In the finance world of 2024, AI has become a game changer for finance teams. Investors now closely examine a company’s financial details before deciding to invest, and AI is playing a significant role here. By automating tasks, improving predictions, and aiding decision-making, AI is making a big impact. It effortlessly handles large volumes of data and offers solutions for budgeting and tax issues. In this article, we’ll explore how AI tools and software for finance have transformed the financial sector and have simplifying operations, and empowering professionals to make smart decisions in today’s fast-paced market.

How AI can Assist in Finance?

AI can be a valuable asset to professionals in the finance industry across various facts:

- Automated Expense and Income Tracking: AI streamlines the process of recording and categorizing financial transactions, offering insights and reports by recognizing recurring patterns in the data.

- Chatbots for Customer Interaction: AI-driven chatbots provide real-time responses to customer inquiries, offering basic financial guidance and account information. They efficiently handle routine tasks and escalate complex issues to human representatives.

- Fraud Detection Systems: AI analyzes vast transactional data sets in real time, pinpointing irregularities indicative of potential fraudulent activities, enhancing security measures.

- Risk Assessment and Management: AI-driven predictive analytics and scenario modeling enable professionals to evaluate and mitigate financial risks effectively.

- Credit Scoring and Underwriting Optimization: AI processes extensive data swiftly to evaluate creditworthiness, expediting credit decision-making and underwriting processes.

- Compliance Oversight: AI monitors transactions for regulatory adherence, promptly flagging potential violations to mitigate risks of penalties and reputational harm.

Advantages of Using AI Tools and software for Finance

- Spotting Risks: AI in finance offers visual representations of data, aiding in predicting future growth and avoiding downturns. This helps investors assess potential risks more effectively.

- Cutting Costs: AI streamlines operations and slashes manual tasks, leading to lower operational expenses.

- Fraud Protection: AI tools are crucial in cybersecurity, swiftly detecting unusual transactions and thwarting fraud with minimal errors.

- Process Automation: AI accelerates manual tasks in finance, boosting efficiency and freeing up human resources for more complex responsibilities.

- Enhanced Support: AI aids in market research and data organization, delivering quicker predictions and insights compared to manual methods.

Challenges & Benefits

While AI brings promising advancements to finance, there are still hurdles to overcome. One concern is the potential for manipulation and hacking, posing risks to accurate data. Misconfigurations may also lead to errors, impacting financial institutions negatively. Despite these challenges, AI presents vast opportunities for growth and efficiency in finance, benefiting both institutions and customers. It streamlines processes, saving time for customers and aiding in the sector’s expansion. However, full reliance on AI remains distant, as human-generated data still plays a crucial role in decision-making.

