Without the proper tool, managing the business expenses may prove to be a real nuisance and although Expensify is one of the widely used platforms, it is not always suited to all businesses. Other users consider it to be too costly, excessively complicated, or without some of the features required. Alternatives come in there. In whatever form or field you may operate, be it as a small business person, freelancer, or large-scale business, various other tools may have multiple or even superior features to those of Expensify, and at a much lower cost or with more flexible parameters.

Expense tracking, expense reports automation, approvals, and integration with accounting systems such as QuickBooks or Xero can be easily performed using alternatives to Expensify. The trick is to identify a solution aligned with your working process, financial possibilities, and the number of employees. There are simpler and user-friendly tools and there are more advanced versions of the tool with mileage tracking, multiple currency support, and real-time policy enforcement.

In this blog, we are going to see some of the best Expensify alternatives currently in the market. We will point out what is offered by each of them, their main capabilities, advantages, and disadvantages, and what types of users will benefit best. At the end, you will be in a better position to select the right expense management software depending on your needs.

Why You May Need an Alternative to Expensify

- Very Costly to Small Teams-Expensify charges per user and this can be very costly, especially to startups and freelancers.

- Complicated User interface – The user dock and navigation are confusing and difficult to utilise by some users.

- Lack of Workflow Configuration – Companies having distinct policies on expenses are likely to find it difficult to customise the system.

- Slow or unreliable Customer Support- Users complain that they are not helped promptly and sometimes not at all.

- No integration with industry-specific advances – Expensify can combine with mainstream systems, but it might fail to find niche tools.

- Lack of Advanced Features in Standard Packages – Mini versions might lack such features as the support of multiple currencies or analytics.

- Faulty Mobile App –The mobile experience may be buggy or restricted.

- Soft Collaboration Tools- Expensify might not be the best option with those collaborating teams that require role-based access or control.

List of 15 Best Expensify Alternatives

1. Zoho Expense

Zoho Expense is an end-to-end expense management software that suits organisations of all sizes. It makes expense tracking easier, automates the approvals, and assists in compliance with the company’s policies. It integrates perfectly into the Zoho ecosystem and is a perfect fit for teams that must have streamlined workflows, such as those using the most popular accounting software, including QuickBooks and Xero. It allows users to scan the receipts, establish mileage allowance, etc.

Zoho Expense is also multi-currency and role-based which is why it can be regarded as ideal to use in an environment of several global teams. Its mobile application will make it possible to submit and approve expenses wherever you are. Finance user groups can track real-time spending patterns using the user-friendly dashboard of the platform. Being considerably cheaper and scalable, the Zoho app can be considered one of the best Expensify alternatives, particularly when a business grows and needs to reduce spending to achieve better visibility of company expenditures.

Key Features:

- Expense report generation In these provisions, automated expense report generation is provided.

- Multi-level approval process

- Mileage and Per Diem Tracking

- Policy alert violation in real time

- OCR auto-scan of receipts

- Connection to book-keeping systems

- iOS and Android mobile applications

Pricing:

- Standard: ₹79

- Premium: ₹149

2. Rydoo

It is the expense management tool of today, emphasising real-time and user-friendly behaviour. Rydoo is a solution designed to suit small companies, as well as international corporations, as it automates all stages of the expenses procedure, ranging from scanning the receipt to the reimbursement. Through mobile, employees can take photos of a receipt and share them with the rest of the finance team and team members can access real-time data to make decisions.

Rydoo also has strong compliance options and supports more than 20 languages, 150 currencies, so it is a nice option to work globally. It is also compatible with large ERP and accounting systems, and the integration of the onboarding and data syncing is not difficult. Rydoo additionally automates authorizations, identifies policy breaches, makes companies audit-ready. I find it is a great substitute to Expensify that is straightforward to utilize in case one cares about efficiency and straightforwardness the most.

