Risk management has become essential for modern businesses dealing with complex operational, financial, legal, and technological issues. In the past, companies handled risk through manual assessments, spreadsheets, and periodic audits. This approach often led to oversights and human errors. Today, the range of risks—such as cyberattacks, data breaches, regulatory changes, supply chain disruptions, environmental hazards, and reputational threats—calls for a more proactive and data-driven approach to risk management. Risk management solutions meet this demand by bringing together risk identification, assessment, mitigation planning, monitoring, and reporting into a single platform.

At its essence, risk management tools allow organizations to identify potential risks, assess their likelihood and impact, and take preventive or corrective actions before those risks become major issues. These systems often work alongside other business tools like ERP, compliance systems, financial platforms, and business intelligence applications, giving organizations a complete view of their vulnerabilities. With real-time data analysis, scenario modeling, and AI-driven insights, risk managers can shift from reacting to crises to planning strategically.

Furthermore, risk management software fits with various regulatory and industry-specific standards like ISO 31000, COSO ERM, GDPR, HIPAA, and SOX. This alignment helps organizations manage risks while ensuring they comply with legal requirements and avoid costly fines. By providing customizable dashboards, automated alerts, and flexible reporting tools, these platforms equip leadership teams to make faster, evidence-based decisions.

Key Features of Risk Management Software

A strong risk management solution typically includes a complete set of features that cover the entire lifecycle of risk identification, evaluation, mitigation, and monitoring. Common key features in most business-grade systems include:

- Risk Identification and Cataloging: Tools to capture and categorize risks across departments, processes, and assets. New risks can be manually recorded by users or imported from linked systems.

- Risk Scoring and Prioritization: Algorithms that evaluate each risk’s likelihood and potential impact, allowing organizations to direct resources where they are most needed.

- Scenario Analysis and Modeling: Predictive tools that simulate “what-if” scenarios, helping risk managers assess how various threats or events could influence business operations.

- Regulatory Compliance Management: Pre-configured templates and compliance checklists for industry regulations, helping organizations remain audit-ready.

- Incident Management: A centralized log and tracking system for actual events, ensuring lessons learned contribute to future prevention efforts.

- Automated Alerts and Notifications: Real-time notifications when risk thresholds are crossed or incidents occur.

- Data Visualization Dashboards: Customizable charts, heat maps, and reports for board presentations or operational oversight.

- Integration Capabilities: APIs and connectors for ERP, CRM, HR, and IT security systems to ensure data consistency across the organization.

Types of Risks Managed by the Software

Risk management software is adaptable across industries and business sizes, addressing various types of risk. The most common categories include:

- Operational Risks: Problems with internal procedures, personnel, or systems, like supply chain breakdowns, equipment malfunctions, or human mistakes.

- Financial Risks: Threats to revenue or capital, including market fluctuations, credit defaults, or currency instability.

- Compliance Risks: Legal or regulatory violations, such as not meeting environmental standards, data protection laws, or workplace safety regulations.

- Cybersecurity Risks: Data breaches, ransomware attacks, phishing attempts, and other digital dangers.

- Reputational Risks: Negative publicity, social media backlash, or product failures that could damage customer trust.

- Strategic Risks: Poor decision-making, problematic mergers or acquisitions, or misaligned corporate strategy.

List Of Risk Management Software

1. MetricStream

MetricStream is a well-known name in enterprise governance, risk, and compliance (GRC) software. It offers a central platform that enables organizations to handle enterprise risks, compliance requirements, audits, and third-party vendor evaluations. MetricStream is especially suited for large, regulated industries such as banking, healthcare, and energy, thanks to its flexible design. Companies can choose specific modules for enterprise risk, operational risk, IT risk, or regulatory compliance and expand their use over time.

The platform features strong reporting and analytics tools, with customizable dashboards and heatmaps to visualize risk exposure. It also includes a comprehensive content library of regulatory frameworks and best practices, allowing for quicker implementation and compliance with standards like ISO 31000, NIST, and COSO. Recent updates have brought in AI-driven insights to help with better decision-making and early identification of potential threats.

Features:

- Centralized risk register and control library

- Real-time dashboards, heatmaps, and analytics

- Third-party risk assessment and monitoring tools

- Policy and compliance automation workflows

- AI-driven insights for proactive risk detection

Pricing:

- Quote-based, varies with chosen modules and deployment size.

2. IBM OpenPages

IBM OpenPages is a strong AI-driven GRC and Financial Risk Management Software platform designed to integrate risk and compliance management in large organizations. Its modular setup covers operational risk, model risk, IT risk, ESG, financial risk, and regulatory compliance, giving businesses the flexibility to concentrate on specific areas while keeping a central risk database. Its integration with IBM’s analytics and AI system, Watson, allows for predictive risk analysis and automated risk scoring.