Also Read: AI Tools For Accounting

Best 10 Tools & Software’s for Finance

| S NO. | AI TOOLS | PRICE | BEST FOR |

|---|---|---|---|

| 1. | Alpaca | Free | Algorithmic trading solutions |

| 2. | Kensho | $20 per month | Predictive analytics in finance. |

| 3. | AlphaSense | 14 Days free | Financial insights & analysis. |

| 4. | Sentieo | 14 days free | Financial Research Insights. |

| 5. | Yseop | Available upon request | Financial Report Generation |

| 6. | PortfolioAI | 14 Days Free | investment portfolios efficiently |

| 7. | Sage Intacct | $52.92 per month | Financial Management |

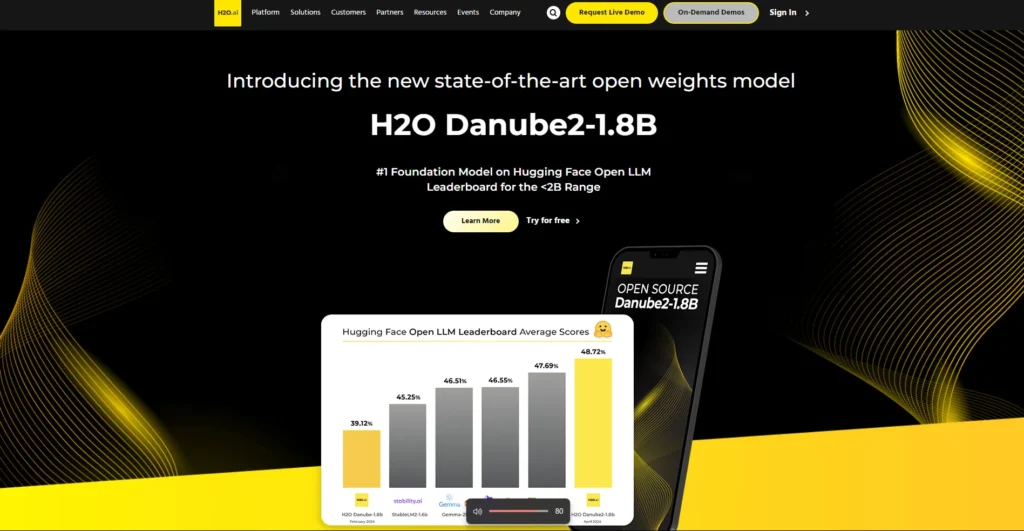

| 8. | H2O.ai | Free | Machine learning analytics. |

| 9. | Ayasdi | $15 Per month | Anomaly detection |

| 10. | DataRobot | 14 Days free | Automated Machine Learning |

About The Tools & Software’s

1. Alpaca

Alpaca offers an API for trading on financial markets, allowing developers to access real-time data, execute trades, and manage portfolios programmatically. With commission-free trading for US stocks and ETFs, Alpaca simplifies the development of trading algorithms for both individual investors and institutional traders.

How to use:

- Sign Up and Log In: Create an account and log in to the Alpaca AI Tool platform.

- Input Data: Provide the tool with data to analyze, such as text, images, or audio.

- Choose Functionality: Select the task you want the AI tool to perform, like text summarization or image recognition.

- Customize Settings (Optional): Adjust settings like language or output format if needed.

- Process Data: Activate the tool to process your data, which might take some time.

- Review Results: Check the results generated by the tool, such as summaries or sentiment scores.

- Download or Integrate Output: Download the output for further analysis or integrate it into your workflow.

Features:

- Text Analysis

- Image Recognition

- Audio Processing

- Customization

- Integration

- Ease of Use

2. Kensho

Kensho is a data analytics and machine learning company specializing in providing actionable insights for financial markets. Their platform utilizes AI algorithms to analyze vast amounts of data, including news, financial reports, and market trends, to generate real-time insights for investors and financial professionals. Kensho’s technology aims to help users make more informed decisions by providing timely and relevant information about market events and their potential impact on investments.

How to use:

- Access Kensho: Sign up for Kensho and log in to the platform.

- Choose Analysis Type: Select the type of analysis you want to perform, such as stock market trends, economic indicators, or specific asset classes.

- Input Parameters: Input the relevant parameters for your analysis, such as specific stocks, time periods, or economic factors.

- Run Analysis: Initiate the analysis process and wait for Kensho to process the data.

- Review Results: Examine the results provided by Kensho, including insights, trends, correlations, and predictions.

- Make Informed Decisions: Use the insights gained from Kensho’s analysis to inform your investment strategies or decision-making processes.

Features:

- Advanced Analytics

- Data Visualization

- Predictive Capabilities

- Customization

- Real-Time Updates

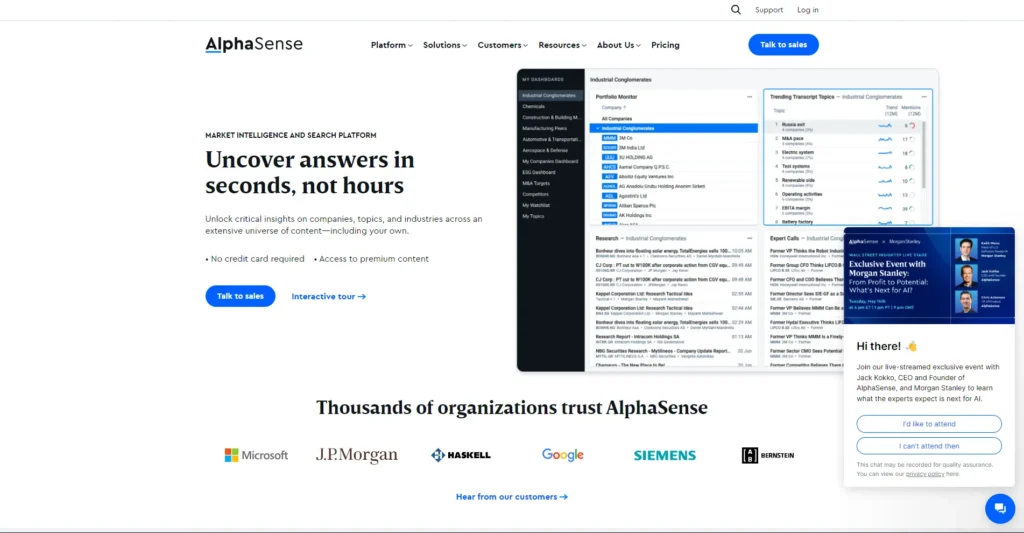

3. AlphaSense

AlphaSense is a comprehensive search engine designed specifically for financial professionals. It allows users to search across a wide range of sources including company filings, transcripts, news articles, and research reports. AlphaSense utilizes natural language processing and machine learning to quickly and accurately extract relevant information from these sources, providing users with actionable insights and helping them make informed investment decisions.

How to use:

- Access and Login: Sign up for an account and log in to the AlphaSense platform.

- Define Search Parameters: Input your search query with specific keywords, companies, or industries.

- Refine Search: Narrow down results using filters like date range, document type, and geographic region.

- Analyze Results: Review various document types such as SEC filings and news articles in the search results.

- Extract Insights: Utilize AlphaSense’s AI for sentiment analysis, trend identification, and data visualization.

Features:

- Semantic Search

- Document Summarization

- Data Visualization

- Collaboration Tools

- Mobile Accessibility

Also Read: Invoice Processing Automation Software

4. Sentieo

Sentieo is a financial research platform that integrates data analytics, document search, and collaboration tools to streamline investment research workflows. It enables users to search across a vast array of financial documents, including filings, transcripts, presentations, and news articles, using advanced search capabilities powered by natural language processing. Sentieo’s platform also includes features for financial modeling, data visualization, and collaboration, allowing investment professionals to conduct comprehensive research and analysis efficiently.

How to use:

- Sign Up/Login: Create an account or log in to Sentieo platform for financial research.

- Dashboard Navigation: Explore dashboard layout for easy access to features and tools.

- Search Functionality: Find financial data, documents, news, and insights with powerful search.

- Document Search: Access extensive database including SEC filings, transcripts, and presentations.

- Data Analysis Tools: Visualize data, perform analysis, and identify trends with advanced tools.

- Collaboration: Share research findings and collaborate with team members through annotations and comments.

Features:

- Comprehensive Data

- Document Insights

- Visualization Tools

- Customization

- Mobile Access

- Security

5. Yseop

Yseop is a natural language generation (NLG) software company that specializes in turning data into written narratives. Its platform uses artificial intelligence algorithms to analyze data and generate human-like text automatically. Yseop’s NLG technology is particularly useful in the finance industry for tasks such as financial reporting, customer communications, and regulatory compliance documentation. By automating the process of generating written content, Yseop helps finance professionals save time, reduce errors, and improve the clarity and consistency of their communications.

How to use:

- Access Yseop: Sign up for Yseop and gain access to its platform or integrate its API into your existing software system.

- Input Data: Provide the necessary data or information that you want to generate insights or reports on.

- Define Rules: Set up rules and parameters for Yseop to follow. This includes specifying the format, style, and structure of the generated content.

- Generate Content: Let Yseop do its magic. It will analyze the input data and apply the defined rules to generate human-like, coherent text.

Features:

- Natural Language Generation

- Customizable Rules

- Multi-Language Support

- Integration

- Scalability

- Security

6. PortfolioAI

PortfolioAI is an AI-powered investment platform designed to assist investors in building and managing their portfolios more effectively. The platform utilizes machine learning algorithms to analyze market trends, assess risk, and identify investment opportunities tailored to each user’s financial goals and risk tolerance. PortfolioAI provides personalized recommendations for asset allocation, diversification, and rebalancing, helping investors optimize their portfolios for better performance. Additionally, the platform offers real-time monitoring and analysis of portfolio performance, allowing users to make informed decisions and adjust their investment strategies as needed.

How to use:

- Sign Up/Login: Begin by signing up or logging into the PortfolioAI platform.

- Portfolio Creation: Create a new portfolio or import an existing one by specifying the assets and their respective allocations.

- AI Analysis: PortfolioAI employs advanced algorithms to analyze your portfolio, considering various factors like risk tolerance, diversification, and market trends.

- Optimization Suggestions: Based on the analysis, PortfolioAI provides optimization suggestions to enhance your portfolio’s performance, such as rebalancing recommendations and asset reallocation strategies.

- Execution: Implement the suggested changes to your portfolio through your brokerage account or trading platform.

Features:

- Portfolio Analysis

- Risk Management

- Diversification Optimization

- Performance Tracking

- Rebalancing Recommendations

- Customization Options

7. Sage Intacct

Sage Intacct is a cloud-based financial management software solution designed for small and midsize businesses. It offers a comprehensive suite of tools for accounting, budgeting, and financial reporting, helping businesses streamline their financial operations and gain better visibility into their financial performance. Sage Intacct automates manual processes such as invoice processing, expense management, and revenue recognition, saving time and reducing errors. Its flexible reporting and dashboard capabilities provide actionable insights that enable businesses to make informed decisions and drive growth. Additionally, Sage Intacct integrates with other business applications, allowing for seamless data flow across different departments and systems.

How to use:

- Set Up: Begin by creating an account on Sage Intacct’s platform and configuring your company’s financial details.

- Data Entry: Input your financial data into the system, including invoices, bills, expenses, and payroll information.

- Automation: Utilize automation features to streamline repetitive tasks such as invoice processing and reconciliation, saving time and reducing errors.

- Reporting: Generate customizable financial reports and dashboards to gain insights into your company’s performance and make informed decisions.

- Integration: Integrate Sage Intacct with other business software such as CRM systems or payroll platforms for seamless data exchange.

Features:

- Scalability

- Accessibility

- Customization

- Compliance

- Security

- Real-time Insights

8. H2O.AI

H2O.ai is an open-source artificial intelligence platform that provides tools and algorithms for data analysis and machine learning. It allows users to build and deploy predictive models for various applications, including finance, healthcare, and marketing. H2O.ai’s platform is designed to be user-friendly and scalable, making it accessible to both data scientists and business users. With its advanced algorithms and automated model tuning capabilities, H2O.ai enables organizations to derive valuable insights from their data and make better-informed decisions.

How to use:

- Installation: Install H2O.ai by following the instructions on their website or using pip if you’re using Python.

- Data Preparation: Load your dataset into H2O.ai. It supports various formats like CSV, Excel, or directly from databases.

- Model Building: Choose a machine learning algorithm from H2O.ai’s library and train your model on the dataset.

- Model Evaluation: Evaluate your model’s performance using metrics like accuracy, precision, recall, or area under the ROC curve.

- Deployment: Once satisfied with the model, deploy it for production use.

Features:

- Scalability

- Automatic Machine Learning (AutoML)

- Support for Various Algorithms

- Interpretability

- Integration

9. Ayasdi

Ayasdi is a machine intelligence software company that focuses on providing solutions for complex data analysis and insights generation. Their platform utilizes topological data analysis and machine learning algorithms to uncover patterns and insights within large and diverse datasets. Ayasdi’s technology is particularly useful in industries such as healthcare, finance, and cybersecurity, where understanding complex data relationships is crucial for decision-making and risk management. By automating the process of data analysis and insights generation, Ayasdi helps organizations accelerate their innovation and improve their operational efficiency.

How to use:

- Data Preparation: First, upload your dataset into the Ayasdi platform.

- Topological Data Analysis (TDA): Ayasdi uses TDA to analyze complex datasets and extract meaningful insights.

- Model Building: Utilize Ayasdi’s machine learning algorithms to build predictive models and uncover patterns in your data.

- Visualization: Ayasdi offers interactive visualizations to explore the relationships and structures within your data.

- Collaboration: Collaborate with team members by sharing insights and findings directly within the platform.

Features:

- Automated Insights

- Predictive Analytics

- Scalability

- Interactivity

- Collaboration

Also Read: AI Tools For Coding

10. DataRobot

DataRobot is an automated machine learning platform that empowers organizations to build and deploy predictive models quickly and efficiently. It automates the end-to-end process of developing machine learning models, from data preparation and feature engineering to model selection and deployment. DataRobot’s platform is user-friendly and scalable, making it accessible to both data scientists and business users. With its advanced algorithms and automated model tuning capabilities, DataRobot enables organizations to derive actionable insights from their data and make better-informed decisions.

How to use:

- Data Preparation: DataRobot’s platform uploads and analyzes datasets to identify patterns and relationships.

- Model Building: DataRobot tests machine learning algorithms and optimizes feature engineering to find the best models.

- Model Evaluation: DataRobot provides comprehensive insights and visualizations on model performance metrics.

- Deployment: DataRobot enables easy deployment of selected models into production with API integration.

- Monitoring and Management: DataRobot continuously monitors model performance, alerts to issues, and facilitates retraining with new data.

Features:

- Automated Machine Learning (AutoML)

- Model Interpretability

- Scalability

- Integration

- Collaboration

- Time Series Forecasting

Conclusion

In conclusion, AI tools and software have become indispensable assets for finance professionals, revolutionizing the way financial tasks are performed and decisions are made. From automating mundane tasks to providing actionable insights from vast amounts of data, AI is reshaping the finance industry by enhancing efficiency, accuracy, and innovation. As the adoption of AI continues to grow, finance teams and institutions can expect to see further improvements in decision-making processes, risk management, and overall operational effectiveness, ultimately driving better outcomes in today’s dynamic and competitive financial landscape.

FAQ’s

1. How does AI help in financial services?

AI can help financial companies by looking at lots of data about transactions. It can find strange things happening and tell when something seems suspicious. This helps the companies stop fraud and protect people’s accounts from being used wrongly.

2. How does AI in finance help automate tasks?

AI can help financial companies find unusual behavior in their records, like strange purchases or transfers, which might mean someone is trying to cheat the system. By doing this, AI can help these companies lose less money, keep people’s accounts safe, and stop fraud from happening.

3. How does AI help in catching fraud in finance?

AI can help financial companies find weird transactions and mark them as suspicious. It looks for patterns that might show fraud. This helps companies lose less money, keep their customers’ accounts safe, and stop fraud before it happens.