscapes to smoothen your budgeting and forecasting. The tool analyzes historical financial data to foresee future cash flows, helping you make informed accounting and finance plans.

The AI algorithms leveraged by the tool mechanize the processing of expenses and invoices, including data extraction, categorization, and approval workflows. Its AI credit risk management feature simplifies the investigation of various business details, including payment history and financial steadiness, to prepare credit terms for lenders and borrowers.

Features

- AI insights: Perform predictive analytics, including forecasting financial trends, cash flow projection, and other key performance indicators for the business’s economic health.

- Fraud detection: Use AI to analyze real-time transactions and detect patterns that may indicate fraud in sales, purchases, and other transactional activities. The feature helps to identify a pattern of probable mistakes by studying historical transactions and assesses future transactions accordingly.

- Automated reconciliation: Match transactions automatically based on predefined criteria. This can include matching bank statements with corresponding entries in the ledger or sub-ledgers. Reconciliation items include cheques, deposits, and other incoming transactions.

Importance of Dynamic 365 Business Central

Accounting and finance directors looking to implement AI and automation functionality to allow data and outcome-driven financial reporting can consider Dynamic 365 Finance. You can plan for payment insights, cash flow forecasting, and budget offers. This process drives better business decisions by accessing accurate drifts and insights and speeding up operational efficiency.

Pricing

| Business Central Essentials | Business Central Premium | Customer Service Professional | Sales Professional |

| $70/month/user | $100/month/user | $50/month/user | $65/month/user |

3. FloQast

FloQast uses generative AI to compete for the business’s financial transactions with the bank declarations and highlight gaps between the budgeted and actual amounts.

Its AI algorithms apply rule-based logic (automated reasoning) to recognize the most similar references for automated matching and reconcile transactions efficiently.

Each transaction is assigned a self-assurance score, allowing you to prioritize reviewing games that may require additional human oversight.

Features

- Automated responses: Train the AI tool to draft responses to team members’ comments and emails, besides updates, using text-based prompts.

- Variance analysis: Calculate the alteration between the budgeted and actual amounts and elucidate the reason behind gaps in the analyzed data. The feature lets you select specific factors to highlight gaps that thoroughly affect the business purposes.

- AI reference field mapping: Use AI to routinely parse through the uploaded accounting spreadsheets or labour-intensive entries and map them to the fields in the existing office books on the system.

Importance of FloQast

Accounting and finance directors looking to leverage automation to address squad queries, identify budget gaps, and map new entries to the fields in the current bookkeeping system can consider FloQast.

The tool’s reconciliation management allows teams to select the most appropriate reconciliation way for each account. This automation can save you time then reduce errors in manual bank reconciliation. It’ll also augment work efficiency and accuracy, especially when working with large sizes of financial data.

Pricing

Request a demo of the pricing

4. Odoo

AI-enabled features in Odoo let you automate expense management for accounting. The tool utilizes ML, NLP, and computer vision to analyze datasets, identify patterns, then make predictions based on historical data.

Its one-click validation feature lets you verify all the extracted financial data for incorrect or missing entries. The tool learns from your selected corrections and provides similar suggestions for future anomalies in uploaded images or PDFs.

Features

- Image and metadata recognition: Use the ocular character recognition (OCR) reader to scan and excerpt data from PDF documents and adapt them into digital invoices.

- Image scanner: Capture and upload paper-based invoices using your Odoo mobile submission and convert them into digital demands.

- Email alias: Choose invoices as the alias model besides selecting the default partner (supplier) for invoices received using this alias. When an email containing an invoice arrives at the alias talk, the feature automatically analyzes the information and creates a new draft.

Importance Odoo

Consider Odoo for your invoice running processes to automate and simplify capturing and totalling data into the system.

As the email alias feature can automatically digitize established invoices, you won’t have to spend time downloading and importing demands from multiple sources. This process makes it easier to accomplish audits with digital invoices.

Pricing

| Free Version | Standard | Custom |

| ₹ 0 | ₹ 500/user/month | ₹ 890/user/month |

5. Ramp

Ramp is for employee expenses, vendor management, and business accounting. The tool automatically collects the expense data using the employee’s virtual card and matches it to the predetermined entries.

The captured details are verified for incorrect or incomplete entries, and non-compliant expenses are flagged, notifying the employees of out-of-policy spending via push notifications or emails.’

The tool analyzes past vendor transactions to assess the price of a product and provides a list of options (new and existing) to ensure you pay a fair price. This feature lets you spot the best vendor according to your planned budget and needs.