Key Features:

- Mobility, which allows instant scanning of a receipt

- Live processes of expense authorization

- ERP and accounting integration

- Company policies personalized by the customer

- More than 150 supported currencies

- Furthermore, the best compliance and auditing tools

- Support on multi-languages

Pricing:

Essentials

- Price: €8/user/month (annually) | €10/user/month (monthly)

Pro

- Price: €10/user/month (annually) | €12/user/month (monthly)

Business

- Price: Custom

Enterprise

- Custom pricing

3. Certify

Certify by Emburse is an expense management system implemented as a cloud-based solution that can be used to automate and streamline the expenses of the company. If you have heard of it, Certify has its clean interface and strong automation, and employees can just submit receipt through a simple photo, and the managers can approve expenses through only a few clicks. It encourages made to order categories of expenses, work flow approvals, and connectivity with the financial systems such as QuickBooks, NetSuite, Microsoft Dynamics.

The analytics tab in Certify makes it clear how the employees spend and presents trends or other prohibited policy issues. It also has in built travel booking and corporate card reconciliation, hence making it an all solution system in travel and expense management. Regardless of whether you are a small enterprises or a large organisation, Certify has flexible pricing, powerful compliance functionality and it has great customer support.

Key Features:

- Single click receipt recognition and uploading

- Automated generation of expense report

- Itinerary and travel booking management

- Enforcement and tagging of policy

- Corporate card integration

- Costing and reporting

- Compatibility of ERP/accounting tool

Pricing:

Certify’em Free

- Price: 100% Free

Certify’em Gold

- Price: $7.99/month or $79.99/year

Certify’em Platinum

- Price: $12.99/month or $129.99/year

4. Concur Expense (SAP)

A fully featured expense management software solution is SAP Concur Expense, which is designed to manage higher expenditures at the enterprise level. It automates all the functions of expense reporting including taking receipts, and managing reimbursements. With the mobile app, employees will be able to photograph receipts and the system will complete information on expenses based on AI. The finance departments enjoy high-level reporting, integration with travel management systems, and enterprise-level compliance functions.

Global scalability and the scope of Concur make it a suitable tool to be used by multinational companies that have a complex structure. The software supports multiple languages, currencies, and tax jurisdictions. Its compatibility with any SAP system plus other ERP systems makes its financial data consistent. Being relatively costly and having other cheaper options, however, it remains a powerful solution with big organizations which require management and visibility at the top.

Key Features:

- Receipt capture and matching Artificial intelligence AI

- Individually custom policy and approval processes

- Globally tax and compliance support

- SAP and other ERP integration

- Transport and expenses management

- Corp Card reconciliation

- Actionable spend analysis

Pricing:

- Automated: $9/report average price

5. Divvy

Divvy combines the features of expense management and corporate credit uniquely so that companies can regulate spending and maintain real-time control over budgets. In contrast to the old-school expense tools, Divvy provides its customers with virtual and physical corporate cards that can be distributed among the staff with certain spending restrictions. Each transaction is automatically logged, classified as well as synchronized with the accounting tools. The platform also removes the process of reimbursement, which was accomplished manually as costs were authorized in advance through budget controls.

Divvy also provides such features as the points of real-time insight in spending, uploading receipts, and settings workflows. It is also free of charge, with Divvy gaining finances by collecting interchange fees on cards swipes. Divvy is a convenient and new age alternative to Expensify offering companies the chance to streamline expenditure and minimize the headache of reimbursement.

Key Features:

- Free service that includes corporate cards

- Spends and budget in real time

- Mobile receipt capture

- Automated expense classification

- Custom workflows

- Software integrations of accounting software

- Role based user access

Pricing:

- Free

6. Spendesk

Spendesk is an intelligent spend and financial risk management software solution that enables you to track your expenses, manage and process all your invoices, and find an approval process as well as virtual cards in a single efficient system. Developed to facilitate the needs of companies with growing businesses and finance departments, Spendesk delivers real-time access to company spending to enable leaders to easily control budgets without micromanaging.

Employees will be able to request to pay, submit a receipt and process a card transaction and be under the policy limits. Manual entry is reduced because virtual and physical cards are issued with custom controls and automated reporting. Spendesk also provides possibilities of pre-approvals and accounting software integrations with the most popular ones. It has a convenient interface and an all-inclusive work model that minimizes common friction in financial processes, as well, and is an attractive alternative to Expensify within the current teams.