The software is suitable for both cloud and hybrid setups, making it adaptable for industries with strict data rules. Its user-friendly design enables both technical teams and business stakeholders to participate in risk assessment and monitoring. The platform also integrates smoothly with third-party applications through APIs for seamless data flow.

Features:

- Modular GRC structure for targeted use

- AI-powered risk analytics and predictive insights

- ESG, model risk, and operational risk modules

- Configurable workflows and dashboards

- Integration with IBM’s AI data analytics software

Pricing:

- Custom quotes based on modules, deployment type, and size.

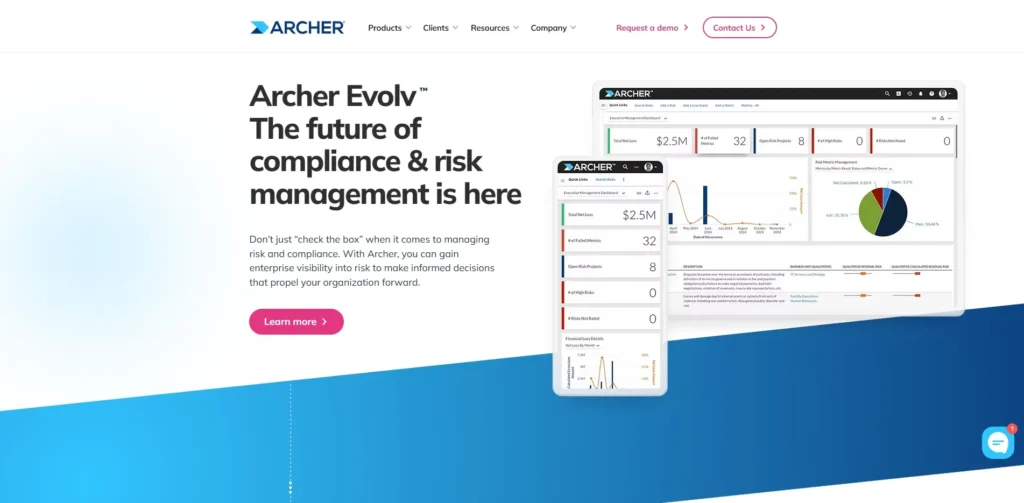

3. RSA Archer

RSA Archer is an established integrated risk management (IRM) platform that helps organizations oversee policies, risks, audits, incidents, and vendor relationships in one place. Its flexible framework lets companies align their governance and risk processes with their business model. Archer covers IT risk, business continuity planning, and compliance management in an auditable environment.

The platform has strong automation features for risk assessments, issue tracking, and remediation workflows. It is particularly popular in sectors that need detailed compliance records, such as financial services and healthcare. Executives may effectively make decisions by delving into detailed information from high-level dashboards using RSA Archer’s reporting tools.

Features:

- Comprehensive policy, control, and risk mapping

- Audit and compliance tracking tools

- IT risk management modules

- Automated risk assessment and remediation workflows

- Configurable reporting and dashboards

Pricing:

- Quote-based, customized for enterprise needs.

4. LogicManager

LogicManager is an enterprise risk management (ERM) platform focused on bridging operational risk data with strategic decision-making. Unlike many competitors, it uses a fixed-fee pricing model that includes onboarding, support, and updates, helping clients predict costs. The platform offers ready-made templates, workflows, and risk libraries that enable organizations to adopt best practices quickly.

It supports risk assessments, vendor risk management, incident tracking, and policy management, with strong visual reporting for board presentations. LogicManager is particularly valued by mid-sized organizations seeking enterprise-level risk capabilities without the complexity and costs of larger GRC systems.

Features:

- Fixed-fee pricing model with all-inclusive services

- Centralized risk register and heatmap visualizations

- Pre-built templates and best-practice workflows

- Vendor risk and policy management tools

- Board-ready reporting and analytics

Pricing:

- Fixed-fee model; custom quotes based on needs.

5. Resolver

Resolver is a cloud-based risk and incident management solution known for its user-friendly design and practical approach to enterprise risk management. It helps organizations log incidents, conduct investigations, and monitor risk trends in real time. Resolver connects risk events to strategic goals, enabling executives to understand the bigger picture and allocate resources effectively.

The platform supports various use cases, including operational risk assessments, audit management, and regulatory compliance tracking. Its incident management module excels in allowing quick responses, root cause analysis, and tracking corrective actions. With capabilities for integrating external data, Resolver ensures that risk teams have current information at hand.