Features

- Vendor comparison: Upload an acquisitions contract, and the tool will benchmark the vendor’s produce price by analyzing crowd-sourced data from competitors. The feature likewise helps you understand the cost per user for a product.

- Categorizing besides coding: Use AI to categorize expenses based on decorations in historical data. Use the categorization to power the coding of costs to the correct accounts.

- AI assistant: Ask questions, build sanction workflows, and get suggestions to reduce business costs from the AI Copilot, your computer-generated assistant.

Importance Ramp

Consider Ramp when looking to augment employee expense and vendor management. The tool powers all repetitive tasks, including capturing and categorizing expenses and setting pricing benchmarks to avoid extravagance on product purchases.

All these capabilities save you time and let you focus on more excellent budget planning and forecasting.

Pricing

| Free Plan | Plus | Enterprise |

| Free of Cost | $12/user/month | Contact sales for pricing |

6. Zeni

Zeni is an inclusive AI bookkeeping tool offering end-to-end financial automation facilities for startups. It handles various bookkeeping tasks, including reconciliations, accounting, and financial reporting.

Zeni’s AI technology helps your company type data-driven decisions and improve financial actions.

Features

- Automated daily accounting in addition to bookkeeping

- Personal dashboard to see all data and make quick, real-time decisions- it calculates where your startup is scorching cash!

- PDF reports ready to advance to your investors

- API Integrations

- Bank & Credit Card Understandings

Importance of Zeni

Zeni gives you real-time admittance to critical metrics (like burn rate, runway, OpEx, and COS, besides cash flow), so you can spot and mitigate trends that could affect your operations.

Pricing

| Stater Plan | Growth Plan | Enterprise Plan |

| $549/month | $799/month | Custom |

7. Vic AI

Vic AI focuses on automating and abridging the accounts payable process. It uses AI to extract data from invoices, validate transactions, and streamline the approval process. Vic AI saves businesses time and reduces errors in your financial processes.

Features

- Accounts allocated processing delivered with AI

- Improve invoice processing yield by 355%

- Real-time insights, benchmark data, in addition, cost optimization strategies

- Master data and supplemental information since any ERP system via our open API and data models

Importance

Vic.ai is not just another AP mechanization tool; it’s an autonomous AP platform that powers AI to solve the most pressing challenges in accounts payable. With its ability to reduce labor-intensive processes, combat fraud, and manage supplier relationships efficiently, Vic.ai is the future of AP organization.

Pricing

Custom Pricing

8. Docyt

Docyt is an AI bookkeeping tool offering automated outlay tracking, receipt capture, and document management. It aims to shorten the running of financial documents and improve compliance with tax and managerial requirements.

Features

- End-to-end bookkeeping

- Capture and track revenue from the profits system to the bank

- Bill Pay, Expense Reimbursement, Receipt Capture, and Vendor 1099 Management

- Accomplish your employee credit cards

- Capture and reconcile receipts

- Track undocumented expenses

- Basic Reporting

- Simple Bookkeeping Email Support

- Dedicated Bookkeeping Expert

- Multi-Entity Consolidations

Importance

With a combination of powerful artificial intelligence and automation, Docyt learns how to categorize your receipts besides invoices. Docyt will then reconcile your contacts with your bank accounts and incessantly sync them to the QuickBooks® ledger.

Pricing

| Impact | Advanced | Advanced Plus | Enterprise |

| $299/month | $499/month | $649/month | $999+/month |

Ending Note

AI has been reshaping the accountants’ job by replacing routine tasks and detecting issues employed in ensuring prudence in the financial domains. AI Tools For Accounting such as Vic.ai, Docyt, and Zeni have been designed to process invoices at an automatic rate, and provide employees with streamlined expense management and financial reporting, therefore freeing accounting professionals valuable time that can be used for analysis, higher-level functions, and client interaction. Through using an AI, accounting firms in the Consequence this fact, it is possible to remove delays and errors, thus substantially improving the financial of companies.

Faqs

What is the first tool used in accounting?

Sumerians, Babylonians, and ancient Egyptians were familiar with the need to count and measure the results of labour and effort. Ancient users created an early method of the abacus whereby they slid beads across a frame to help with counting and simple calculations.

Which tool is used for accounting determination?

QuickBooks is one of the best and most popular office tools for accessibility. With QuickBooks mobile apps, you can access admittance data 24/7, work from anywhere, then access financial reports on the go. QuickBooks will routinely back up your data to the cloud and sync the information across all your devices.

Read More: