Efficient management of cash is crucial for businesses looking to maximize liquidity, reduce expenses, and enhance efficiency. Enhanced options provide features like cash prediction, automated matching, and immediate insight into cash balances.

A recent study found that companies that adopt advanced cash management systems see a 20% improvement in cash flow visibility and a 15% decrease in processing costs. These tools improve cash operations and improve decision-making capabilities, guaranteeing companies can better manage their assets and maintain development in a competitive market.

In this blog, we’ll explore the best cash management solutions, their key highlights, and how they can update your organization’s cash management strategy.

What are Cash Management Solutions?

Cash management tools and practices outlined to optimize a company’s liquidity, control cash flow, and maximize financial effectiveness. These solutions cover cash forecasting, liquidity management, receivables and payables administration, and financial reporting.

Their essential goal is to ensure adequate cash accessibility to meet obligations while minimizing idle cash that could be better contributed or used strategically. Automating these forms reduces manual errors, speeds up financial closing procedures, and gives real-time visibility into cash positions.

Advanced cash management solutions offer predictive capabilities through tools that analyze chronicled data and market trends to estimate future cash flows. This foresight is basic for maintaining liquidity for daily operations and unexpected costs.

By enhancing the accuracy and productivity of cash operations, these solutions lead to cost savings and progressed financial performance. Leveraging technology helps businesses improve cash management, reduce processing times, and gain important insights into cash flow patterns.

This supports superior strategic planning and cultivates a more resilient financial structure, empowering companies to navigate market uncertainties confidently.

Features of Cash Management Solutions

- Cash Forecasting: Anticipate future cash flows utilizing historical data and market trends.

- Real-Time Cash Visibility: Screen cash positions in real-time across different accounts and areas.

- Automated Reconciliation: Coordinate transactions consequently to reduce manual errors and speed up financial closing.

- Liquidity Management: Optimise the task and utilization of cash to meet short-term commitments and key speculations.

- Payables Management: Proficiently manage outgoing payments to control cash outflows and take advantage of early installment discounts.

- Financial Reporting: Produce comprehensive reports and dashboards for better financial investigation and decision-making.

- Compliance and Risk Management: Guarantee adherence to regulatory requirements and relieve financial risks.

- Integration Capabilities: Consistently integrate with existing ERP and financial frameworks for cohesive operations.

- Multi-Currency Support: Manage exchanges in multiple currencies to encourage worldwide operations.

- Fraud Detection and Prevention: Execute security measures to distinguish and prevent fraudulent activities.

- Mobile Access: Access cash management tools and data on the go through mobile applications.

How to Choose the Best Cash Management Solutions?

- Identify Business Needs: Decide particular cash management requirements such as cash determining, liquidity management, and reconciliation needs.

- Assess Features and Capabilities: Look for basic features like real-time cash visibility, automated forms, multi-currency support, and fraud prevention.

- Integration with Existing Systems: Ensure the solution can consistently integrate along with your current ERP, accounting, and banking systems.

- Scalability: Select a solution that can develop with your trade and handle increased exchange volumes as needed.

- User-Friendliness: Assess the client interface and ease of use to guarantee quick adoption by your group.

- Customization Options: Consider arrangements that offer customization to fit your unique business forms and workflows.

- Vendor Reputation: Investigate the vendor’s track record, client reviews, and industry reputation.

- Support and Training: Look for comprehensive client support and prepare resources to help with implementation and ongoing use.

- Cost and ROI: Analyse the entire cost of ownership, counting initial setup, subscription fees, and potential ROI from productivity gains.

- Security and Compliance: Guarantee the arrangement meets your security standards and complies with significant financial regulations.

- Trial Period or Demo: Select solutions that offer a trial period or demo to test functionality before making a last decision.

List of Top 13 Cash Management Solutions

1. Rho

Rho provides one of the best tools for cash management suitable for businesses under its brand. All in one, it unites corporate banking, cost management, and automated accounts payable. The solution aims to extend the company’s general financial transparency and strengthen its economic governance, while at the same time upgrading work processes. Since security and integration are key attributes of strong enterprise software, Rho enables organizations to optimize their financial management.

Key Features

- Unified Financial Platform: Integrates banking, expense management, and accounts payable.

- Automated AP: improves accounts payable forms with automation.

- Real-Time Financial Visibility: Gives up-to-date insights into cash stream and expenses.

- Secure and Compliant: Guarantees high-level security and compliance with financial directions.

- Customizable Workflows: Offers adaptable workflows to suit commerce needs.

Best For

Medium to huge businesses looking for a coordinated financial management platform.

Pricing

Custom Pricing

2. Causal

Causal is a modern financial planning platform that helps businesses manage their cash flow, budgets, and financial models. It is known for its intuitive interface and powerful analytical capabilities, making financial planning accessible and efficient.

Causal enables businesses to create dynamic models and scenarios, providing a clear view of financial health and future projections.

Key Features

- Dynamic Financial Modeling: Build and update financial models easily.

- Scenario Analysis: Test different financial scenarios and their impacts.

- Real-Time Collaboration: Collaborate with group individuals in real time.

- Integration Capabilities: Consistently coordinating with the help of accounting tools and ERP systems.

- Custom Reporting: Generate tailored financial reports.

Best For

Startups and growing companies that need flexible and dynamic financial planning tools.

Pricing

| Plan | Pricing |

|---|---|

| Reporting | $99/month |

| Modelling | $250/month |

3. Tesorio

Tesorio gives a cash flow performance innovation that enables organizations to control their cash stream and working capital. It uses machine learning to assist in minimizing the chance of errors such as wrong cash forecasting, automation of Accounts Receivables, and effective cash management. Tesorio increases transparency and improves decision-making in terms of cash movement.

Key Features

- Cash Flow Forecasting: Provides accurate and predictive cash flow forecasts.

- Automated AR: improves accounts receivable with automation.

- Working Capital Management: Optimises working capital with real-time insights.

- Machine Learning: Utilises AI for improved forecasting and suggestions.

- Integration with ERP: Effectively coordinating with existing ERP systems.

Best For

Mid-sized to huge enterprises looking to optimize cash flow and working capital.

Pricing

Custom pricing

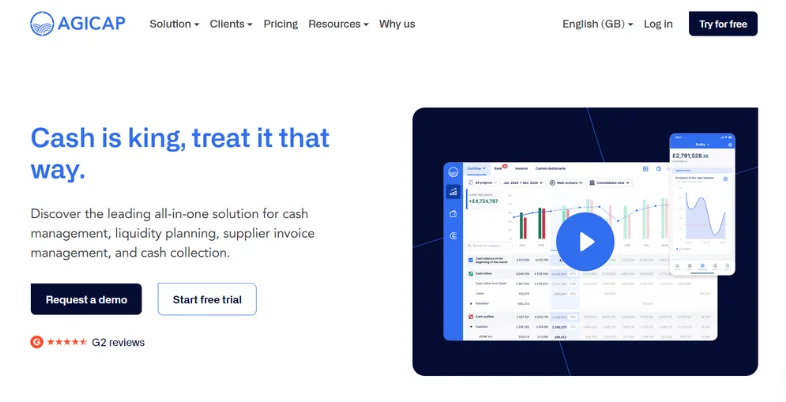

4. Agicap

Agicap is a cash flow solution that aims to assist SMBs to productively manage their cash flows. It offers opportunities to monitor the current cash stream on a progressing basis, forecast the future, and arrange for different situations.

Agicap is designed to ease working capital management and enhance the view of cash flows to ensure that optimal decisions are made while the liquidity is secured.

Key Features

- Real-Time Cash Flow Monitoring: Track cash stream in real-time.

- Forecasting and Scenarios: Make accurate forecasts and test diverse scenarios.

- Bank Integration: Syncs with multiple bank accounts for comprehensive visibility.

- User-Friendly Interface: Easy to use with minimal setup.