Features:

- Incident reporting and investigation workflows

- Enterprise risk assessments and dashboards

- Corrective action tracking and audit trails

- Integration with external data sources

- Configurable risk scoring and reporting

Pricing:

- Custom quotes; mid-market deployments usually have lower entry costs than larger GRC suites.

Suggested read: Employer of Record Services

6. Riskonnect

Riskonnect is a highly configurable enterprise risk management platform that combines ERM, claims management, third-party risk, and business continuity in one solution. Built with a no-code/low-code design, it allows organizations to customize workflows and forms without heavy IT support. This appeals to complex enterprises wanting control over their setups without relying entirely on vendor services.

The platform offers advanced analytics and real-time dashboards for both operational and financial views of risk. Riskonnect’s integrated approach ensures that risk data flows smoothly across departments, enhancing collaboration and speeding up decision-making. Large organizations often choose it to centralize multiple risk domains into one accurate source.

Features:

- Fully configurable workflows and dashboards

- Integrated ERM, claims, vendor, and continuity planning

- No-code/low-code forms and process builder

- Real-time KRI monitoring and reporting

- Cross-departmental data sharing and analytics

Pricing:

- Enterprise-level, quote-based pricing based on modules and scale.

7. NAVEX Global

NAVEX Global, through its NAVEX One platform, provides a full suite for governance, risk, and compliance, emphasizing ethics and policy management. It is well-regarded for its whistleblower hotline, compliance training modules, and policy lifecycle management. This makes NAVEX especially valuable for organizations that prioritize regulatory compliance, ethical conduct, and third-party governance.

NAVEX One integrates incident reporting, third-party risk evaluations, compliance training, and case management into a single platform. Its analytics tools offer compliance officers actionable insights into policy adherence and regulatory readiness. The platform can serve both small businesses through packaged options and large enterprises through tailored deployments.

Features:

- Policy and procedure lifecycle management

- Hotline and whistleblower reporting systems

- Compliance training and certification tracking

- Third-party risk assessment tools

- Integrated incident reporting and analytics

Pricing:

- Custom quotes; small business packages available for quicker procurement.

8. OneTrust

OneTrust has grown from a focus on privacy and consent management to a broad trust and risk platform that includes privacy, third-party risk, AI governance, and ESG compliance. It is particularly suitable for organizations in heavily regulated sectors that require strong data privacy, security, and vendor management capabilities.

The platform’s privacy tools include data mapping, consent management, and automated privacy impact assessments, while its third-party risk module allows ongoing monitoring of vendor compliance. OneTrust also supports AI governance frameworks to help companies ensure responsible and compliant AI use. With modular packages and usage-based pricing, it can cater to both mid-sized and large enterprises.

Features:

- Workflows for data privacy management and compliance

- Vendor risk tracking and ongoing evaluation

- Tools for evaluating the effects of AI and privacy

- ESG and sustainability reporting modules

- Extensive regulatory content library

Pricing:

- Modular and usage-based pricing; quotes provided upon request.

9. LogicGate (Risk Cloud)

Using pre-configured templates, LogicGate’s Risk Cloud is a no-code governance, risk, and compliance platform that lets businesses design unique risk workflows.This flexibility suits companies wanting to start small with specific risk processes and grow without replacing their systems.

Its applications cover many use cases, including enterprise risk, third-party risk, compliance, and control testing. The platform integrates with popular tools like Slack, Microsoft Teams, and Jira, allowing teams to incorporate risk management into their workflows. LogicGate’s drag-and-drop builder enables business users to create and update processes without needing coding skills.

Features:

- No-code application and workflow builder

- Pre-built templates for quick deployment

- Integration with collaboration and ticketing tools

- Risk scoring and automated reporting

- Vendor and compliance management applications

Pricing:

- Application-based licensing; custom quotes available.

10. ZenGRC (Reciprocity)

ZenGRC by Reciprocity aims to simplify compliance, audit readiness, and risk management for growing organizations. It features a user-friendly interface and an all-inclusive pricing model, appealing to companies looking for predictable costs and minimal onboarding friction.

ZenGRC offers a centralized control library, automated evidence collection, and pre-loaded compliance frameworks like SOC 2, ISO 27001, and HIPAA. Its vendor risk module tracks and evaluates supplier compliance, while its reporting tools generate auditor-ready documentation. The platform streamlines complex compliance workflows into manageable tasks without losing control or visibility.

Features:

- Centralized repository for policies and controls

- Automated evidence collection and mapping

- Pre-built compliance framework templates

- Vendor risk management capabilities

- Audit-ready reporting and dashboards

Pricing:

- All-inclusive pricing; vendor provides tailored quotes.

11. RiskWatch

RiskWatch is a risk management and compliance platform designed to help organizations identify vulnerabilities, assess potential threats, and ensure regulatory adherence. It offers an integrated suite of tools for security assessments, policy management, and audit preparation. RiskWatch emphasizes automation, reducing the manual workload involved in risk evaluation by providing customizable assessment templates, scoring models, and automated reporting.

The platform supports diverse industries such as finance, healthcare, government, and manufacturing, ensuring sector-specific compliance requirements are met. With its cloud-based architecture, RiskWatch enables secure access for distributed teams, maintaining data integrity and confidentiality.

Features:

- Customizable security and compliance assessment templates

- Automated scoring, risk prioritization, and remediation tracking

- Policy management with version control

- Real-time dashboards and reporting for audits

- Industry-specific compliance support

Pricing:

- Custom quotes based on organizational needs and deployment scale

12. CURA Software

CURA Software provides a highly configurable enterprise risk management platform for industries like finance, manufacturing, and government. The system allows organizations to capture, assess, and manage strategic, operational, and compliance risks within one interface. Its strength lies in custom workflows that adjust to the organization’s governance model, ensuring a precise fit.

CURA’s dashboard offers executives a combined risk heatmap for quick identification and response to critical exposures. The software integrates smoothly with business intelligence tools for enhanced analytics.

Features:

- Centralized risk repository with real-time updates

- Customizable workflows for risk approval and escalation

- Visual risk heatmaps and executive dashboards

- Integration with BI platforms for advanced reporting

- Multi-level user permissions for secure access

Pricing:

- Custom pricing based on implementation scope.

13. Protecht.ERM

Protecht.ERM is an integrated enterprise risk management solution that addresses operational, compliance, and IT risks. Known for its easy-to-use interface, Protecht.ERM helps organizations move away from manual spreadsheets to automated, auditable workflows. It covers the full risk management lifecycle, from identification to tracking and reporting.

A standout feature is its incident capture system, which enables front-line employees to report risk events in real time, ensuring nothing gets missed. The platform also supports compliance frameworks like ISO 31000 and APRA CPS 220.

Features:

- End-to-end risk lifecycle management

- Real-time incident reporting and tracking

- Compliance framework alignment (ISO, APRA, etc.)

- Configurable reporting templates and dashboards

- Secure cloud hosting with role-based controls

Pricing:

- Subscription-based pricing tailored to the organization’s size.

14. A1 Tracker

A1 Tracker focuses on providing risk management solutions that work closely with project management and insurance processes. It is highly customizable, supporting various risk categories such as contract, construction, supply chain, and compliance risks. The platform is great at tracking contractual obligations, insurance claims, and project milestones.

This makes it perfect for industries that rely heavily on contracts. Its real-time reporting tools give managers immediate insights into risk trends and financial impacts, helping them make quicker decisions.

Features:

- Customizable risk categories and workflows

- Integration with project management tools and ERP systems

- Insurance and claims management module

- Financial impact analysis for risk events

- Field data entry via mobile access

Pricing:

- Custom quote based on modules selected.

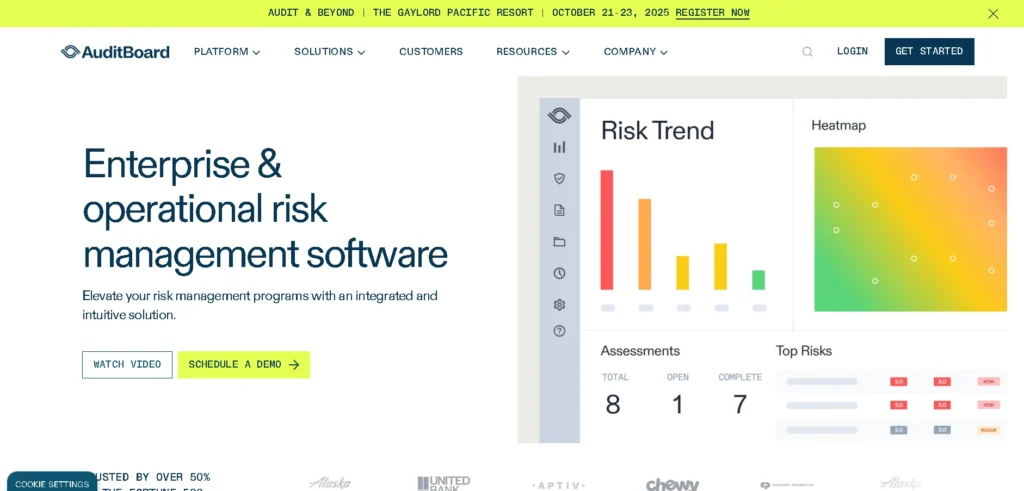

15. AuditBoard Risk Oversight

AuditBoard’s Risk Oversight platform is designed for modern companies seeking a unified approach to risk, audit, and compliance. It provides a centralized space to manage enterprise risks with flexible risk assessment tools and real-time collaboration features.

The platform works closely with AuditBoard’s other tools, allowing risk managers to connect issues directly to audit findings, controls, and improvement plans. Its reporting engine creates easy-to-understand visual dashboards that serve both operational teams and executive boards.

Features:

- Dynamic risk assessment and prioritization

- Integration with audit and compliance modules

- Centralized risk repository with collaboration tools

- Customizable dashboards for executive reporting

- Cloud-native platform with enterprise-grade security

Pricing:

- Custom pricing available upon request.

Benefits of Implementing Risk Management Platforms

Using risk management software brings clear benefits that go beyond compliance and incident reduction. These benefits often include:

- Improved Decision-Making: Leaders gain a clear view of potential threats, enabling faster and more confident strategic decisions.

- Cost Savings: Early risk detection and mitigation lower the chances of expensive incidents, legal fines, or operational downtime.

- Enhanced Compliance: Built-in regulatory frameworks help organizations meet local and international standards without manual tracking.

- Centralized Data Access: Stakeholders can access a unified collection of risk-related data, boosting collaboration and breaking down silos.

- Scalability: Cloud-based risk management tools can grow alongside the organization, responding to new risks and operational challenges.

Challenges in Risk Management

Even with its advantages, implementing and maintaining risk management software can present obstacles. These challenges include:

- Initial Setup Complexity: Configuring the platform to suit an organization’s specific risk profile can take considerable time and resources.

- Data Accuracy: The software’s success heavily relies on the quality of the input data, making accurate reporting vital.

- User Adoption: Employees may resist new workflows or not fully use available tools without proper training.

- Integration Hurdles: Connecting the system to older software and databases can be technically challenging.

Future Trends in Risk Management Software

The next generation of risk management software is likely to use advanced AI, machine learning, and predictive analytics for greater precision and automation. Real-time risk monitoring through IoT devices, blockchain-based audit trails for compliance, and natural language processing for analyzing unstructured data—like news articles and social media posts—are becoming more commonplace. Additionally, ESG (Environmental, Social, Governance) risk tracking is emerging as a standard feature, helping organizations assess their sustainability and ethical impact alongside traditional risks.

Conclusion

Choosing the right risk management software is about more than just using a digital tool; it involves creating a strong framework that protects your organization from uncertainty, operational disruptions, and compliance failures. As industries grow more complex and data-driven, effectively anticipating, assessing, and mitigating risks has become a strategic advantage. The right solution should fit your organization’s size, regulatory environment, and operational needs, while offering the flexibility to adjust to future challenges.

Modern platforms go beyond traditional risk registers. They integrate AI analytics, real-time monitoring, and predictive modeling to provide decision-makers with practical insights. This shift ensures that risk management is not just a reactive task but a proactive force for business resilience. By carefully evaluating features, scalability, integration options, and vendor support, businesses can select software that meets both current needs and long-term stability. Ultimately, a smart investment in the right platform can turn risk management from a compliance requirement into a key driver of sustainable growth.

FAQs

1. What is risk management software?

Risk management solutions are a digital system that helps organizations identify, assess, monitor, and minimize risks affecting business operations, compliance, or reputation. It centralizes risk data, automates reporting, and provides tools for tracking risk-related metrics, ensuring proactive decision-making.

2. Why is a risk management platform important for businesses?

It helps businesses spot potential threats before they turn into major problems. By delivering real-time insights, compliance tracking, and predictive analytics, it reduces financial losses, boosts operational efficiency, and reinforces resilience against uncertainties.

3. Which industries benefit the most from risk management solutions?

While every sector can gain from it, industries with high regulatory requirements or operational risks—like finance, healthcare, manufacturing, construction, and IT services—often see the most significant advantages.

4. How do risk management tools improve compliance?

Most platforms include compliance features that track regulation changes, document adherence, and generate audit-ready reports. This reduces the risk of penalties and ensures compliance with industry standards.

5. Is risk management software suitable for small businesses?

Yes. Many modern solutions are scalable and available through cloud deployment, making them accessible and affordable for small and mid-sized businesses without extensive IT budgets.