Key Features:

- Corporate physical and virtual cards

- Live expense management and authorizations

- Computerised receipt matching

- Invoicing and payment checks

- Budget control and policy control instruments

- Accounting soothing (Xero, QuickBooks)

- Role-based and multi-user permission It may happen that secured files contain sensitive information that cannot be shared with multiple users or those with different roles but still need to access the information contained in the secured file as well.

Pricing:

- Custom pricing

7. BILL Spend and Expense

BILL Spend & Expense combines the strength of BILL and Divvy to enable expenses tracking, budgeting, and financial automation. As one of the effective office automation tools, it enables companies to spend cards with set limits, monitor all the transactions in real time, and eliminates the need for reimbursements. Employees can submit receipts through the app, and finance teams gain control over rogue spending thanks to automated approval flows and budget visibility.

The system can be readily interfaced with the accounting system such as NetSuite, and QuickBooks, and its comprehensive reporting aids in enhancing audit precariousness, and policy gratifications. Its free pricing model (charged per card use) makes it attractive among startups and small- and medium-sized firms that wish to take full control without expensive fees.

Key Features:

- Expense monitoring and free spend management

- Virtual/physical cards issue and management

- Expenses/budget tracking in real-time

- Real-Time receipt capture

- Customful approval flows

- Uninterrupted accounting integration

- In-depth tracked and reporting analytics

Pricing:

- Essential: $45 user/month

- Team: $55 user/ month

- Corporate: $79 user/ month

8. Fyle

Fyle is a modern expense management tool that gives small and medium-sized organizations access to enterprise-level features. Fyle integrates with popular business applications such as Gmail, Outlook, and Slack with powerful capabilities that enable employees to submit expenses directly through their email inbox or through a chat. Its artificial intelligence automatically categorizes and extracts expense data, and sets rules and workflows of approval in real time.

The expenses are reimbursed faster, and the finance staff have access to real-time information on expenses. Fyle also allows managing corporate cards and integrates with such large accounting systems as NetSuite and Xero. Its ease of use and fast configuration make it an ideal replacement of Expensify to those technical teams, which want flexibility and speed in configuration.

Key Features:

- Expenses via e-mail and chat

- Machine learning based on data reconciliation and classification

- Policies checks and approvals in real-time

- The system of corporate card management

- Accounting software add-ons

- Mobile app Receipt scanning

- Individual analytics and reports

Pricing:

- Growth: $11.99 user/ month

- Business: $14.99 user/ month

9. Emburse Abacus

Emburse Abacus is an integration expensing tool with the emphasis on speed and control. As opposed to legacy solutions, Abacus does not wait until the end of the month to submit and process expenses but does it in real time. Its real-time policy support put the red flags immediately, and intelligent rules and workflow builders enable quick approvals. The system seamlessly integrates with your accounting software and gives you simple steps that you can take to understand spend behaviors.

The nightclub staff is able to record expenses on their mobile phones, and finance staffs obtain data in the form of expense in clean and ready-to-audit data. Abacus is a perfect fit to fast-growing startups and small groups of people because it allows them to spend less time and more time automating and being transparent without following conventional systems.

Key Features:

- Live expense entry and approval

- Configurable policies and workflow

- Intelligent automatic rule generation

- Direct accounting system integration

- Scanning of receipts and labeling

- Audit-configured reports and data export

- Mobile experience that is user-friendly

Pricing:

- Custom pricing

10. Navan

Hailing as TripActions, Navan is a travel and expense management platform that is all-in-one. It integrates corporate card, expense reports in real-time and travel booking in the same portal. The Navan allows personnel to reserve travel; submit expenses on the fly and enjoy corporate purchasing on smart cards. Travel and expense data is automatically reconciled and the need to do manual work is minimal resulting in more visibility.

The AI-based insight is one of the ways through which leaders of finance can make more informed decisions and manage departmental expenses. Navan has excellent compliance features and a clean mobile app, which makes it suitable in particular for companies that often have to travel and would like to maintain full financial control.

Key Features:

- Integrated means of travel and expenses

- Intelligent Cards-cards alongside the corporate world

- Travel booking that is policy-based

- Real-time, automatic recording and reporting of received receipts

- Spend analysis with help of AI

- Audit and compliance technology

- International monetary assistance and taxation assistance

Pricing:

- Custom pricing

11. FreshBooks

FreshBooks is one of the most popular cloud-based accounting and invoicing systems, which also incorporates tracking of expenses as a fundamental capability. It is intended mostly on freelancers, small businesses, and service providers and has a simple, user-friendly interface to track spending, create invoices, and log time, and to organize finance in a single location. As an added bonus, users are able to import expenses automatically with connected bank accounts and credit cards, attach receipt to expenses via a mobile phone, and export tax and accounting reports.

FreshBooks simplifies the ability to characterize spending, keep tabs on mileage, and monitor billable expenses by project or client. While it is not a dedicated expense management suite like Expensify, the built-in tools serve the purpose well for those seeking an all-in-one financial management solution. Additionally, for businesses looking into cloud cost management tools, FreshBooks offers several useful features that align with broader financial oversight and cloud-based expense tracking needs.

Key Features:

- Personal expense tracking from escalated bank feeds

- Capturing of mobile receipts and tracking of miles

- Time tracking and invoices integration

- Client-related price tagging

- Tax friendly reports and summaries

- Custom costs accounts

- Flawless project and budget monitoring

Pricing:

- Lite: $8/ month

- Pro: $15.20/ month

- Premium: $26/ month

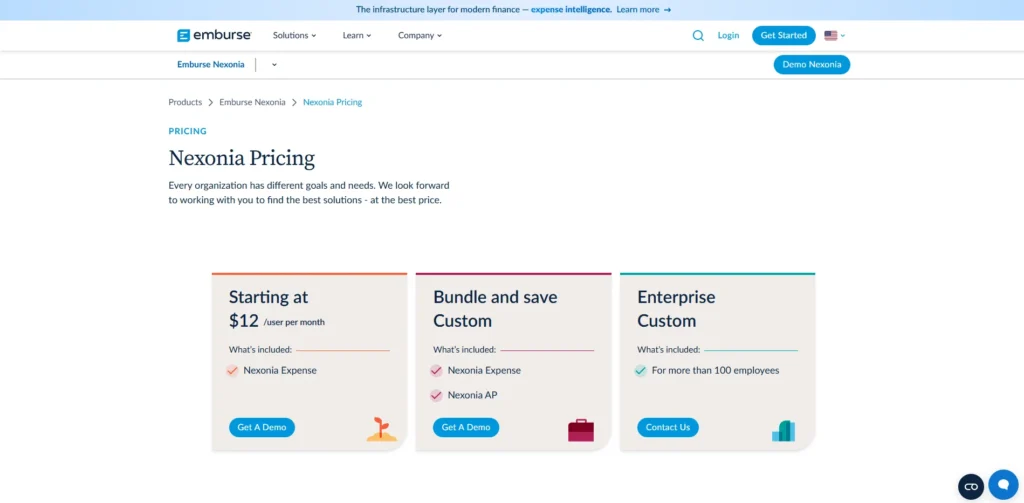

12. Nexonia Expenses

Nexonia Expenses is a sophisticated expense management software solution intended for use by mid-size companies and enterprises. It offers extensive customization capabilities, strong integrations with back-office business solutions such as NetSuite, Sage Intacct, and SAP, and robust policy enforcement tools. Nexonia enables receipts to be entered through mobile or web, and automates multi-tier approvals.

It is a complete solution as corporate card reconciliation, mileage tracking, and per diem management are in-built on the system, and fits all the complex organizations. It also pays in support of operations around the world with multi-currency options, tax compliances, and localization. Nexonia is most appropriate to firms that require heavy control, configurability, integration capabilities, and usability.

Key Features:

- Complete option of approval workflows

- Software ERP and accounting integration

- Expenditure and expense management mobile

- Corporate card reconciliation

- Tax and multi-currency compliance

- Tracking of per diems and miles traveling

- Finger prints and analytics

Pricing:

- $12/ user per month

13. Wave

Wave is another free nonprofit accounting software system with basic expense and bookkeeping facilities that are much suited to small companies, freelancers, individuals, and nonprofit organizations. Using Wave helps simplify a variety of features that includes importing bank transactions, scanning of receipts, and controlling business expenditure by use of a clear and user-friendly dashboard.