- Custom Alerts: Set alerts for critical cash flow events.

Best For

Small to medium-sized businesses seeking straightforward cash flow management.

Pricing

Custom based pricing

5. Kyriba

Kyriba is a next-generation cloud-based treasury and finance arrangement that highlights modern cash management convenience. It helps companies advance liquidity, mitigate dangers, and advance their operational results.

This makes Kyriba a perfect cash management arrangement for companies with operations and investments across the globe because it offers real-time cash visibility, figures, and workflows.

Key Features

- Liquidity Management: Optimises liquidity and working capital.

- Cash Forecasting: Gives exact and real-time cash figures.

- Risk Management: Manages financial risks with robust tools.

- Automated Workflows: improves treasury operations with automation.

- Global Cash Visibility: Offers comprehensive visibility across all accounts.

Best For

Large global enterprises require advanced treasury and cash management capabilities.

Pricing

Custom Pricing

6. Coupa

Coupa fits perfectly within its broader spend management offering. In doing so, it offers real-time permeability of cash, improved cash determination, and productivity in treasury processes to businesses. Together with Coupa, organizations can manage their cash streams successfully to minimize risks and make sound financial choices.

Key Features

- Real-Time Cash Visibility: Monitor cash positions in real time.

- Enhanced Forecasting: Create accurate cash flow forecasts.

- Spend Management Integration: Coordinating with Coupa’s spend administration platform.

- Liquidity Optimisation: Optimise liquidity and working capital.

- Risk Reduction: Moderate financial risks with progressed tools.

Best For

Enterprises looking for an integrated spend and cash management solution.

Pricing

| Plan | Pricing |

|---|---|

| Registered | Free |

| Verified | $549/Year |

| Premium | $499/Year |

| Advanced | $4,800/Year |

7. CashAnalytics

CashAnalytics deals mainly with automated cash flow forecasting & cash management for organizations. Its solution engages organizations in expanding cash visibility, improving the stream of the figure, and speeding up the decision-making system. They give comprehensive reports and investigations for their clients to help them in improving their cash flow.

Key Features

- Automated Cash Forecasting: Rearranges and automates determining processes.

- Liquidity Management: Gives tools to manage liquidity effectively.

- Detailed Reporting: Produces comprehensive cash stream reports.

- Data-Driven Insights: Offers experiences for better decision-making.

- Integration with Financial Systems: Consistently interfaces with existing financial systems.

Best For

Businesses require robust cash forecasting and liquidity administration tools.

Pricing

| Plan | Pricing |

|---|---|

| Power User | $458.365/month |

| Team | $1,004.038/month |

| Enterprise | Custom pricing |

| Service Provider | Custom pricing |

8. Treasury Intelligence Solutions (TIS)

Treasury Intelligence Solutions (TIS) gives a cloud-based solution for supervising cash, payments, and liquidity. It provides moment visibility into cash balances, improves installments, and upgrades treasury functions. TIS helps businesses optimize liquidity, progress financial control, and decrease risks.

Key Features

- Real-Time Cash Visibility: Offers real-time insights into cash positions.

- Payment Automation: improves and automates payment processes.

- Liquidity Management: Optimises liquidity across the organization.

- Risk Reduction: Mitigates financial risks with robust controls.

- Cloud-Based Platform: Provides accessibility and scalability.

Best For

Enterprises seeking comprehensive cash and payment management solutions.

Pricing

Custom based pricing

9. CMS-IR

CMS-IR is a cash management service that provides products and services for increasing the availability of cash and enhancing cash flow. It offers functionality in cash forecasting, cash reconciliation, and reporting. Specifically, CMS-IR is developed to improve overall financial accountability, and operational efficiency and manage decision-making processes.

Key Features

- Cash Forecasting: Gives tools for exact cash flow forecasts.

- Automated Reconciliation: Disentangles compromise processes.

- Financial Reporting: Creates detailed monetary reports.

- Liquidity Administration: Moves forward liquidity administration and control.

- User-Friendly Interface: Simple to utilize and execute.

Best For

Little to medium-sized businesses searching for compelling cash flow and liquidity management.

Pricing

Custom based pricing

10. Finastra

Finastra’s cash management tool offers comprehensive instruments for managing liquidity, installments, and treasury operations. It gives real-time cash permeability, automated workflows, and advanced analytics. Finastra makes a difference, businesses optimize cash flow, diminish risk, and improve financial performance.

Key Features

- Liquidity Management: Optimises liquidity and working capital.

- Real-Time Cash Visibility: Gives real-time bits of knowledge into cash positions.

- Automated Workflows: improves treasury and cash operations.

- Advanced Analytics: Offers detailed analytics for better decision-making.

- Risk Management: Mitigates financial risks effectively.

Best For

Large enterprises looking for comprehensive treasury and cash administration solutions.

Pricing

Custom Pricing

11. Nomentia

Nomentia gives advanced management solutions that help businesses manage liquidity, installments, and treasury operations efficiently. It offers real-time cash permeability, automated cash stream forecasting, and coordinates payment processing. Nomentia aims to enhance financial control and optimize cash flow management.

Key Features

- Cash Flow Forecasting: Gives precise and automated figures.

- Real-Time Cash Visibility: Offers experiences into cash positions in real-time.

- Integrated Payments: improves payment processing.

- Liquidity Management: Upgrades liquidity control and optimization.

- User-Friendly Interface: Natural and simple to utilize.

Best For

Mid-sized to huge businesses trying to find capable liquidity and cash flow administration.

Pricing

Custom based pricing

12. Wealthfront

Wealthfront combines high-interest savings funds with simple access to stores. It is outlined for people and businesses looking to maximize returns on cash while maintaining liquidity. Wealthfront gives consistent integration with financial accounts and automated cash administration features.

Key Features

- High-Interest Savings: Offers competitive intrigued rates on savings.

- Easy Access to Funds: Gives liquidity with no withdrawal punishments.

- Automated Cash Management: Rearranges cash administration with automation.

- Financial Integration: Coordinating with different financial accounts.

- Security and Compliance: Guarantees high-level security and administrative compliance.

Best For

People and small businesses are looking to maximize cash returns and keep up liquidity.

Pricing

Custom pricing

13. Serrala

Serrala gives end-to-end cash management solutions that optimize liquidity, manage hazards, and improve financial operations. It offers tools for cash determination, payment processing, and financial reporting. Serrala points to enhancing cash visibility, improving financial control, and supporting key decision-making.

Key Features

- Cash Forecasting: Provides tools for accurate cash flow predictions.

- Payment Processing: improves and automates payment workflows.

- Financial Reporting: Generates comprehensive financial reports.

- Risk Management: Mitigates financial risks with advanced controls.

- Liquidity Optimisation: Enhances liquidity management and control.

Best For

Large enterprises need comprehensive cash management and financial control solutions.

Pricing

Custom Pricing

Conclusion

Choosing the best cash management solution is basic for optimizing liquidity, streamlining financial operations, and upgrading decision-making processes. Businesses should survey their particular needs, evaluate features, and consider integration capabilities to guarantee they select a solution that adjusts to their financial goals. Emphasizing real-time permeability, automated processes, and vigorous security can lead to improved cash flow management and operational proficiency. Ultimately, a well-chosen cash management solution not only supports financial stability but also cultivates strategic development, allowing companies to explore market uncertainties with greater certainty and agility.

Read more:

FAQs

1. What are cash management solutions?

Cash management tools and practices that optimize liquidity, control cash stream, and maximize financial proficiency by automating and improving monetary processes.

2. Why are cash management software solutions imperative for businesses?

They upgrade liquidity, reduce costs, improve cash stream visibility, and support superior financial decision-making, guaranteeing a company can meet its obligations and contribute strategically.

3. What features should I look for in a cash management tool?

Look for cash estimating, real-time visibility, automated reconciliation, multi-currency support, and integration with existing systems.