It also has the options of custom expense category, recurring billing and invoice tracking, all of which are free. Wave is not as feature-advanced as Expensify in the corporate-level operations or automations, but it beats any other party when it comes to affordability and ease of usage by people that need basic expense tools combined with accounting and invoicing. Wave suits best the personal use or really small enterprises which want to receive a trustworthy financial instrument at a reasonable cost.

Key Features:

- No cost expense traceability with no surprises

- Credit cards and bank synchronization

- Custom tags and descriptions to each expense

- Integration of invoice and payments

- Easy scan of mobile receipts

- Financial reporting on a real time basis

- Tax filing made easy to export

Pricing:

- Start: $0

- Pro plan: $170/ year

14. Pleo

Pleo is a spend management platform which provides employees with smart company cards where they can spend directly and be able to track the expenses and budget in real-time. Pleo was created as a tool for modern businesses; it removes the complications associated with reimbursements because it gets team members access to business funds with virtual or physical cards that are pre-approved.

All expenses are classified automatically, and receipt uploading is possible through a mobile app. The finance department may restrict and manage expenses and set limits in real-time. Integrating with the leading accounting platforms, such as Xero and QuickBooks, and having extensive European compliance functions, Pleo is a very good choice for businesses who want a clear, programmed approach to everyday spending.

Key Features:

- The company cards have spending limits

- Real time tracking and approval of expenses

- Auto classification of transactions

- Uploading of receipts and reminders through mobile phones

- Accounting software integration Smart integration Seamless accounting software — a culmination of the combination of a smart tag and accounting software.

- Role-Based access and controls

- Individual department or group budgets

Pricing:

- Essential: $39/ month

- Advanced: $89/ month

- Beyond: $179/ month

15. Soldo

Soldo can be defined as a pre-purchased business expense card that is accompanied by an effective expense management software. It assists companies in the creation of customized rules applied to employee cards, monitoring of real-time spending, and collection of receipts, and transactions details in real-time. Soldo works with multi-user approaches and has a fine target control that enables users to have advanced control of their finances and activities.

It is particularly beneficial to those teams that work in separate geographical areas because it is capable of supporting multiple currencies and VAT monitoring. Soldo is also compatible with accounting services such as Xero, QuickBooks, and NetSuite, which guarantees error-free bookkeeping and expedited reconciliation. It is a good Expensify alternative to the firms interested in control, automation, and cross-border expenses.

Key Features:

- Payroll deduction prepaid expense cards

- Real-time monitor of expenditures and spending limits

- Receipt capturing and policy enforcement

- Multi currency ,VAT.

- Spend rules and spending caps

- Major accounting systems integrations

- Finance teams dashboard Centralized

Pricing:

Standard Plan

- Price: £21/month + VAT (includes 3 users)

Plus Plan (Most Popular)

- Price: £33/month + VAT (includes 3 users)

Conclusion

The correct decision about a tool to use as a helpful expense management tool is important to simplify financial processes, increase compliance related to the company, and provide real-time data about company spending. Although Expensify would be a powerful choice, it is not a good solution for every business due to limitations in pricing, usability, or features. Fortunately, the market offers a wide range of Expensify alternatives, such as Zoho Expense and Rydoo, as well as integrated platforms like Divvy, Pleo, or Soldo.

You may require corporate cards, automations of workflows, travel expenditure management, or expense controls, and you have a solution that best suits the size of your organization, the industry, and the workflow. It is important to evaluate each of the tools according to the needs of your team, based on integrations as well as your budget to fit the right one. This transition to a more applicable expensing tool will save much time, reduce expenditures, and also increase the efficiency of operation.

FAQs

1. Which Alternative to Expensify is the Best Free One?

Both Wave and BILL Spend & Expense provide excellent free options to small business.

2. What are the Best Expensify Alternatives that Can Take Care of Large Enterprises?

SAP Concur, and Nexonia fit the enterprise requirements in which extensive customization is required.

3. Is it Possible to Handle the Travel and Costs in a Single System?

Yes, Navan and Certify provide combined travel and expense management solution.

4. What is the Smart Company Card Tool?

Corporate cards from Pleo, Divvy, and Soldo come with built-in spend control features.

5. Does it Have Any Other Alternative with Good Accounting Integrations?

Spendesk, Fyle, and Zoho Expense are compatible with programs like Xero and QuickBooks.